Asymmetric Market Update™️ #28

Our thoughts on what is relevant in Crypto and Markets…

Macro

This meme perfectly captures the first quarter of 2025, as it has been nothing short of exhausting. The S&P 500 and Bitcoin ripped to new all-time highs, only to be smashed down into correction territory as all risk assets moved toward a correlation of 1.

Crypto received the most positive headlines in its history, yet crypto had its worst first quarter since 2018.

Let’s relive this past trauma with a lengthy post with more charts than an AP calculus exam.

Tariff Timeline: The Catalyst for Market Volatility

At the start of the year, we emphasized that the first half of 2025 would be materially more challenging than the last. This call has played out, albeit much more aggressively than we had thought. Volatility has surged, correlations across asset classes have risen sharply, and risk assets have corrected—not because of fundamental weakness but due to an unpredictable and aggressive shift in U.S. trade posture as Trump and his administration are trying to reshape global trade.

February 1: The U.S. imposes tariffs on Canada, Mexico, and China.

February 4: China retaliates.

February 10: The U.S. raised steel and aluminum tariffs to 25%.

February 26-27: U.S. threatens EU with 25% tariffs; plans further China tariff hikes.

March 3-4: Tariffs take effect (25% on Canada, 25% on Mexico, and 20% on China) with immediate retaliation.

March 5-6: Partial automaker exemptions announced; some Canadian/Mexican tariffs postponed.

March 12: Global steel/aluminum tariff expansion; exemptions removed.

March 26: 25% tariff announced on all foreign automobiles and parts (effective April 2).

March 31: Announcement of reciprocal tariffs targeting all countries globally.

April 2: “Liberation Day” tariffs were announced, exceeding market expectations

April 4: China’s 35% retaliation tariffs on all U.S. imports.

This is all good for America, right? Tariffs = more revenue for the U.S., right?

Didn’t Trump say, “WE'RE GONNA WIN SO MUCH YOU MAY EVEN GET TIRED OF WINNING AND YOU'LL SAY PLEASE PLEASE IT'S TOO MUCH WINNING WE CAN'T TAKE IT ANYMORE…”

What does “winning” look like?

Markets didn’t fall apart in isolation. They were already under pressure.

During Q1, soft data collapsed, and investor sentiment was deeply negative. Surveys showed growing pessimism, and business leaders cited uncertainty. But markets were trying to find footing, supported by a relatively strong fundamental backdrop: resilient labor markets, cooling inflation, and solid earnings.

It was a fragile balance. Investors were positioned for volatility and “reciprocal tariffs,” not for what looks like protectionism. The assumption was that trade would be tough but manageable. Going into “Liberation Day,” many market participants’ worst-case scenario was a 15% tariff rate. That rate would have been a negative shock to markets—but digestible. Instead, tariffs came out at a weighted rate of 24%, with expectations for that to climb toward 27% with Section 232 tariffs (national security tariffs on steel and aluminum).

The tariff announcement went far beyond market expectations. Instead of a phased, reciprocal approach, the administration imposed sweeping, high-impact measures. Markets immediately began repricing—not just tariffs, but retaliatory tariffs.

Bearish sentiment (AAII Bears) jumped to the third-highest reading of all time — a contrarian indicator at this extreme level.

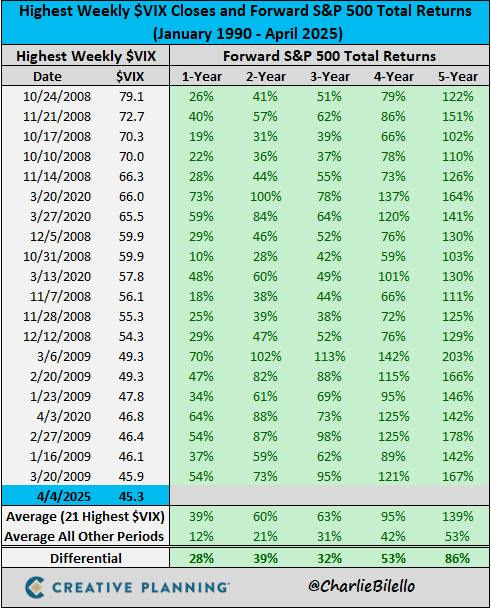

The Volatility Index (VIX) closed above 45 for the first time since COVID.

High-yield credit spreads meaningfully widened (albeit from record lows—not blowing out), signaling that it’s no longer just equity markets that are concerned.

