Asymmetric Market Update™️ #29

Our thoughts on what is relevant in Crypto and Markets…

Macro

While April was a historic month, we’re not going to rehash Liberation Day—that bloodbath got its own set of headlines last month. But let’s be honest: not much has changed. Markets are still held hostage to tariff tweets. Liquidity is still razor thin. Algos are still driving market moves. And while fear indicators like credit spreads and the VIX have rolled over, we’re still trading in a regime where one man’s tweet can override every so-called “bottoming signal” on your dashboard.

Make no mistake—markets have flashed classic bottoming signals everywhere. Credit spreads? Peaked. VIX? Rolling over. Bitcoin? Closing the gap on gold. Pessimism? Still pinned at extremes. Technicals? Screaming capitulation. But none of it matters if price action is glued to headline velocity and liquidity depth is at record lows.

And yet, economists and strategists keep playing the same tired game—projecting GDP, payrolls, and PCE like it offers some edge. It doesn’t, in this market where it can all change with one tweet. The market and the economy are different animals. When GDP prints its worst, the market has often already bottomed. That’s why recession obsession is usually backward-looking. Yes, recession odds are high. But this is a policy-driven slowdown—tariff-induced, not credit-crisis born. It can be reversed just as easily. Our models suggest that it will probably reverse, especially as the labor market softens and inflation continues to drift lower. The Cleveland Fed tends to agree on inflation:

Meanwhile, the permabears are dusting off Ray Dalio’s Principles for Dealing with the Changing World Order to justify USD collapse narratives and de-dollarization trades. Don’t get us wrong—it’s a brilliant book, and many of its warnings hold long-term weight. But betting against the Dollar has been a money-losing strategy for decades. Someday, the U.S. will lose reserve status. Just not today. Fear sells—but it’s a terrible investment strategy. We’re aware of the narrative. We’re just not participating in it.

Most investors are still trying to forecast the future like it’s some economic Magic 8-ball—GDP, payrolls, PCE, rinse and repeat. But if you don’t understand what’s happening now, your hit rate will be worse than Jim Cramer’s. This isn’t a macro-driven market. It’s a tariff-driven market. Tariffs are the sun, and everything else—growth, inflation, earnings—is just orbiting debris.

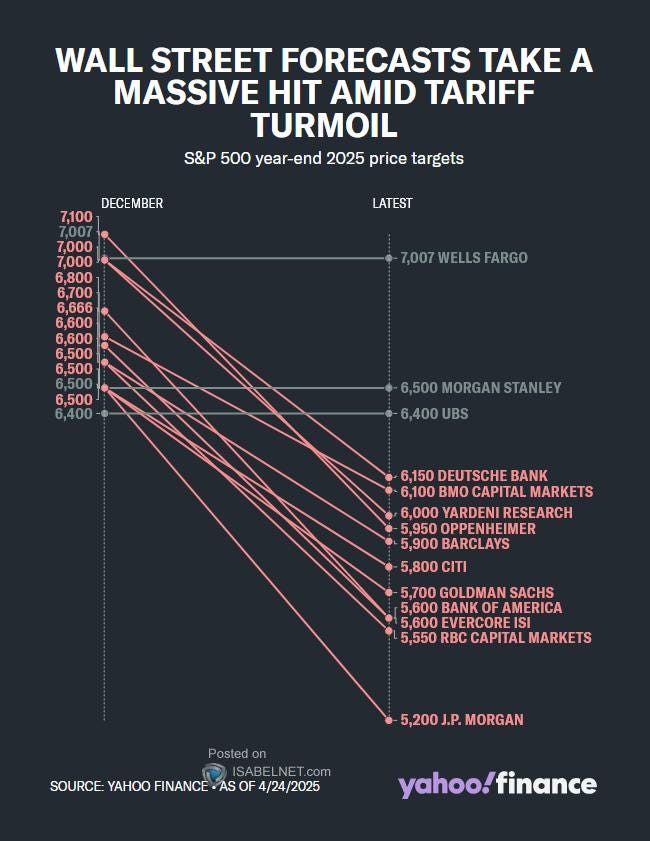

Need proof? Look at the drastic revisions to Wall Street forecasts.

