Asymmetric Market Update™️ #30

Our thoughts on what is relevant in Crypto and Markets…

Macro

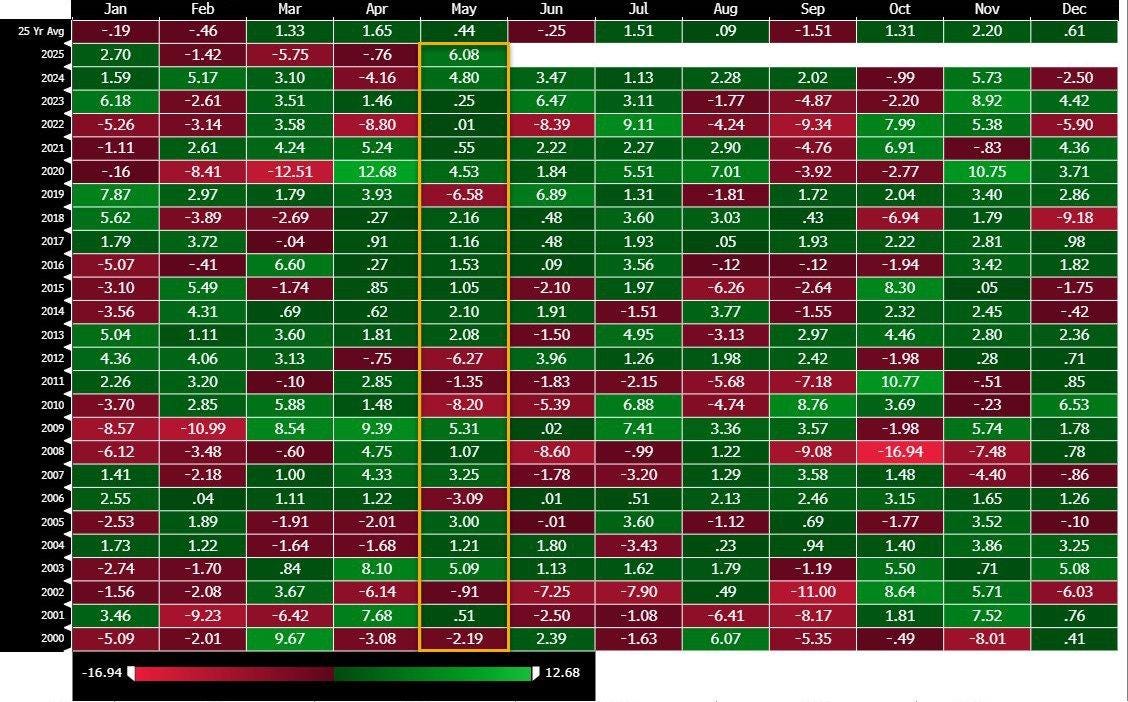

Coming off the heels of a treacherous April, May turned out to be a face-ripping rally largely driven by retail investors, not the “smart money” crowd. Markets don’t need good news to rally, just fewer reasons to panic. In May, they got both. This past May was the best-performing May for the S&P 500 this century.

The quarter began in disarray, as markets reacted to self-inflicted wounds around tariff uncertainty. But beneath the headlines, the fundamentals were never broken. As we noted in April, the setup — solid data, sour (and frankly political) sentiment, and offside positioning — was ripe for a historic comeback.

And that’s exactly what happened.

We flagged that discretionary managers were re-risking across equities, credit, and even alts, while systematic funds were still sitting out:

“We’re seeing discretionary PMs warming back up… But the machines haven’t followed. Why? Because they don’t care about Powell or earnings. They care about price, vol, and correlation regimes. That’s it.”

In other words, humans were re-risking. The algorithms hadn’t caught up yet.

We also pushed back on the idea that soft data (surveys, sentiment) would drag hard data (jobs, earnings, spending) down with it. In fact, we leaned the other way: hard data would hold, and soft data would eventually catch up.

In May, we got:

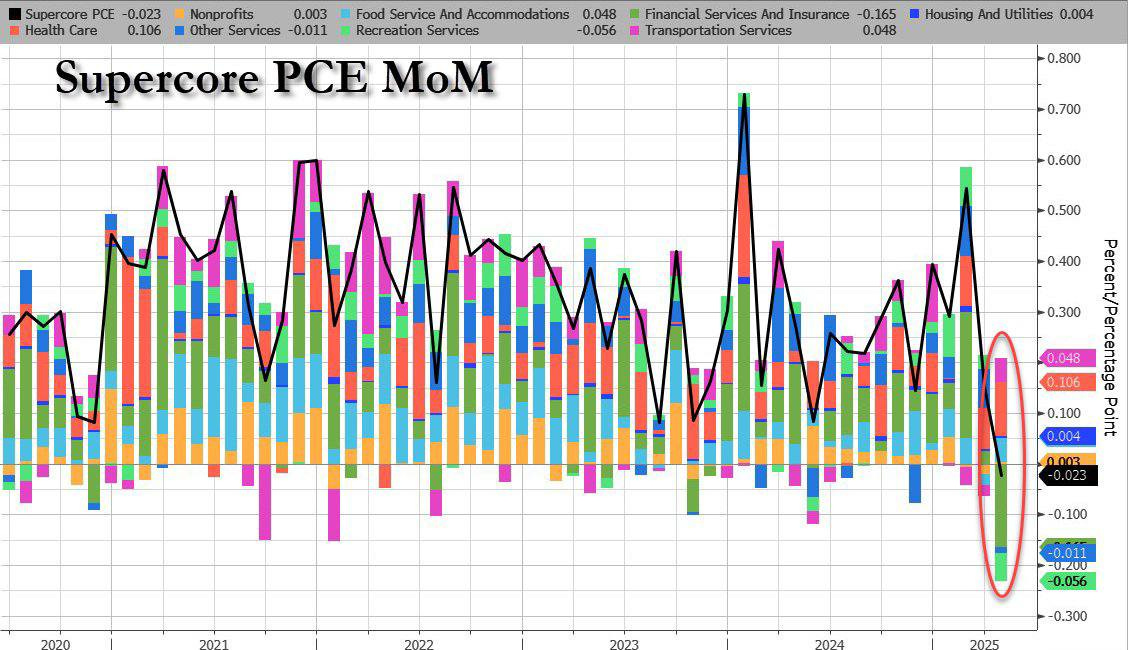

Cooler-than-expected inflation

Strong job numbers

Robust earnings across mega-cap tech are still expected to be robust.

Steady consumer data

And a flurry of dealmaking chatter from the White House

The “Trump put” was clearly found.

From last month’s Market Update:

“We expect the Trump administration to deliver some form of tariff relief—optically if not functionally—before July 8, which we are already starting to see. The deals will be light on details and heavy on headlines. That’s fine and how Trump operates…and how markets currently trade.”

As you can tell, there were plenty of positive headlines going around, the complete opposite of headlines that sent the S&P sharply lower earlier this year. As the narrative shifted from panic over policy to optimism about progress, equities surged higher. Strong consumer spending, stable data, and underweight positioning meant it didn’t take much for the S&P to snap back near its highs in just a few weeks.

At the end of May, we saw a brief pullback in equities and crypto as trade uncertainty reared its head again, with rumors over a deal with China souring, and U.S. pension funds forced to sell as they rebalanced their portfolios.

"US Pensions are modeled to SELL $19bn of US equities for month- end... $19bn to sell ranks in the 89th percentile amongst all buy and sell estimates in absolute dollar value over the past three years and in the 85th percentile going back to Jan 2000" - Goldman Sachs

That’s done. The rebalancing is behind us. However, trade uncertainty is lingering, yet we don’t think it will. Countries are highly incentivized to ink a deal by July 8th, unless the Courts step in, which could throw a curveball at Trump; however, this is not our base case.

So what about now? Equities are up 20% from their lows, and Bitcoin is up 40% from its lows. Does the rally still have room to go? Are we going to all-time highs? Yes, but expect some turbulence. Remember, we just witnessed a record-breaking performance for May, so a breather is both natural and healthy.

Positioning remains the key driver. Offsides exposure and record corporate buybacks were strong tailwinds for risk assets throughout May, which will continue, but have less of an effect.

"..the precedent for huge rallies during Earnings Season, similar to 1Q25’s, is that the month ahead returns are choppy with plenty of volatility - an average gain in the VIX of 19.0% " - Evercore ISI

Put differently: a breather was and is both needed and expected.

Gross leverage has climbed to the 99th percentile, but that’s mostly a function of rising asset prices — it tends to rise mechanically with the market. What’s more telling is that net leverage is now back above 50%, which speaks to actual risk appetite. That makes the entry point here, on a pure risk/reward basis, far less attractive than it was a month ago.

The next move likely hinges on trade headlines.

It’s hard to believe we don’t get some positive news before July 8th, the soft deadline for multiple trade partners.

Hedge funds are already moving and playing catch-up:

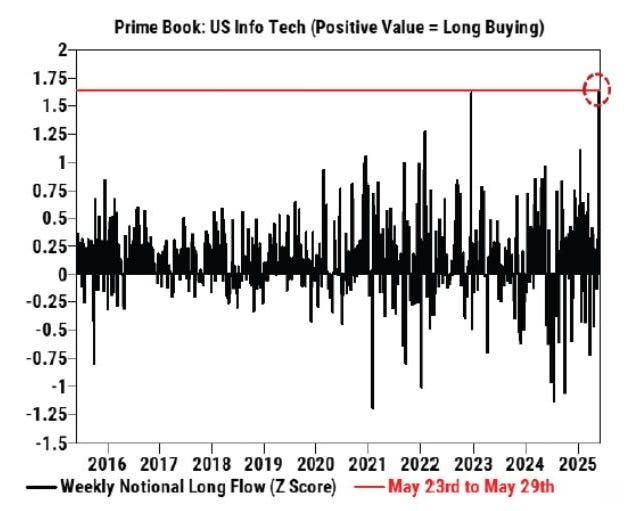

"HFs net bought US Info Tech stocks for a 3rd straight week and every day [last] week ... [the] week’s notional long buying in the sector was the largest in more than 10 years (+1.6 z score), pointing to a positive turn in sentiment."

If headlines cooperate, which we think they will (barring any curveballs from the courts), algos have room to re-engage.