The Dollar Index (DXY) had a z-score move of -4.4, last observed during COVID.

The day after “Liberation Day”, retail bought the dip harder than in over a decade…

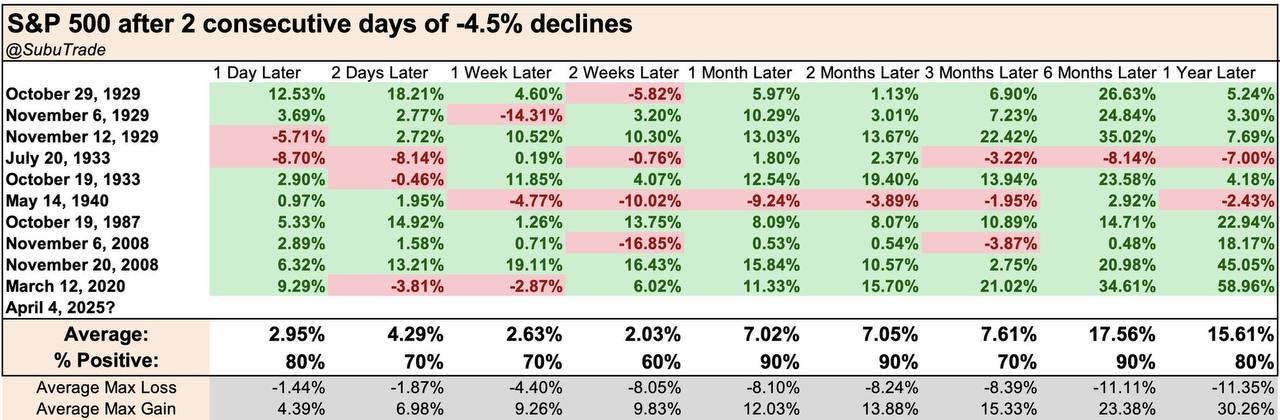

…only to get rinsed by the markets with another 5% drop. The S&P 500 fell more than 10% in two days, which is only the 4th time in history that it has happened. The other times were:

October 1987 – Black Monday Crash

November 2008 – Global Financial Crisis

March 2020 – COVID Crash

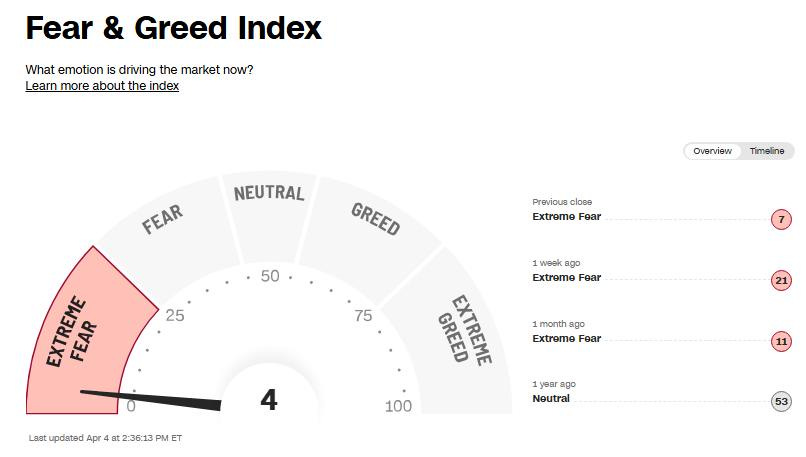

The day after the retail rinsing, the Fear and Greed Index dropped to four (4).

Hedge Funds’ L/S Ratio collapsed to the lowest on record.