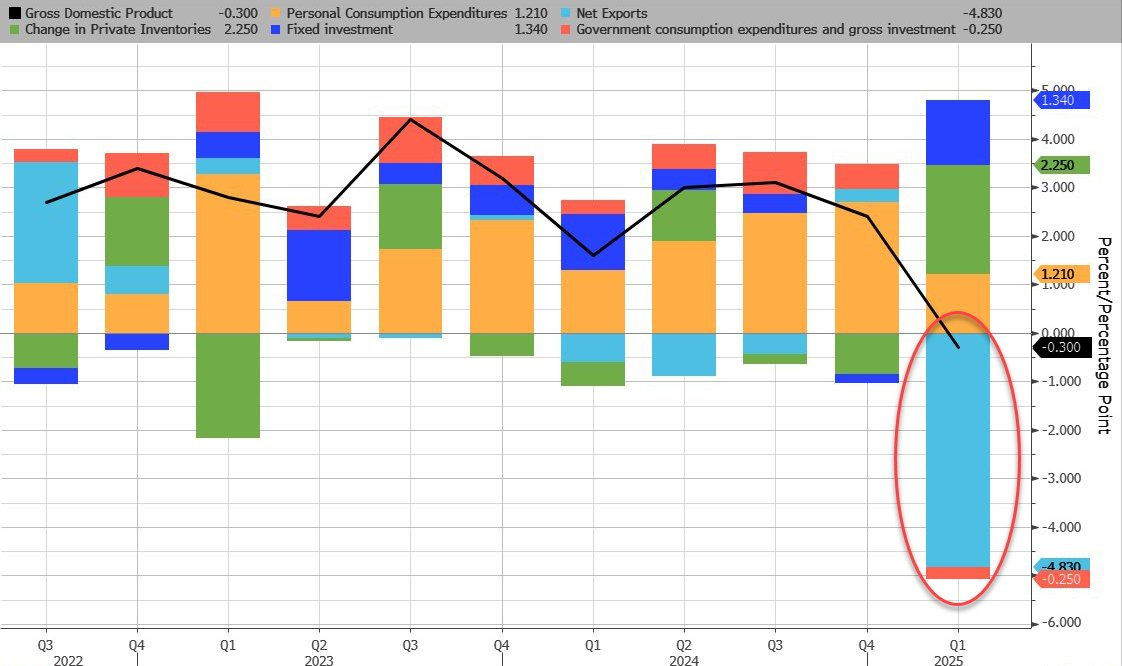

Q1 GDP came in at -0.3%. It was a known-known—entirely tariff-induced—and yet markets still flinched. However, they did come back to reality in short order. The intraday whipsaw was not because the data surprised, but because we’re still trading in a fragile, twitchy environment where shallow liquidity meets hypersensitive positioning.

Even mega-cap earnings, which by all accounts have been robust as expected, are being downplayed by CEOs offering cautious forward guidance—not because business is weak, but because they, too, don’t know how to price in tweet-driven trade policy risk.

Q2 GDP will likely limp somewhere between 0.5% and 1.0% annualized. Real growth is soft, inflation is above 2%, but it is trending lower. This isn’t a hard landing. It’s a grind. Cooling, not cratering.

And what about the U.S. consumer—the supposed weak link? They are still standing, and delinquencies are falling.

Real (inflation-adjusted) wages remain positive. While spending is becoming more selective (see Starbucks), it’s still healthy.

Just listen to the CEOs of the credit card giants:

“Our customer base is very different than our competitors' customer base. And it's really resilient and pretty stable. I think that they are continuing to spend, albeit at not levels that we saw coming out of the pandemic.”

— Stephen J. Squeri, American Express

“Consumer spending has remained resilient, with payment volume growth steady at 6% year-over-year… discretionary spending in some categories like airlines has softened slightly.”

- Ryan McInerney, CEO at Visa

Again, cooling, not cratering.

To keep the short story short: consumers remain healthy, although they are pulling back on spending due to tariff-induced uncertainty. Both "Main Street" and "Wall Street" are citing concerns over uncertainty surrounding tariffs (see our last Market Update), as some of the hard data is softening but could quickly reverse as the Trump administration walks back tariffs on China.

Credit markets tell the same story. Spreads have peaked and are drifting back toward equilibrium—even if that “equilibrium” still sits around 400bps.

Despite occasional headline-induced spikes, the Volatility Index (VIX) has also rolled over and continues to grind lower. Although spikes in the VIX are to be expected given the volatility of daily headlines, the local maximum is in.

And here’s something most people missed: on April 24th, we got a breadth thrust signal—the 16th time since 1939.

In plain English, we went from a market where only a few stocks were driving gains… to one where nearly everything started participating simultaneously. When that many names flip from red to green in ten trading days or less, it typically signals the start of a durable move higher, not a “dead-cat bounce” as markets become less sensitive to one stock’s earnings.

Taken together—falling credit spreads, compressing volatility, rare, internal strength signals like a breadth thrust, and a myriad of technical bottoming signals—suggest that the bottom is in or at least in the “bottoming” process.

Let’s rewind to April 7th.

No need to rehash every tick, but what mattered wasn’t the move—it was the rate of change. Trillions changed hands on air, driven not by conviction, but by near-record thin books.

At the time, S&P liquidity was among the worst we’ve seen in years. That’s why markets could swing 5–10% on whispers. This wasn’t about valuations or fundamentals. It was about depth—or the lack of it.

That structural fragility hasn’t gone away. Book depth has improved marginally, but we’re still in a twitchy, flow-sensitive regime. Psychology is fragile. The machines are still in charge.

That brings us to positioning. In this environment, flow drives price, and the flow has been one-sided. “Follow the flows.”

Systematic strategies are still short. This isn’t Tiger Global or Altimeter selling, it’s machines (think The Medallion Fund). We’re seeing discretionary PMs warming back up across equities, fixed income, and even alts. But the machines haven’t followed. Why?

Because systematic models don’t care about Powell. Or earnings. Or forward guidance. They care about price momentum, realized volatility, and correlation regimes. That’s it.

The big three:

CTAs: Buy strength, sell weakness.

Vol targeters: Cut exposure when volatility rises.

Risk parity: Shift allocations as volatility relationships change.

When trends break down or volatility spikes, these strategies sell automatically. There are no meetings, no gut checks, just output = buy or sell. That’s why they often dump risk at the lows and chase near the highs. Their models are backward-looking by design, and they still see red.

That’s also why valuations can stay stretched and price action feels disconnected from sentiment at the highs and lows. The discretionary side is tiptoeing back in. However, the machines, representing 60–70% of equity flows, are still defensively positioned.

And here’s why this matters.