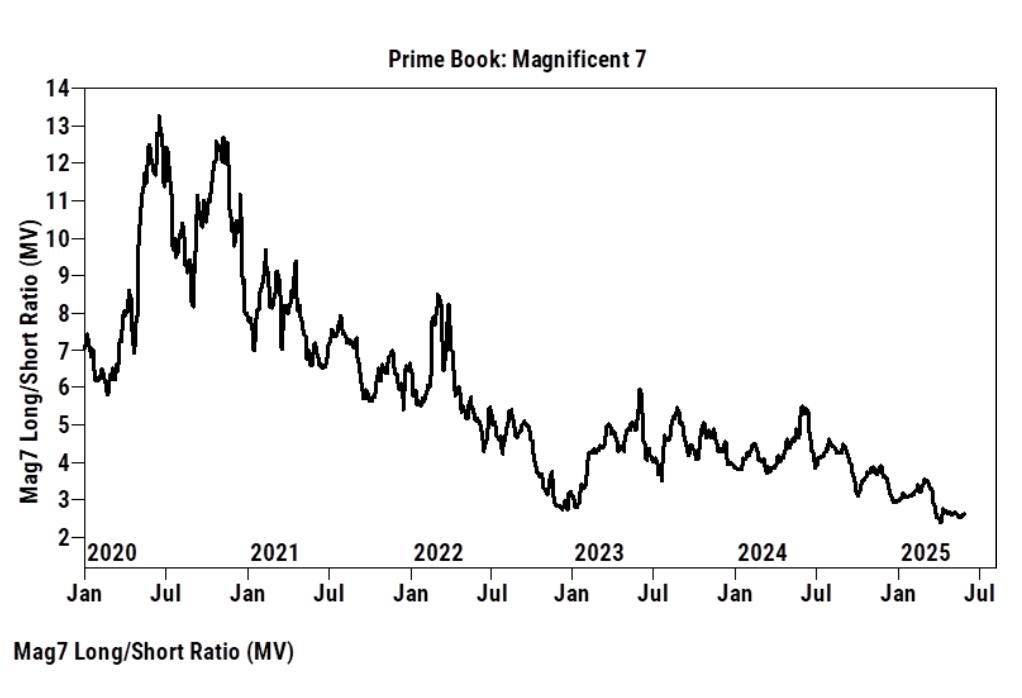

One thing to note is that Hedge fund exposure to the Magnificent 7 continues to decline.

Why does this matter? It creates a two-sided dynamic:

On the way up: These names can continue to grind higher without help from hedge fund flows, meaning hedge funds underperform as Mag7 rallies, especially if the rest of the book is value/cyclicals or short-duration tech.

Eventual: The pain trade forces re-risking. Funds that are light on these names may be forced to chase performance, especially into quarter-end or if macro data surprises to the upside.

So, despite stretched sentiment and lofty valuations, the lack of positioning makes the rally more durable, not less. It’s hard to break something that no one’s leaning on.

While we will experience some short-term (really short-term) volatility with tariffs back in the spotlight and inflation reports over the next two weeks, the rally in equities has some legs as it becomes, once again, a hated rally.

The Macro Data Continues to Cooperate.

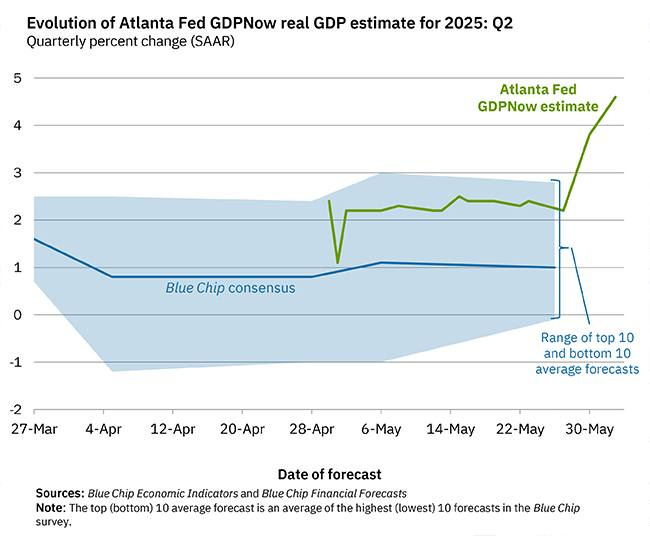

GDPNow forecasts remain robust and rising, helped in part by base effects from last quarter, but still point to real momentum. Inflation has been less sticky than feared, jobs data is fine (although unemployment is slowly rising), and corporate earnings haven’t meaningfully slowed.

We’re also finally seeing soft data start to catch up.

Sentiment, which had been deeply depressed earlier this year, is beginning to improve, driven in part by a more constructive tone on trade. The growth signal from soft data has solidified, even as the hard data remains steady. That divergence was central to our bullish view last month and is why we maintain a constructive view on the macro backdrop.

We’ve also noted a subtle, but important dynamic: consumers aren’t pulling back because they have to… they’re pulling back because they want to. Yet retailers like Walmart have not seen a slowdown at all.

Dollar General and Five Below, two discount retailers that import heavily from China, are having phenomenal years (stock price YTD below):

While headlines like “foreign travelers to the U.S. are down”, air travel overall is in lockstep with 2024.