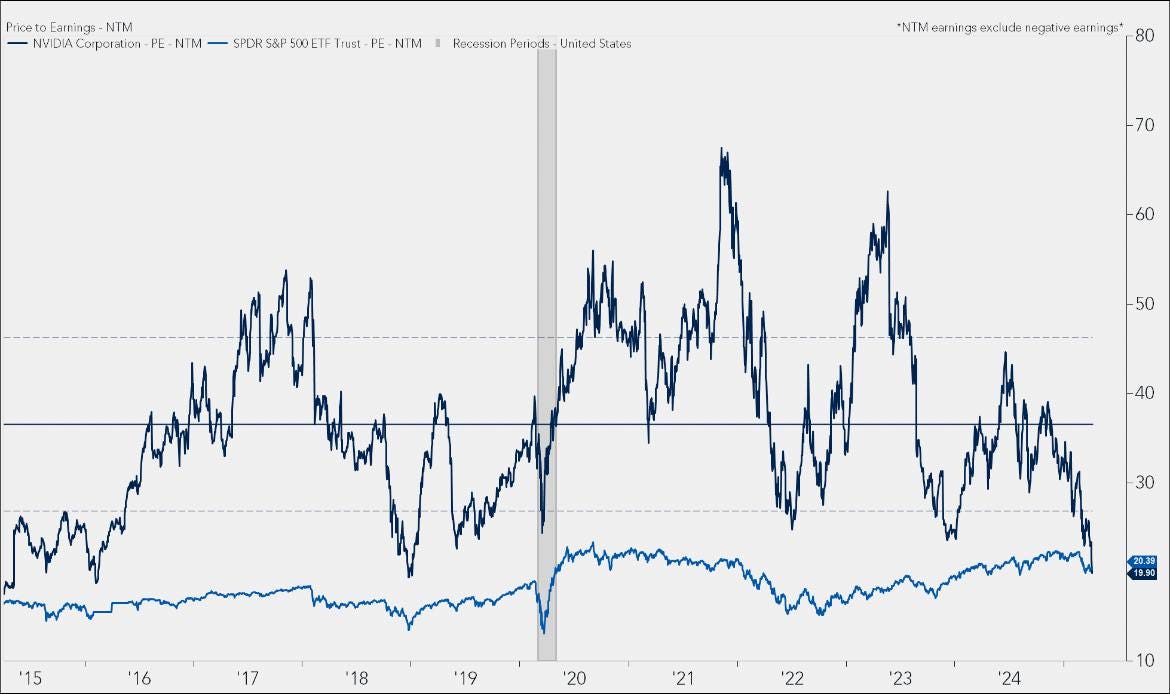

Tech stocks were particularly hard hit as supply chain concerns reemerged. Nvidia trades at a price-to-earnings (P/E) discount relative to the S&P 500.

Blink twice at the chart; you may think the S&P 500 is trading like a memecoin.

Asset managers and OTC desks scrambled for protection. Those with downside hedges wanted more, and those without became forced buyers.

You even had legendary investor and HF/venture manager Brad Gerstner call for deals to be made to stop the bleeding.

After all this carnage, equity markets have now lost $10 trillion since President Trump was inaugurated. Is this what “winning” feels like, Mr. President?

The silver lining? Bitcoin and altcoins fared much better than equities (recently).

Relative to the Magnificent 7, Bitcoin is at its highest level ever!

Persistent Risks

Tariffs remain the biggest market risk—not just the immediate impacts but the second-order effects that could drag the U.S. into recession if meaningful progress isn’t made. Country-by-country renegotiations will take place, and deals will be made.

However, China is the key variable. Xi didn’t follow through on the “Phase One” deal during Trump 1.0, and now the stakes are even higher as both countries accelerate their AI arms race. That geopolitical overlay adds another layer of complexity—and volatility.

We still think it’s likely that Trump and Xi will eventually reach an agreement. But as we sit here today, Liberation Day was not a “clearing event.” Uncertainty remains elevated (at all-time highs based on some metrics), and markets haven’t gotten the clarity they hoped for.

As negotiations progress, we’ll closely watch whether semiconductors and pharmaceuticals remain exempt from tariffs. If either of those sectors gets pulled in, the risk of a more systemic repricing in large-cap tech increases meaningfully. However, as shown above, many of the innovation leaders and AI are already trading at historical valuation discounts.