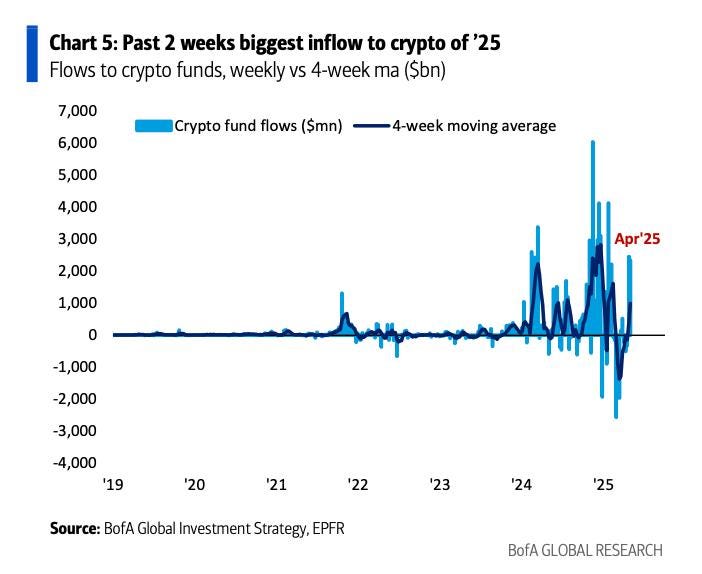

We’ve started to see flows turn: Treasuries recorded the largest four-week inflow since Q1 2023, and U.S. Bitcoin ETFs saw their third-highest inflow week of the year. These aren’t euphoric flows by any stretch of the imagination, but they are “bottoming” ones, suggesting that the worst of the fear trade is behind us.

To quote JP Morgan’s Michael Cembalest:

“The stock market is unique – it cannot be indicted, arrested or deported; it cannot be intimidated, threatened or bullied; it has no gender, ethnicity or religion; it cannot be fired, furloughed or defunded; it cannot be primaried before the next midterm elections and it cannot be seized, nationalized or invaded. It’s the ultimate voting machine, reflecting prospects for earnings growth, stability, liquidity, inflation, taxation and predictable rule of law.”

Markets don’t care about your opinion. They care about your positioning. You’re either on the right side of flow—or you’re not. If you have been sidelined since April 7th, you have missed an incredible short-term rally.

So, now what?

Equity markets have rallied hard off the lows, with the S&P 500 printing nine straight green days in a row at the time of this writing, a feat that hasn’t occurred since 2004.

Will we still experience down days and contemporaneous volatility shocks? Yes.

Are we going to re-test the lows? No, or put another way, it’s highly unlikely. Why?

Positioning. Institutional traders and investors are still wildly under-allocated and have already sold most of their positions. Given the lack of sellers as measured by positioning, it’s tough to see the market blowing through the lows, and dips are for buying.

We expect the Trump administration to deliver some form of tariff relief—optically if not functionally—before July 8, which we are already starting to see. The deals will be light on details and heavy on headlines. That’s fine and how Trump operates…and how markets currently trade. U.S. trading partners are incentivized to sign something before the clock runs out, even if they quietly renegotiate later to avoid maximum pain.

What about the Fed? Are cuts still coming? Yes.

Real rates remain restrictive, but the bond market and inflation forwards suggest the Fed will cut. The latest NFP print suggests a resilient labor market, with the unemployment rate steady at 4.2%, but revisions continue to come in lower.

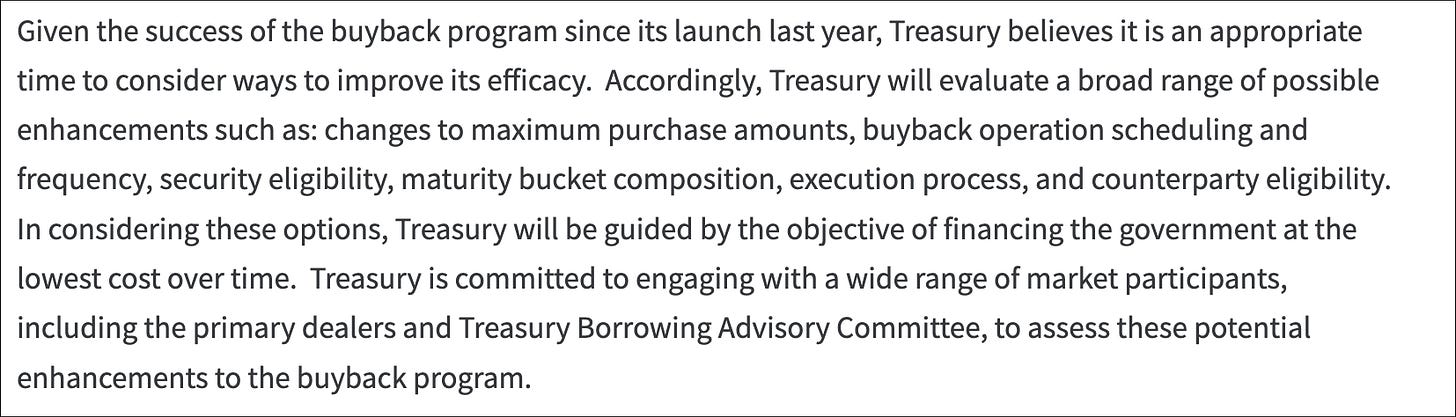

However, even if cuts do not come this quarter, as noted last month, we expect to see some non-QE QE thanks to the Treasury:

As discussed in our last Market Update, the Fed has signaled an end to QT (good for liquidity-sensitive assets) while also being pressured on the regulatory front with the banking industry (i.e., credit). Credit is the lubricant for markets, and as this becomes more abundant due to deregulation, we should, again, see liquidity-sensitive assets outperform. This combination of rate cuts, the ending of QT, deregulation, and the introduction of non-QE QE bodes incredibly well for Bitcoin.

We said this last month:

“...Bitcoin, is historically less sensitive to earnings/guidance risk and is positioned to benefit from any liquidity tailwinds the Fed throws at this environment.”

We continue to hold this view. Bitcoin remains less exposed to earnings or margin compression and stands to benefit most from any Fed pivot or regulatory unwind. With the Fed dovish, tariffs easing, and liquidity expanding, Bitcoin dominance hasn’t peaked.

To sum it up, we think:

Tariffs get eased—optically if not functionally.

The Fed leans dovish, cutting and/or easing QT to counter tariff drag.

Liquidity-sensitive assets outperform (Bitcoin especially).