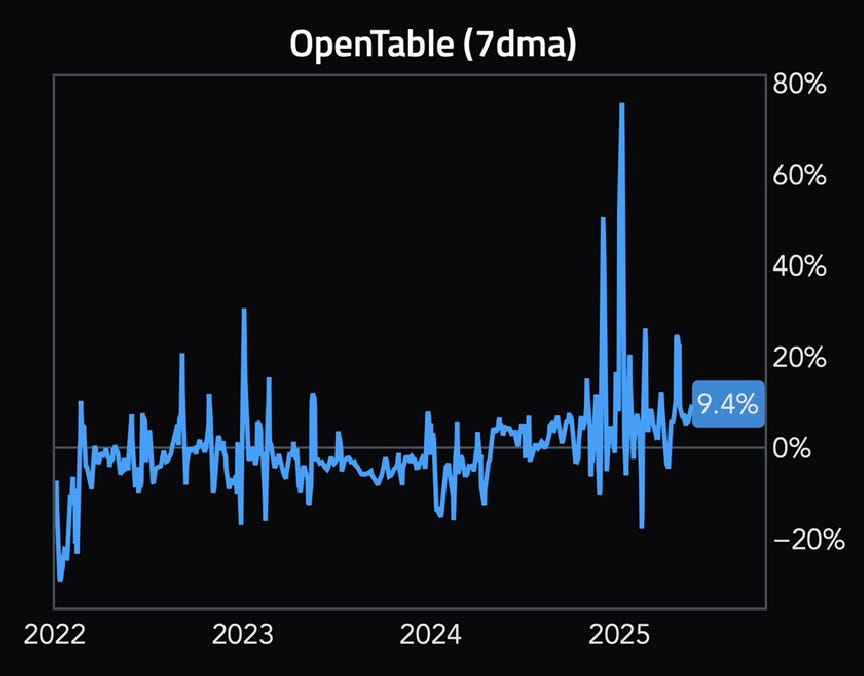

And people are still dining out!

As we wrote about in August 2024, the economy represents a bimodal distribution, where the left mode of distribution is lower to middle class, and the right mode of the distribution is upper class to wealthy; the struggle is evident in the left mode of the distribution, while the right mode remains relatively unaffected. That is still the case nearly a year later:

On balance, the consumptive class’s foundation remains strong. What we need next is follow-through on trade policy. That’s the last piece. If we achieve this, both hard and soft data can continue to improve in tandem, driven by positive talks between Trump and Xi, thus lifting risk assets higher.

The Fed and the Liquidity Setup

Over the last two months, we discussed how we thought Bessent would push Fed Chair Jerome Powell to act, but I did not think it would be Trump doing additional pushing, in person. It was expected that Trump would continue to call JP to request rate cuts verbally, but it’s another thing to meet with him at the White House.

We continue to believe that rate cuts are likely to come this summer. Why? Because real rates are still restrictive, inflation is cooling, and the labor market remains stable, albeit slightly weak (the Fed needs to get ahead of this).

But rate cuts are only one piece of the liquidity puzzle.

The Fed has already signaled the end of QT and quietly hinted at a form of non-QE QE, a liquidity boost in everything but name. Meanwhile, bank regulation is also softening, clearing the way for easier credit conditions in the back half of the year.

Why does this matter? Trump pressuring Powell, QT winding down, and looser bank regulations all point to a more supportive policy backdrop. In a market still climbing the wall of worry, as economic boomers dust off valuation concerns and positioning remains low, this shift in liquidity will be the unlock for another leg higher, especially if US/China trade talks continue to improve, which appears to be happening now:

Crypto

Over the past five weeks, U.S. Bitcoin ETFs have attracted more than $9 billion in inflows. Gold ETFs? Down $2.8 billion. ETH has finally caught a bid too — and for the first time in a while, it looks real as these flows aren’t just traders putting on basis trades (CME open interest hasn’t kept up with the notional ETF inflows), they are accumulating real size.

In our last Market Update, we covered the importance of “asset issuance.” Since then, we’ve noticed a good bit of dialogue happening — some from institutions and some from Crypto Twitter (CT) researchers — expanding on the topic. While it’s encouraging to see this concept become more mainstream, a good bit of the discussion tends to miss the forest for the trees.

For example, take the notion of an asset issuer’s “moat.” Currently, no one has a true moat in the asset issuance space. It’s simply too early, and most protocols lack a true moat (where switching costs to the end user would be expensive). They instead have marketing.

What matters is who’s shipping product at a fast pace and who’s out-innovating the competition. Who’s actually building something sticky that drives value to the end-user? Copycats in crypto only validate the original innovation - very few leapfrog the first of something.

This dynamic is especially brutal in the borrow/lend category. Kamino is a product in the borrow/lend space that has continued to innovate and focus on driving value to the end-user, which is no surprise as to why it is the leading lending protocol on Solana (and it wasn’t first).

However, memecoin trading (the trenches) is exhausted. Trading volumes are down, and engagement is low.

One could discount the drop in activity as being cyclical, and usually, they’d be right.

But this time… there’s a new shiny object for crypto native traders → Hyperliquid.

Hyperliquid currently offers the best trading experience in crypto for any decentralized exchange (DEX), supporting both spot and perpetual (perps) trading.

Spot, perps, everything. Clean UI, buttery execution, CEX-like feel, without the KYC and withdrawal delays. Most retail investors and many funds that don’t actively trade have yet to use Hyperliquid and have likely missed the tripling of $HYPE over the past couple of months. Just like in TradFi, where algos were caught massively underweight and pensions had mechanical rebalancing to do, we’re seeing the same dynamic here: flows chasing performance, with $HYPE catching a sustained bid.

Why Hyperliquid Works

The common narrative surrounding Hyperiquid’s success is that it does not require Know Your Customer (KYC) verification, has niche listings, and engages in regulatory arbitrage.