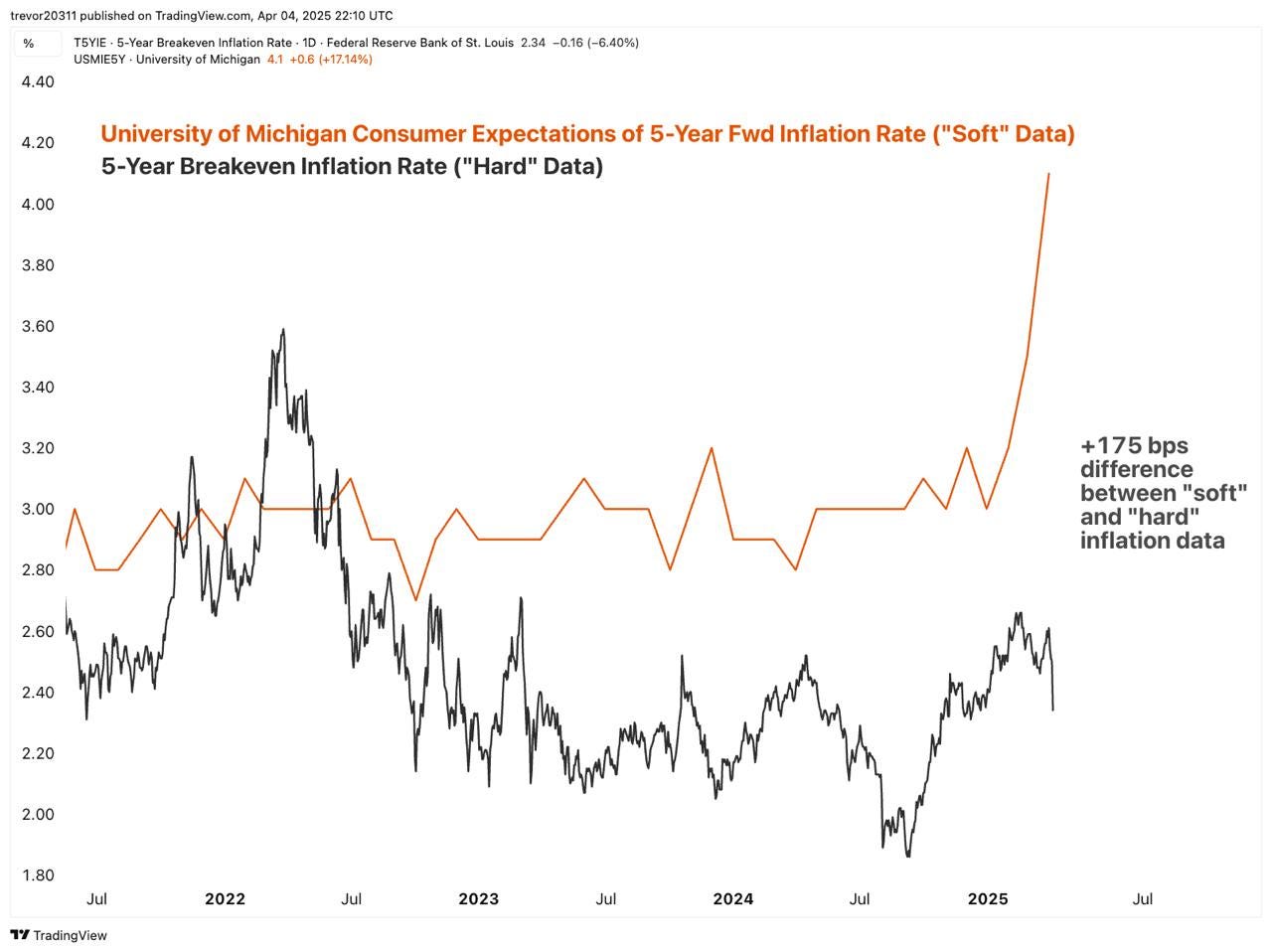

Other than tariffs, we have noted that soft data is in the gutter and has started infecting some of the hard data (perception becomes reality), as seen in the VIX.

One of this market's defining features is the dramatic divergence between soft data (sentiment and surveys) and hard data (economic fundamentals).

Take, for instance, consumer-based inflation expectations vs market-based inflation expectations:

We expect CEOs on Q1 earnings calls (starting next week with banks) to sound cautious. Earnings will likely be solid, but guidance will be soft. We find it highly unlikely that any CEO will raise or maintain the guidance they anticipated before Liberation Day. If those stocks rally on soft guidance, the market has likely bottomed. If not, look out below:

Case in point: Lululemon reported solid Q4 earnings last week—beating on revenue, profits, and net income—but the stock sold off double digits. Why? Forward guidance flagged soft consumer traffic.

"We are operating within a dynamic macro environment that's really contributed to a cautious consumer..."

—Calvin McDonald, CEO, Lululemon

This is nuanced, though. Consumers are still earning a real wage. Disposable income is up, but spending is slowing. They’re choosing not to spend—they're not being forced to cut back.

It’s unlikely that hard data will confirm a negative feedback loop for a few more months—if at all.

Questions worth asking:

Are mega caps pulling back on CapEx?

Are data centers still being built?

What are credit card companies seeing?