Earnings growth will be challenging for most corporations, but they will benefit from trade policy clarity and deregulation.

And if we’re right? Bitcoin dominance has not topped.

Crypto

There has hardly been a more exciting time in crypto. Headlines that once screamed “crackdown” now sound like onboarding campaigns. States, nations, and institutions are leaning in. Private crypto firms are filing to go public. SEC charges are getting dropped. Political momentum is here, louder and more durable than most expected.

And yet, markets haven’t exploded higher. Why?

It’s not that investors don’t understand Bitcoin—they’re still trying to figure out if it’s acting like the asset it’s supposed to be—a diversifier, a haven, a modern hedge.

Gold held up well during the recent selloff. Bitcoin, initially, didn’t. But as the dust settled, BTC found its footing, and ETF flows skewed positive again. The message? Institutions may still be skeptical, but they want exposure to the orange coin. Maybe not as a religion. But as a rotation.

While that debate plays out in committee rooms, Bloomberg panels, and dinner tables, capital is already rotating in. Just weeks after Liberation Day, we saw the largest weekly inflows into crypto funds this year, followed by the second largest the week after.

As mentioned in the Macro section, it’s a good sign that we’ve either found the bottom or are firmly in the bottoming process.

We are solely focused on majors, but I want to dive deeper into the weeds on the crypto front, more so than in the past.

I want to talk about asset issuance and why it’s not just a byproduct of bull markets and excess fervor but one of the few moats in crypto.

Asset issuance is the creation and distribution of new tokens.

From memecoins to tokenized T-bills and RWAs, creating and distributing new assets is the gateway to everything else: trading volume, fee generation, liquidity routing, and user acquisition. It’s the entry point to the entire on-chain economy.

Why focus here? Because issuance has been the single most lucrative vertical in crypto outside of stablecoins.

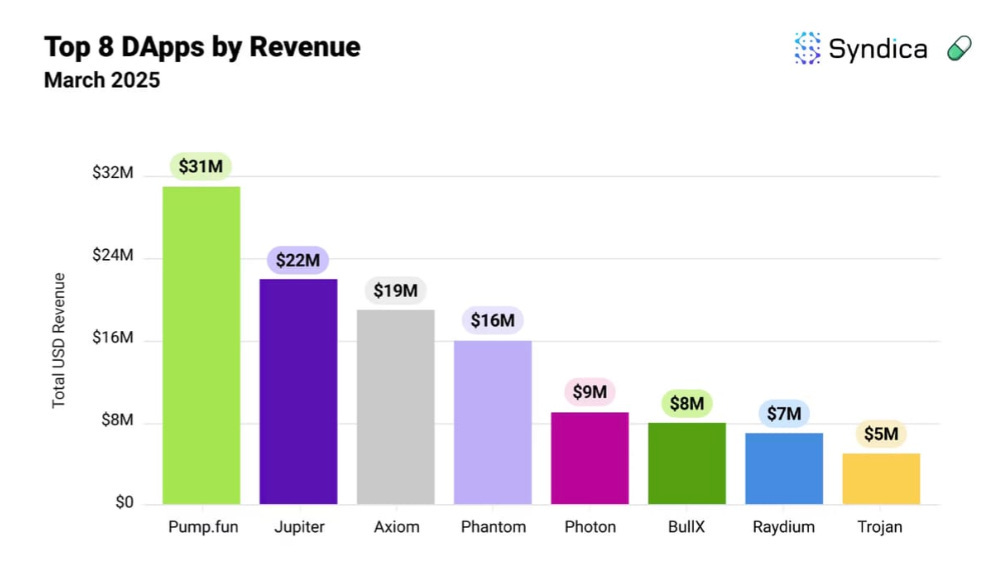

Just look at the top dApps on Solana. What do the biggest earners do? They control creation and/or flow.

What does the top earner do? They have created a platform where anyone can issue new tokens. Pump.fun turned token issuance into a consumer product. Anyone can launch a token. The fees? Compounded. The attention? Massive. And now they’re moving downstream—launching their own AMM to stop leaking revenue to Raydium.

Think about asset issuance as the gateway drug for all economic activity in crypto. Whoever controls that initial point of creation captures not just the issuance fees, but also:

The initial distribution fees

The trading volume that follows

The AMM liquidity

The downstream composability and innovation

The long-term relationship with the token creator

And critically—the flow

On the surface, most of Crypto Twitter (CT) sees this as a memecoin arms race. But it's much more than that when you think about it. It’s about controlling where assets (not just memes)—and attention—begin and the follow through (i.e. which AMM captures the volumes).

It’s impressive that Raydium is on the above list, as many DEXs/AMMs struggle to generate substantial revenue and retain some meaningful market share, as more centralized counterparties take market share due to better pricing/fills. How has Raydium done this? They have carved out a niche in the market with token issuance, largely in memecoins. However, with pump.fun launching their own AMM, they have lost meaningful market share. They know this.

So, how do you get it back? You take back asset issuance.

What's the "simplest" way to do this? Launch a competing launchpad. You might be thinking, "The last thing we need is another launchpad," and you're right. All these launchpads really do remind us of the NFT marketplaces that started popping up everywhere in 2021/22. Just a few survive and retain users/liquidity. We are still in the bundling phase of launchpads, not the unbundling. That will come later. These launchpads are likely to be commoditized tools in a larger strategy, controlling the flow of assets.

The Launchpad revenue won't matter much for Raydium as they will make more from controlling flow to their AMM, their money printer, in the long run, as they solidify some percentage of asset issuance on Solana.

Raydium's new launchpad, LaunchLab, is off to a strong start.

On April 27th, they did 15% of total launchpad volumes, which is better than any pump competitor has done.

Many tokens have already graduated and cleared a $1M+ market cap (the total LaunchLab token market cap ~ is $40 million at the time of writing), and the incentive model looks competitive—multiples better than Pump's.