That’s not wrong. But it’s not why they’ll stay dominant.

Hyperliquid has proven two critical things:

The founders and broader team are elite engineers with extensive experience in capital markets.

Hyperliquid has better spreads, better execution, and deeper order books than most CEXs and DEXs.

Want to buy a Bitcoin perp in size? Hyperliquid probably has the best fills.

Want to scalp memes with 5x leverage? Same story.

Want to run an ETH-BTC basis trade while farming $HYPE? Yep, you can do that too.

Hypeliquid also has the HyperEVM, enabling other teams to build on top of Hyperliquid’s L1. “Precompiles”, short for Precompiled contracts, is a technology that collects information generated from Hyperliquid L1 and makes it available for use in HyperEVM. Without Precompiles technology, all price data would need to be copied from Hyperliquid L1 to HyperEVM for smart contracts to read, which causes delays in the EVM block generation process as the number of assets to copy increases. In contrast, Precompiles collects information and includes it in each block, allowing requesters in HyperEVM to selectively utilize needed information, minimizing network load at the EVM level.

Precompiles enable direct querying of liquidity, oracle, vault, staking, and other information from Hyperliquid L1 in HyperEVM. While centralized exchanges like Binance have no way to utilize large orderbook liquidity in external DeFi protocols, Hyperliquid makes this possible through its liquidity program.

Now, with write and read precompiles going live soon, you can expect increased usage of the HyperEVM. Users can experiment with money markets using Felix, run a delta-neutral strategy on Liminal, or (once live) stake $HYPE with Kinetiq and leverage their liquid staking token ($kHYPE) to amplify their position on other DeFi platforms.

While Hyperliquid is not without its flaws (only 21 validators for the entire network), the team’s execution and the fanatical community behind Hyperliquid are undeniable. It is no surprise that $HYPE is now in the top 15 by market capitalization, and we suspect it is only a matter of time until it is in the top 10.

VC

Pioneering a New Horizon

The crypto VC landscape continues to hum with bold ambition, harnessing a resurgent market while dodging the ghosts of past exuberance. Three trends dominate: the fusion of AI and blockchain, a blockbuster funding surge, and the speculative allure of SocialFi with tokenized attention. Fueled by Bitcoin’s post-tariff rebound and a pro-crypto U.S. stance, crypto VC is carving a path of innovation grounded in discipline. Yet, macro volatility and speculative risks loom, demanding a focus on tangible value.

AI x Crypto: Promise Meets Pushback

The AI-blockchain nexus is a VC juggernaut, with $917M invested in decentralized AI projects, per Trammell Ventures. Firms like a16z, Pantera Capital, and Hack VC are backing Sentient ($85M seed for decentralized AGI), io.net ($30M Series A for a DePIN compute network), Hyperbolic ($17M for GPU tokenization), and Payman ($3M pre-seed for AI-driven crypto payments). These projects decentralize AI compute and data—io.net, for instance, connects 1.2 million GPUs globally, per its Q1 report, while Payman enables autonomous on-chain transactions. The AI token market, soaring from $2.7B in April 2023 to $39B by October 2024, is projected to hit $45B by early 2026 (CoinGecko). Yet, X posts like “AI x Crypto is just 2021 ICOs in disguise—where’s the real blockchain utility?” question whether blockchain is essential, warning of hype-driven valuations.