Is AmEx flagging high-end consumer pullbacks?

A negative feedback loop may surface like this:

Consumer sentiment continues to deteriorate.

CEOs respond by pulling back on CapEx and hiring.

That pullback hits corporate earnings and profit margins.

Layoffs begin to accelerate.

GDP weakens.

Earnings expectations are revised lower, triggering another leg down in equities.

Some of these we are already seeing:

University of Michigan Consumer Confidence: There was a steep drop at an alarming rate.

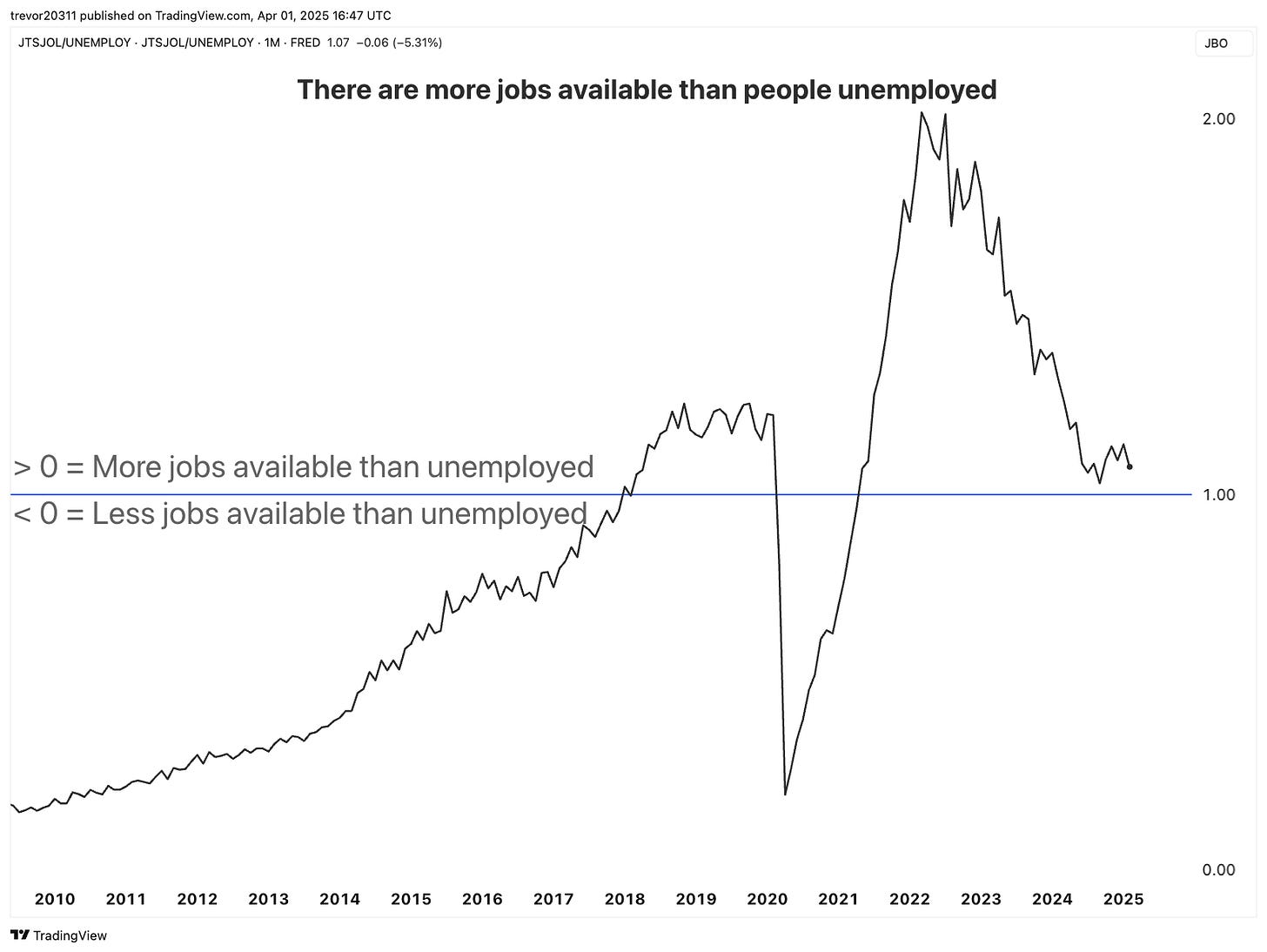

Employment Expectations: Fear of layoffs is rising—even though job openings still exceed unemployed.