One piece the markets have yet to fully price in is that LaunchLab isn’t just a launchpad—it’s a launchpad for launchpads.

Any team can now fork and deploy their own version, with custom bonding curves, fee parameters, and even a cut of post-graduation swap fees. In other words, LaunchLab isn’t just a product. It’s infrastructure. Raydium provides the rails. Others bring distribution. And regardless of who owns the UI, Raydium earns 25bps on all swap volume—a passive, scalable monetization layer. Want to launch on boopdotfun? On Bonk? Great! Do it, and after the token graduates, it moves to Raydium.

I imagine Raydium is leaning heavily into this B2B component as it plays well into their strengths: open infra, deep composability, and passive monetization. Just look at how well Bonk did with LetsBONK.fun. Bonk generated nearly $1m in fees in the first 3 days, which was made possible in partnership with Raydium/LaunchLabs. And where do these flows go after graduation? Again, it is the AMM money printer that is Raydium.

The real question is whether these incentives and customization are enough to start chipping away at Pump's grip on the market. LaunchLab favors the "one-hit wonder" strategy, with teams looking for more customization and creativity in launch and bootstrapping runway with rev share via trading volumes.

Pump's model is tuned for velocity. You get a flat SOL rate per token that hits a $69k market cap, and zero cut of protocol fees via PumpSwap. So the name of the game is launching as many tokens as possible and riding waves of hype.

LaunchLab, or forking your own version of it, is the way to go if you're gunning for a viral hit and care more for long-term success. If you're flooding the markets with meme after meme, Pump has historically stacked faster. Take Fartcoin, for example—if it did $5B in lifetime volume, LaunchLab's 10% cut of AMM fees would've netted the creator ~$1.25M. On Pump, that same token generated 0.5 SOL in earnings for the creator.

$1.25M vs essentially $0.

Same token, wildly different outcome for the creator.

I think this is one of the most exciting tools that comes with launching on Raydium/Bonk over pumpfun. You could launch here and bootstrap revenue if you are a creator or an early-stage team. While Pump might dominate the velocity of coins, even though a few wallets launch the majority, Raydium's LaunchLab will probably win out regarding teams wanting to build something more substantial. I do think, over time, LaunchLab launchpads take most of the velocity.

On CT, this entire battle over launchpads assumes the only assets to ever live on Solana will be memes, which I don't think will hold true. As the crypto ecosystem matures and regulatory clarity improves, we will continue to see more diverse assets come onto Solana:

Equity-like assets

T-bills

Real estate

Tokenized funds and investment products

In-game assets

The two big asset issuers right now are Pump and Raydium, but Pump lacks composability. At the same time, Raydium is fully open-sourced, meaning Raydium should capture a lion's share of asset issuance on Solana outside of memecoins. Raydium's programs were among the first on Solana to support Token-2022 (now Token Extensions), which caters to institutional asset issuance, potentially putting Raydium in a position to build an institutional-facing product line.

Pump doesn't even have an IDL (Interface Definition Language) for their PumpSwap, so it's hard to picture a world where institutional teams, serious projects, or traditional finance entities would use them in their current state. They've optimized for memecoin velocity, not enterprise-grade reliability. However, this could all change overnight if they open up.

This might seem like a lot about asset/token issuance, but it's important to discuss as the launchpad war is more than just a mere memecoin launchpad war. It's about which platforms will become the fundamental infrastructure for the tokenized economy, and who ultimately controls the flow. It’s about owning the infrastructure to support the tokenization of everything, from memes to T-bills.

We believe teams focused on building robust asset issuance infrastructure, not just chasing memecoin velocity, will make the most durable businesses in crypto's next institutionalizing phase. These businesses also sit at the intersection of fundamentals and memetic value (i.e. the sweet spot).

VC

A Market at a Crossroads

The crypto venture capital landscape in April hums with a restless energy, caught between the promise of a rebound and the echoes of past turbulence. Over the past month, discussions have coalesced around surging funding rounds, the allure of crypto-AI integration, a shifting regulatory horizon, and the hard-won lessons of earlier excesses. Against a backdrop of economic turmoil stirred by Trump’s policies, crypto VC navigates a delicate balance, chasing innovation while grappling with volatility. This is a story not of clear victories or defeats but of a market adapting, reflecting, and redefining itself.