Funding Surge: Maturing Amid Risks

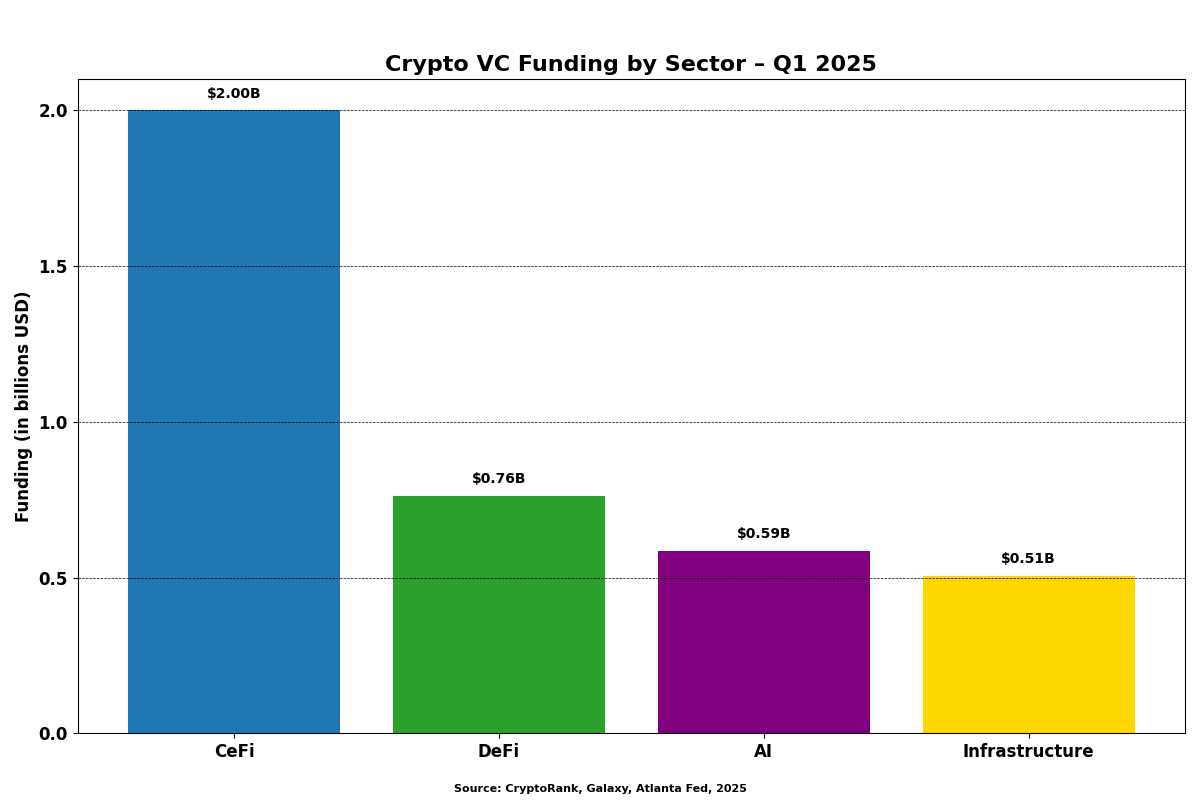

Q1 2025 saw $5.85B raised across 446 deals, a 61% leap from 2024, per CryptoRank and Galaxy. A $2B Binance deal led the way, joined by 12 rounds over $50M, including Allora Labs ($35M for AI analytics), Plume Network ($50M for RWA tokenization), and OG Labs ($35M for modular AI chains). CeFi ($2B), DeFi ($763M), and infrastructure ($506M) dominated, with later-stage deals capturing 65% of capital, signaling maturity. AI and DePIN reflect real-world utility, but $20B in locked token value from launches like Berachain (5% float ratio) risks volatility, per CryptoRank. New fund fundraising ($1.9B, $130B average fund size) remains constrained, with a declining median reflecting caution. The Atlanta Fed’s -2.8% GDP forecast for Q1 2025 tempers enthusiasm, though Bitcoin’s recovery from April’s $74,425 low shows resilience.

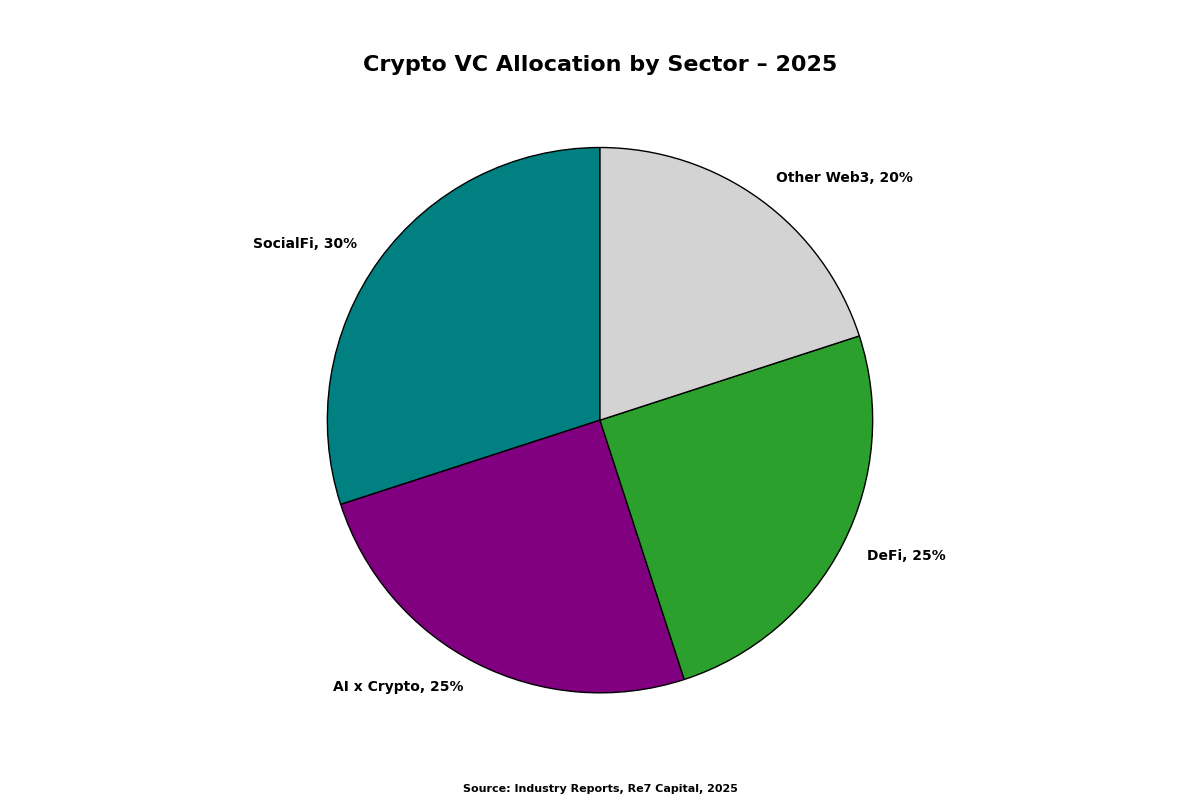

SocialFi and Tokenized Attention: A Risky Frontier

SocialFi, merging social media with DeFi, is a high-stakes VC bet. Re7 Capital’s $10M fund, backed by Lens founder Stani Kulechov and Farcaster’s Dan Romero, targets 30 early-stage startups, with 60% of capital committed and a June 2025 close planned, per industry reports. Lens Chain, a Layer 2 with sub-cent fees and 50ms finality, enables SocialFi apps in days, while Farcaster’s “frames” turn posts into mini-apps, hosting 200+ projects. Tokenized attention—e.g., Lens users earning 0.01–0.1 tokens per engagement—redefines monetization, bypassing Web2 gatekeepers. Yet, X posts note SocialFi’s unproven adoption and competition from centralized platforms, with Re7’s fund details lacking primary confirmation.