NFIB Uncertainty Index: Near record highs—“Main Street” is nervous. Expect this to rise if no positive news on the tariff front, leading to negative feedback loops in the economy.

Where do we go from here?

At the start of the year, we said we were less optimistic about markets given two years of “up only,” record-high valuations, elevated concentration, and the likelihood of a more dogmatic Trump approach to trade than during his first term.

The era of easy money is over.

Still, we didn’t expect this inconsistency in language or policy execution—and frankly, protectionism out of the White House. These tariffs do not reflect “balanced trade,” which Robert Lighthizer has advocated for since Reagan was in office and was a close advisor to President Trump. Most market participants expect them to be rolled back quickly, but therein lies the rub.

Trump appears to be in his “IDGAF era.” Before Liberation Day, forced unwinds in multiplatform funds triggered mechanistic selling of momentum and “crowded” stocks, including crypto. Many participants lightened up (or were forced to), assuming April 2nd would not be worse than the consensus view of a 15% tariff rate.

The rate was worse than any economist expected, and the delivery, in true Trump fashion, looked more like a frat boy showing his fraternity brothers how to make $1M on his 14-team parlay than delivering news of the largest increase in tariffs since the 1930s.

The formula itself was an iconic facepalm moment.

The clearing events over the past 24 months were mostly market-driven and often became great buying opportunities. Hard data held firm while soft data fell apart. That dislocation has historically set up attractive entry points.

After a -10% move in two days, the math supports starting to put capital to work.

Especially if you are a long-term investor.

AAII bearish sentiment is near extremes (contrarian indicator).

Along with prime book capitulation.

Financial conditions have significantly tightened.

Positioning has fallen sharply to the lower end of its typical band, the lowest in two years (z score -0.73, 15th percentile as of April 3rd). Discretionary investors have cut their positioning from slightly above neutral last week to underweight (z score -0.45, 23rd percentile). At the same time, the positioning of systematic strategies also plunged to the lowest in two years (z score -0.71, 19th percentile).

It feels like Liberation Day should have been a market-clearing event, but it wasn’t.

Long-only (LO) funds relentlessly sold Thursday and Friday, and CTAs pressed their shorts (and, according to Goldman Sachs, are now short $24.7B in U.S. Equities). LOs offered tech, industrials, and financials - recall, the banks start reporting earnings this coming week.

Trading volume across the entire stock market was the highest ever. Just look at the $QQQ:

Real stress surfaced in the markets during the April 4th trading session. $HYT, Blackrock’s Corporate High Yield Fund, is now trading at a -6.26% discount to its NAV and was as low as an -8% discount during the trading day.

Fast money traders are rapidly increasing their short exposure.

The market was priced for a 15% tariff rate. The market was not priced for 24%+.

As mentioned earlier, retail aggressively bought the dip the day after “Liberation Day,” while hedge funds capitulated and pressed shorts. That tells us two things: hedge funds are repositioning defensively in response to second-order risks, while retail is still playing the 2020–2021 “buy the dip” playbook.

When institutional capital is de-risking and retail is stepping in, it often creates an air pocket in price discovery. And air pockets lead to violent, unhedged selloffs—especially in fragile sentiment environments like we saw on Friday.

And it should be no surprise; the top of the order book liquidity in SP500 futures contracts was ~$2M on Friday (the historical average is 6.5X that number).

Sweeping $75M worth of E-minis would cost a trader $2M.

However, this illiquidity and lack of positioning work both ways. If clarity improves and flows reverse, those same positioning gaps could fuel a sharp upside squeeze as hedge funds chase performance higher.

There’s also a near-term wildcard: These tariffs don’t fully go into effect for another week. A lot can happen between now and then. One or two headline-grabbing deals—whether real or symbolic—could be enough to change the expected trajectory. But for now, the administration seems willing to absorb some near-term pain in exchange for leverage, which is why the “Trump Put” still looks far out-of-the-money.

That’s the real difference between 2025 and past shock events. In 2008, we had Lehman. In 2020, we had lockdowns and coordinated stimulus. In 2025? We have Trump. There’s been no singular break—just political whiplash. Until something breaks more structurally, neither the Trump Put nor the Fed Put will likely show up in full force.