The Pulse of Funding: A Resurgent Tide

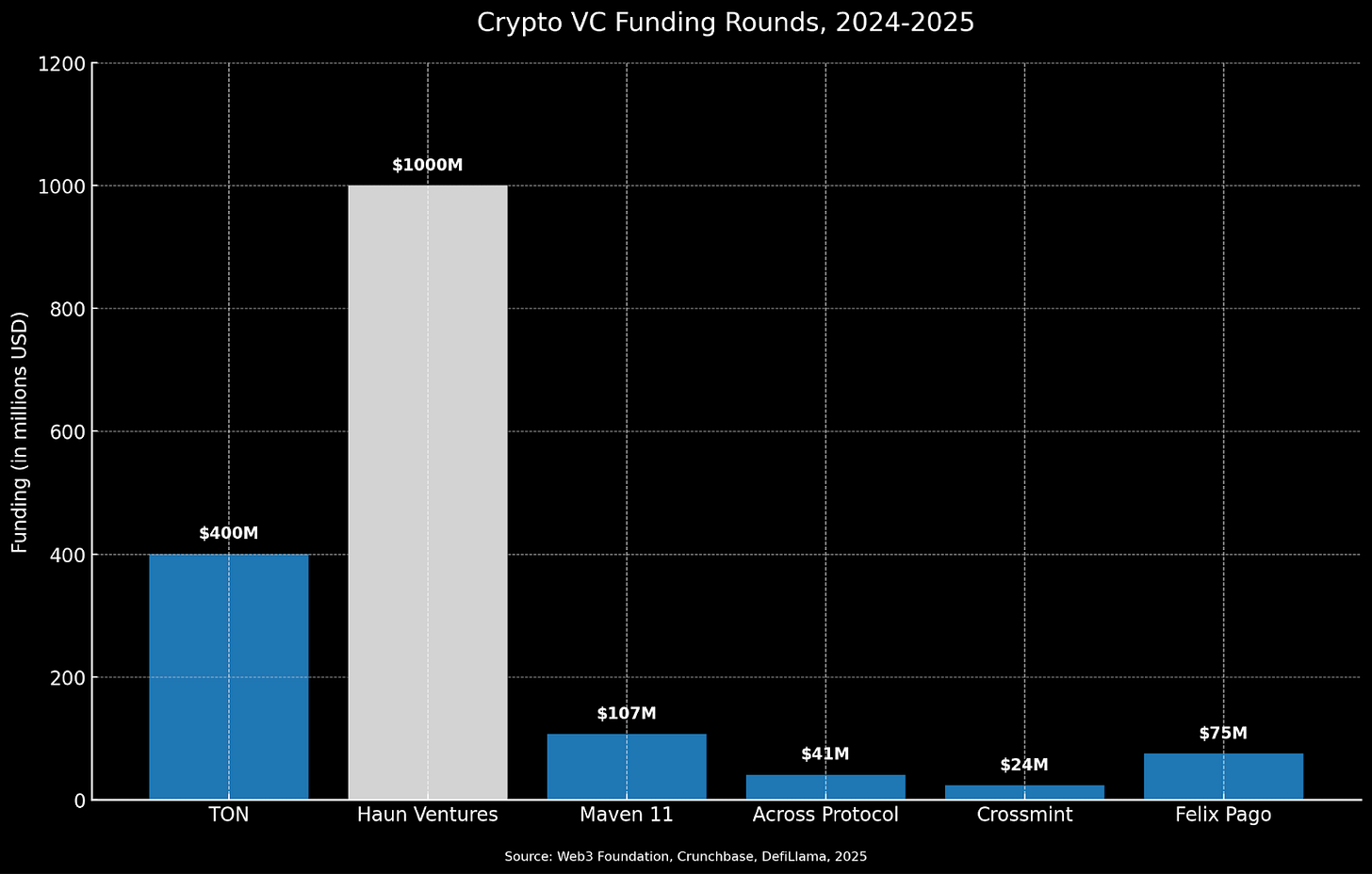

Venture capital in crypto is reclaiming its momentum, with a notable uptick signaling renewed confidence. In the first quarter of 2025, crypto startups raised $4.92 billion, a sharp rise from $3.63 billion in Q4 2024, according to DefiLlama. This past week alone saw $172 million in funding, more than double the $72 million raised in the prior week, with firms such as Amex Ventures, a16z, and Multicoin Capital backing projects ranging from stablecoins to payments. Felix Pago, a Miami-based startup that enables cross-border payments to Latin America, led with a $75 million raise, highlighting the appeal of real-world applications. High-profile deals, such as Toncoin’s $400 million investment from Sequoia and Ribbit, tied to Telegram’s billion-user base, and Haun Ventures’ $1 billion fund target, further amplify the narrative of selective optimism. Maven 11’s $107 million fund, focused on consumer apps and AI-blockchain intersections, and smaller raises like Across Protocol’s $41 million token sale and Crossmint’s $23.6 million for Web3 onboarding reflect a broad appetite for infrastructure and enterprise solutions, though Maven’s delayed close hints at cautious limited partners still wary of 2022’s losses.

This resurgence, while impressive, is tempered by perspective. Funding remains below the peaks of 2021-2022, and the concentration of capital in established ecosystems suggests a market favoring certainty over experimentation. We are seeing a market lean on proven players while testing new waters.

Crypto-AI: Ambition and Ambiguity

The convergence of blockchain and artificial intelligence remains a magnetic force for VCs, promising to redefine digital economies. With $917 million invested in decentralized AI projects, the sector is celebrated as transformative—Hack VC dubs it “the biggest source of alpha,” while Theta Capital views it as the decentralized foundation of AI. The AI token market’s growth is striking, ballooning from $2.7 billion in April 2023 to $39 billion by October 2024, with forecasts pointing to $45 billion by early 2026.

Yet, skepticism shadows the enthusiasm. On platforms like X, skeptics question whether these projects truly require blockchain, arguing that many are AI ventures disguised as crypto ventures to attract venture capital dollars. The risk of inflated valuations looms, echoing past crypto bubbles. This duality—ambition tempered by ambiguity—captures the crypto-AI narrative, where potential battles against the specter of overpromise.

Regulatory Winds and Political Currents

The regulatory environment, once a headwind, is turning favorable. The Trump administration’s push for Bitcoin reserves and the SEC’s Crypto 2.0 Task Force signal a pro-crypto shift, with recent SEC dismissals of lawsuits against firms like Coinbase and Ripple easing tensions. Yet, VC activity remains subdued, with some describing it as a “standstill” despite these gains. The Trump family’s World Liberty Financial, raising $550 million for a token sale and stablecoin, adds visibility but stirs concerns about political entanglements that could deter institutional VCs. The interplay of policy and politics is reshaping the landscape, offering opportunity laced with complexity.

Reckoning with the Past, Reimagining the Future

Crypto VC’s present is inseparable from its past. The 2021-2022 funding boom, fueled by loose capital, inflated valuations, and spawned tokens with scant utility, often leaving retail investors burned. Critics, including voices on X, label crypto VCs as “gamblers,” highlighting that new funds are hit hard by losses from speculative bets. Yet, crypto’s structure offers a unique edge: unlike traditional startups, crypto projects can unlock liquidity quickly through token sales, enabling faster returns for VCs, though volatility remains a double-edged sword, as noted by Fortune. Despite criticism, success stories persist—Paradigm and Multicoin posted substantial gains in 2024, with Multicoin up 56%, suggesting that disciplined strategies can thrive. This reckoning is driving a shift toward fundamentals, with VCs under pressure to back projects with lasting value over fleeting hype.