A Market Forging Value

The past month found crypto VC at a pivotal juncture, balancing bold innovation with hard-won pragmatism. The $5.85B raised in Q1 signals a market rebounding with vigor, yet the road ahead hinges on navigating macro volatility and speculative traps. AI x Crypto could redefine decentralized economies, but its success depends on proving blockchain’s utility beyond hype, as skeptics demand. The funding surge reflects a maturing sector, yet low float ratios and constrained fundraising signal a need for disciplined capital allocation. SocialFi’s tokenized attention models promise user-driven ecosystems, but scaling adoption against Web2 giants remains a hurdle. The path forward requires VCs to prioritize projects with tangible impact—AI compute networks that deliver, DeFi protocols with real-world utility, and SocialFi platforms that capture mainstream users. Regulatory clarity and Bitcoin’s resilience offer tailwinds, but a -2.8% GDP forecast and market correlations demand agility. As crypto VC pioneers this new horizon, its ability to bridge blockchain’s promise with measurable outcomes will shape a transformative future.

Sources: CryptoRank, Galaxy, Trammell Ventures, CoinGecko, Atlanta Fed, DefiLlama

Bitcoin DeFi

The Evolving Bitcoin DeFi Ecosystem

Bitcoin DeFi is entering a breakout phase. What was once a quiet build cycle is now turning into visible progress, as teams launch mainnets, ship cross-chain infrastructure, and integrate with top-tier centralized exchanges. With real yield, native assets, and trust-minimized bridges gaining traction, a credible alternative to wrapped-token DeFi is taking shape — rooted directly in Bitcoin.

Recent developments:

Liquidium Aims to Launch Bitcoin Cross-Chain Lending: Asymmetric Portfolio company Liquidium, a Bitcoin dApp focused on NFT lending announced at Bitcoin Vegas they are expanding their scope to create a cross-chain lending dApp enabling Bitcoin to Stablecoin loans. Link

Mezo Announces May Mainnet: Asymmetric Portfolio company Mezo, goes live with MUSD, a BTC-based stablecoin. Link

Garden Finance Crosses $1.2Bn of Bitcoin Transferred: Garden Finance, a Bitcoin-to-Bitcoin stableswap powered by an intent-solver architecture — has surpassed $1.2Bn in total transaction volume. The protocol has generated nearly 39 BTC in fees to date, highlighting growing demand for seamless, capital-efficient BTC-native bridging. Link

MagicEden Doubles Down on Bitcoin DeFi with Spark Partnership: Details of the partnership have not been announced, but hints suggest a performant trading environment for Bitcoin-native assets (fungibles). Link

Oyl Launches Alkanes — Bitcoin Metaprotocol: After previously raising a $3M seed round, Oyl launches Alkanes, a Bitcoin metaprotocol which enables native smart contracts with WASM VM. Link

As the Bitcoin-native DeFi stack matures, momentum is shifting from speculative hype to product-market fit. Protocols are solving for usability, liquidity, and capital efficiency — without compromising on decentralization. Bitcoin is slowly making its way to be a cornerstone of every onchain environment.

Bitcoin L2s

Ecosystem integrations are accelerating as BitVM2 makes meaningful strides toward real-world adoption. This month, BOB (Asymmetric PortCo) a Bitcoin L2, in collaboration with Fiamma, launched a trust-minimized BitVM2 bridge on testnet, enabling the minting of bobBTC — a Bitcoin-backed asset usable across BOB’s EVM-compatible chain. This marks the first time a Bitcoin wrapper can be trustlessly bridged using Bitcoin-native validation rather than external multisigs or federations.

Why is this a big deal?

BitVM2 enables the execution of arbitrary computations (think smart contract logic) using Bitcoin’s native opcode set, but evaluated off-chain with on-chain fraud proofs. This allows trust-minimized BTC bridging — a foundational requirement for Bitcoin-native DeFi — without introducing external consensus layers. In essence, BitVM2 could unlock Bitcoin's version of Ethereum's rollup ecosystem.

Despite a noisy market, the core thesis for Bitcoin-based finance remains unchanged— and increasingly validated:

Bitcoin is the collateral of the internet: Programmability remains limited. L2s like BOB, Mezo, Bitlayer, Stacks, and Botanix aim to change that — without diluting Bitcoin’s trust model.

Institutional appetite for Bitcoin yield is rising: To capture it, we need capital-efficient, secure ways to deploy BTC in on-chain strategies (e.g., lending, basis trades, restaking).

UX is catching up: With one-click BTC staking, familiar EVM wallets, and smart BTC wrappers like bobBTC, Bitcoin DeFi is crossing the usability threshold.

Security is becoming programmable: BitVM2, Babylon staking, and native bridges are making Bitcoin a programmable trust anchor — not just a passive store of value.