A Shift Toward the Tangible

Amid this introspection, crypto VC is pivoting toward tangible impact. Consumer applications—gaming, social platforms, and on-chain contests—are gaining traction. Bitcoin-focused startups are a standout, with a 50% spike in pre-seed deals and $1.2 billion invested from 2021 to 2024. In 2024 alone, these startups raised $234 million, representing a 30% increase in funded projects, including Bitfinity (layer-2), SatLayer (staking), and Mezo (DeFi), according to Trammell Venture Partners. A pie chart would illustrate this focus: 40% on consumer apps in blue, 30% on Bitcoin infrastructure in gold, 20% on AI-crypto in purple, and 10% on other bets in gray.

Not all trends, however, inspire equal confidence. Some VCs chase “mindshare-driven” narratives—AI tokens or memecoins tied to Trump or Melania branding—raising concerns about long-term sustainability. The focus on consumer apps and Bitcoin reflects a quest for adoption and stability, but the pull of speculative gains persists, highlighting crypto’s dual identity as both an innovation hub and a volatile frontier.

Navigating a Volatile Horizon

The economic backdrop looms large. Trump’s tariffs triggered market crashes, with Bitcoin dipping to $74,425 on April 6; its 0.77 correlation with the S&P 500 amplified losses. The Atlanta Fed’s forecast of a -2.8% GDP contraction for Q1 2025 fuels risk-off sentiment, slowing VC capital flows. Yet, crypto shows resilience: Bitcoin has rebounded after a tariff pause, and Q1 2025’s $4.92 billion in funding marks a recovery from the lows of 2024. Bitcoin’s outperformance against gold since the 2024 election offers hope, but its entanglement with traditional markets challenges its narrative as a hedge. This volatility shapes a cautious VC landscape, where opportunities coexist with uncertainty.

Reflections on a Market in Flux

Crypto venture capital is a market at a crossroads, poised between resurgence and restraint. The $4.92 billion raised in Q1, blockbuster deals like Felix Pago and TON, and the pivot to Bitcoin and consumer apps signal a sector regaining its footing. Yet, macro turbulence, past failures, and overhyped narratives like crypto-AI demand vigilance. The space is in a moment of transition, where ambition meets scrutiny. As regulatory tailwinds strengthen and lessons from 2021-2022 guide decisions, crypto VC is reimagining itself, seeking to bridge blockchain’s promise with real-world impact. The path ahead is uncertain, but in this flux lies the chance to redefine what’s possible.

Bitcoin DeFi

The Evolving Bitcoin DeFi Ecosystem

After a year of building in the shadows, Bitcoin DeFi pioneers are stepping into the spotlight – launching networks, conducting token generation events (TGEs), and deploying the infrastructure needed to onboard the next wave of users. SDK integrations with major CEXs like Binance and Bybit are bridging familiar workflows for institutional players, family offices, and TradFi funds, bringing them into the decentralized arena.

Recent developments:

Arch Network Raises $13M Series A: Asymmetric Portfolio company Arch, a bridgement execution platform bringing smart contracts to the baselayer for Bitcoin and metaprotocols, announces raise led by Pantera Capital. Link

Babylon Genesis Goes Live: Following a successful token generation event (TGE) and network launch, it's the first Bitcoin-Secured Network (BSN), anchoring its L1 security to Bitcoin via Babylon staking. Link

Lightspark’s Spark Platform Launches: Now live on mainnet, Spark enables stablecoins and related applications to operate in a trust-minimized manner on the Bitcoin blockchain. Link

Lombard Finance’s SDK Boosts Staking: Lombard Finance released a software development kit (SDK) enabling one-click Bitcoin staking and minting of LBTC, a liquid staking token. Integrated by Binance and Bybit, the SDK simplifies BTC routing to Lombard’s DeFi Vault, unlocking potential DeFi opportunities. Link

Solv Finance Targets Middle East: Solv announced a Shariah-compliant BTC yield offering, expanding Bitcoin staking opportunities in the Middle East. Link

BTCfi TVL Soars to $5.8B: Bitcoin’s total value locked (TVL) has reached $5.8B representing a dramatic increase of 1,350% from just $400M 1 year prior, driven by new protocols and integrations. Link

This emerging design space marks a clear pivot from custodial wrapped assets toward trust-minimized primitives anchored directly to Bitcoin. With $5.8B now locked in BTCFi protocols – a 13.5x increase over the past year – the foundation is set for a Bitcoin-native DeFi stack that is composable, interoperable, and decentralized.

Bitcoin L2s

Ecosystem integrations continue to deepen with further advances being made to BitVM. BOB (Asymmetric PortCo), in collaboration with Fiamma launched a trust minimized BitVM bridge on testnet, enabling bobBTC minting. Additionally BOB recently announced wallet support with Xverse, making it easier for Bitcoin-native users to access Ethereum-style apps on BOB's hybrid chain with simple 1-Click DeFi. This marks a key step in improving UX across the Bitcoin L2 stack as well as the convergence of the L1 and the L2 stacks. They have also added support for popular tooling like WalletConnect and RainbowKit, making it seamless for developers to port over existing EVM apps. Across the board, we’re seeing a push to bridge the familiar experience of Web3 with the unique constraints and security model of Bitcoin.