While there are alternative approaches to Bitcoin interoperability — Stacks’ sBTC recently closed its third vault, demonstrating continued traction in its peg-out mechanism — new entrants are also recognizing the importance of Bitcoin-native collateral. Notably, Sui announced upcoming support for sBTC, marking the first time a non-Bitcoin chain will integrate with the asset. These developments highlight a growing demand for Bitcoin-backed assets across ecosystems, even as BitVM2-based solutions like bobBTC push for deeper trust minimization and native Bitcoin alignment.

Source: BitcoinEcoTK

Metaprotocols

Oyl Corp's Alkanes is a Bitcoin metaprotocol designed to enable native smart contracts on the Bitcoin network. It draws inspiration from Bitcoin metaprotocols like Ordinals and Runes, utilizing techniques such as the "witness envelope" to embed smart contract code directly into Bitcoin transactions.

Alkanes allows developers to deploy WebAssembly (WASM) smart contracts to the Bitcoin blockchain. These contracts are written in languages like Rust, compiled into wasm files, and embedded within Bitcoin transactions. The system leverages the Unspent Transaction Output (UTXO) model, enabling contracts to hold balances, interact with other contracts, and access transaction and block data. This design facilitates functionalities such as checking balances, reading/writing storage, and enforcing conditions on spending through Bitcoin's scripting capabilities.

Rebar Labs is a component of the Alkanes ecosystem aimed at enabling transaction ordering and execution within the Bitcoin mempool. As shown below as a mempool transaction with Rebar ordered transaction in blue:

Alkanes employs a WASM-based virtual machine for executing smart contracts, providing a secure and efficient environment for contract execution. The indexer for Alkanes is also built using WASM through a framework called Metashrew. Metashrew allows for deterministic and verifiable indexing of the blockchain, ensuring that the state derived from smart contract executions is consistent and reproducible. This setup supports functionalities like simulating contract executions, computing fuel costs, and accessing historical state data.

We’re excited to see teams like Oyl Corp pushing the boundaries of what's possible on Bitcoin by building metaprotocols like Alkanes to enable native smart contracts. Even if constrained by Bitcoin’s inherent throughput limitations, these efforts reflect a growing ecosystem-wide interest in extending Bitcoin’s functionality without compromising its core principles. The exploration of WASM execution, deterministic mempool ordering via Rebar, and programmable logic through covenants shows that innovation in Bitcoin-native development is accelerating in thoughtful, layered ways.

Bitcoin Staking

Institutions are finally getting a way to earn real yield on their Bitcoin — without giving up custody or taking on bridge risk. Enter lstBTC, a new institutional-grade Bitcoin yield product from CoreDAO and Maple Finance, designed to turn idle BTC into a performance asset. Backed by trusted custodians like BitGo, Copper, and Hex Trust, lstBTC enables accredited investors to earn 4–6% BTC-denominated yield while the underlying Bitcoin remains secured via Bitcoin-native time-locks, not smart contracts or synthetic wrappers. Yield is generated through Maple-managed, risk-optimized strategies like staking, lending, and basis trades, effectively creating a secure, transparent vault product with trading desk precision.

However, lstBTC is not permissionless — access is gated via KYC and restricted to institutions and accredited investors. While that limits open DeFi composability, it signals a powerful shift: regulated Bitcoin capital is being mobilized, not just held — and doing so with onchain primitives rather than off-chain IOUs.

Source: BitcoinEcoTK

dApps

At Bitcoin Vegas, the Liquidium team announced the next evolution of their product — expanding into cross-chain lending and borrowing of digital assets like Bitcoin, Ethereum, and Solana. While Liquidium’s v1 launched as a Bitcoin-native NFT lending dApp using Discreet Log Contracts (DLCs), the team is now building on a new technical foundation: ICP Chain Fusion. This approach allows smart contracts to seamlessly interact across multiple blockchains. Initially, it will enable instant NFT-backed loans on Bitcoin, with broader cross-chain lending capabilities to follow.

Connecting Bitcoin to assets and systems that already have clear product-market fit is one of the most exciting developments in Bitcoin DeFi. Liquidium’s deployment on ICP Chain Fusion is a strong example — enabling users to borrow stablecoins like USDC and USDT on the chain they desire stablecoins on, against BTC, abstracting wrapping through ckBTC.

What makes this integration stand out is the user experience, which you can try here as a demo: link. Instead of forcing adoption of new, siloed ecosystems, it leverages wallets and assets users already trust. By linking Bitcoin to familiar on/off ramps and stablecoin liquidity pools, it builds a more intuitive, capital-efficient borrowing experience.

This is how Bitcoin becomes usable in real-world DeFi — through elegant connections rather than isolated infrastructure. We are excited to see the incentives programs and campaigns that the team builds to attract substantial amounts of liquidity to compete against other lending dApps.

Team Updates

Joe spoke at Binance in Abu Dhabi and TOKEN2049 in Dubai at the end of April.

Joe was mentioned in The Washington Post article “These young people see meme coins as their best shot at the American Dream”.

Check out Joe’s NEWSBTC interview “Bitcoin To $400,000, Solana To $420, Ethereum Dead Weight, Says Fund Manager”.

Dan spoke at Bitcoin Vegas at various events such as BitGo, Inscribing Vegas and Arch.

Lukasz spoke at Consensus in Toronto and Bitcoin Vegas at the end of April.

All Market Updates

Please let us know if you have any questions or comments.

As always, thank you for your support.

– Asymmetric