Source: BitcoinEcoTK

Teams like BOB and Bitlayer (Asymmetric PortCos), with their technical depth and user-centric approaches, are well-positioned to continue to lead on activity and TVL metrics. As Bitcoin L2s mature, they are poised to capture a larger share of DeFi activity, potentially processing 25% of BTC transactions in the coming years. With Bitcoin’s unmatched security anchoring these ecosystems, the convergence of Bitcoin-native innovation and cross-chain capabilities heralds a transformative era for programmable finance.

Source: BitcoinEcoTK

Metaprotocols

We are excited to announce that Arch Network (Asymmetric PortCo) has secured $13M in a Series A funding round led by Pantera Capital. Arch introduces the ArchVM which is a modified-SVM architecture, allowing Rust developers to build fast Bitcoin dApps and settle to the base layer. The metaprotocol is compatible with existing Bitcoin wallets like Xverse and interoperable with token standards such as Runes, BRC20, and Alkanes as well as non-fungible asset standards such as Ordinals. We are excited for the team as they continue to grow their ecosystem within Bitcoin.

Arch architecture has three core components as depicted in the below illustration.

ArchVM: a UTXO-aware VM capable of handling state changes and off-chain computation, enabling smart contracts accessible from the base layer with Solana-like TPS.

dPoS: decentralized validator network using a Proof-of-Stake consensus with the Arch token.

Cryptographic multisig: built using an implementation of FROST + ROAST signature schemes enabling key aggregation and multi-party computation.

With the new funding, Arch Network plans to further develop its platform, expand its validator network, and support a growing ecosystem of Bitcoin-native dApps. This includes applications in decentralized exchanges (DEXs), lending platforms, stablecoins, and more, all aiming to operate without compromising Bitcoin's foundational principles.

Bitcoin DeFi requires a unique custody construction, especially as institutional participation grows. Unlike Ethereum-based DeFi, which is typically accessed via non-custodial wallets or browser extensions, institutional allocators – such as family offices, hedge funds, and asset managers – operate under strict regulatory and compliance requirements. This means they can only custody assets with qualified custodians like Anchorage Digital or Fireblocks (via Fordefi), limiting their ability to directly interact with traditional DeFi smart contracts. As a result, Bitcoin-native DeFi protocols must design around these constraints – either by integrating directly with institutional custodians, building MPC-based access layers, or offering SDKs that allow BTC to flow into DeFi vaults while satisfying enterprise-grade custody and reporting standards. Arch is a team that has recognized this and is working with these partners to integrate its stack.

Arch's innovative architecture positions it as a pivotal player in the evolution of Bitcoin DeFi, offering a secure, efficient, and truly decentralized framework for financial applications on the Bitcoin network.

Bitcoin Staking

In April, Babylon launched its Genesis chain, the first Bitcoin-Secured Network (BSN), with a successful Token Generation Event (TGE) for its BABY token, boasting a $880 million fully diluted valuation (FDV). The launch introduced Tower, a Babylon-native decentralized exchange (DEX), which saw $250M in BTC deposited. Along with this was the ability to unstake BTC, of which around $600M was withdrawn, dropping Babylon’s TVL from its peak of 55k BTC ($5.2B) to 49k BTC ($4.6B). Note, that the data depicted in the graph below displays a decline in may related to an LST provider data feed change.

Currently, Bitcoin deposits to stake within Babylon are open to the public for the first time after a four-month closure pre-TGE. The current yield is 1.31% which is paid in BABY tokens.

Source: BitcoinEcoTK

The current Bitcoin LST market has over $4B in TVL, primarily within Babylon. Lombard Finance has solidified its position as the leading LST provider, staking over 21,000 BTC through Babylon’s protocol by April 2025, capturing 40% of Babylon’s delegated stakes. Its flagship LBTC, a yield-bearing, cross-chain token backed 1:1 by BTC, powers $1.5 billion in TVL, with 60% fueling DeFi strategies on Pendle, Maple Finance, and Morpho. Lombard recently launched an SDK enabling one-click BTC staking and LBTC minting, integrated by Binance and Bybit. Lombard moved over 5,000 BTC to top finality providers – Figment, Galaxy, Kiln, and P2P – aiming to decentralize custody for LBTC holders.

Source: BitcoinEcoTK

dApps

One of our portfolio companies, Liquidium, has been a pioneer in Bitcoin-native lending, initially leveraging Discreet Log Contracts (DLCs) to enable peer-to-peer loans directly on Bitcoin L1. This architecture allowed users to post Ordinals as collateral and borrow BTC without wrapping assets or relying on third parties—preserving Bitcoin’s trust-minimized principles. Liquidium still uses DLCs for Ordinal-backed loans today, providing a fully native and non-custodial borrowing experience.

Now, the protocol has expanded its design with the launch of instant loans – a new mechanism purpose-built for fungible assets like BRC-20s and Runes. These loans are powered by ICP Chain Signature technology, enabling decentralized and programmable execution of Bitcoin transactions using threshold signatures. Lenders are able to configure their BTC liquidity within parameters of min-max LTV ranges dynamically managed based on the market price, borrowers can receive BTC instantly without needing a matched lender, bringing greater scalability and UX improvements to the BTCfi landscape.

Within a month of launching, lenders are gaining comfort in managing their liquidity in an in-app wallet address; in less than a month of launching, 80% of all loans for fungible tokens on Bitcoin are now derived from instant loan liquidity. We are excited about the new features the team is working on in stealth and should be able to share this soon!

Source: X (Robin, Liquidium)

Team Updates

Joe was on another episode of Bits & Bips “How to Reignite Market Confidence Amid Tariff Turmoil”

Joe spoke at Binance in Abu Dhabi and TOKEN2049 in Dubai at the end of April.

All Market Updates

Please let us know if you have any questions or comments.

As always, thank you for your support.

– Asymmetric

Probably the best update so far Joe

Somehow the best alpha available on the Street is free. Thanks Joe. Legend.