The Fed

Rate cuts might not be as bullish this time around for markets—they need clarity (and a massive drop in uncertainty) to regain their footing. However, as the Fed implements its put—and they will—assets that are hyper-sensitive to liquidity will rise (e.g., Bitcoin).

After the disastrous NFP print, the futures markets on Friday are now pricing between four and five rate cuts (100-125 bps) for 2025 (we’ve been asserting four cuts since the beginning of the year).

It's important to make this distinction clearly:

When we say “markets,” we’re not talking about everything. We’re talking about equities. And when it comes to equities, we’re cautious — macro headwinds are strengthening, and the path to policy clarity is murky at best, albeit they could be resolved via one Truth Social post…it is Trump after all.

But crypto? It's an entirely different setup.

Crypto, particularly Bitcoin, is historically less sensitive to earnings/guidance risk and is positioned to benefit from any liquidity tailwinds the Fed throws at this environment.

Despite being dead wrong all of 2024, Arthur Hayes may have struck (digital) gold with his latest piece. His latest read on the Fed is consistent with ours:

“The Fed is supposedly busy with its quixotic quest to bring the manipulated and fugazi metric of inflation below their made-up 2% target. They are actively removing money/credit out of the system by reducing their balance sheet, which is called quantitative tightening (QT). Because banks fucked up so badly in the 2008 Global Financial Crisis (GFC), regulators required them to pledge more of their own equity capital against treasuries that they purchased, called the supplementary leverage ratio (SLR). Therefore, banks cannot finance the government using infinite leverage.

However, it is very simple to change this state of play and turn the Fed and banks into inelastic buyers of treasuries. The Fed can decide, at a minimum, to end QT and, at a maximum, to restart QE. The Fed can also exempt banks from the SLR, allowing them to purchase treasuries using infinite leverage.”

The Fed continues to rescue markets. And they’re already signaling that they’re slowing the pace of QT. In their March statement:

"The Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage‑backed securities. Beginning in April, the Committee will slow the pace of decline of its securities holdings by reducing the monthly redemption cap on Treasury securities from $25 billion to $5 billion."

This is a liquidity tailwind. The Fed is stepping in, but not yet with the urgency that would justify backing up the truck.

This is positive for Bitcoin, and paired with deregulation pressures from Bessent on Jerome Powell, it paints a rosier picture for liquidity-sensitive assets. However, equity markets are less sensitive to liquidity and face more geopolitical headwinds till Trump and the rest of the world can agree on “balanced trade”, and that’s why we think the breakout in Bitcoin vs. the Magnificent 7 is worth paying attention to. This could change if the tariff tantrum is over in the next few weeks as markets potentially reprice higher, but it is not our base case. Regardless, the outlook for Bitcoin looks more favorable than traditional equities.

As we lick our wounds from Q1, remember the golden rule in crypto: survival is all you need.

Crypto

The amount of positive headlines and regulatory breakthroughs to start the year has been better than any crypto investor could have imagined.

However, prices and volumes have collapsed. This has nothing to do with crypto fundamentals but is due to tariff-induced uncertainty, which we outlined in the “Macro” section. Let’s instead discuss a few things happening in the broader crypto economy.

As regulatory headwinds transform into tailwinds, M&A activity within crypto has accelerated, with 84 transactions completed in just the first quarter of 2025.

As many crypto startups hit peak revenues around the end of 2024, the “fundamentals” narrative took hold in many minds. This narrative is only heightened by the uptick in M&A, as companies flush with cash can inorganically grow, mimicking many high-growth compounders in traditional markets.

Many crypto participants are now fixated on "fundamentals," but the narrative remains deeply flawed.

Across the industry, fees are frequently confused with revenue, and regulatory uncertainties have historically blocked startups from distributing profits to token holders. With a pro-crypto U.S. administration now in place, regulatory clarity looms on the horizon, potentially unlocking revenue-sharing opportunities. Yet, this shift alone won't rescue struggling projects.

Consider the words from a fellow market participant:

"Just because you can now 'turn on the fee switch' doesn't mean investors will buy your project."

"Just because you have the fee switch on doesn't mean you have any fees/revenue to distribute back to users, which just makes the project worthless especially if there are real revenues being distributed elsewhere."

The fundamental truth is that the regulatory clarity provided by the current administration hasn't "saved" struggling tokens—it's exposed them to a more demanding standard. When projects can no longer hide behind regulatory uncertainty as an excuse for not delivering value, investors will ask harder questions about sustainable business models. Thus, crypto-native zombie protocols have been born.

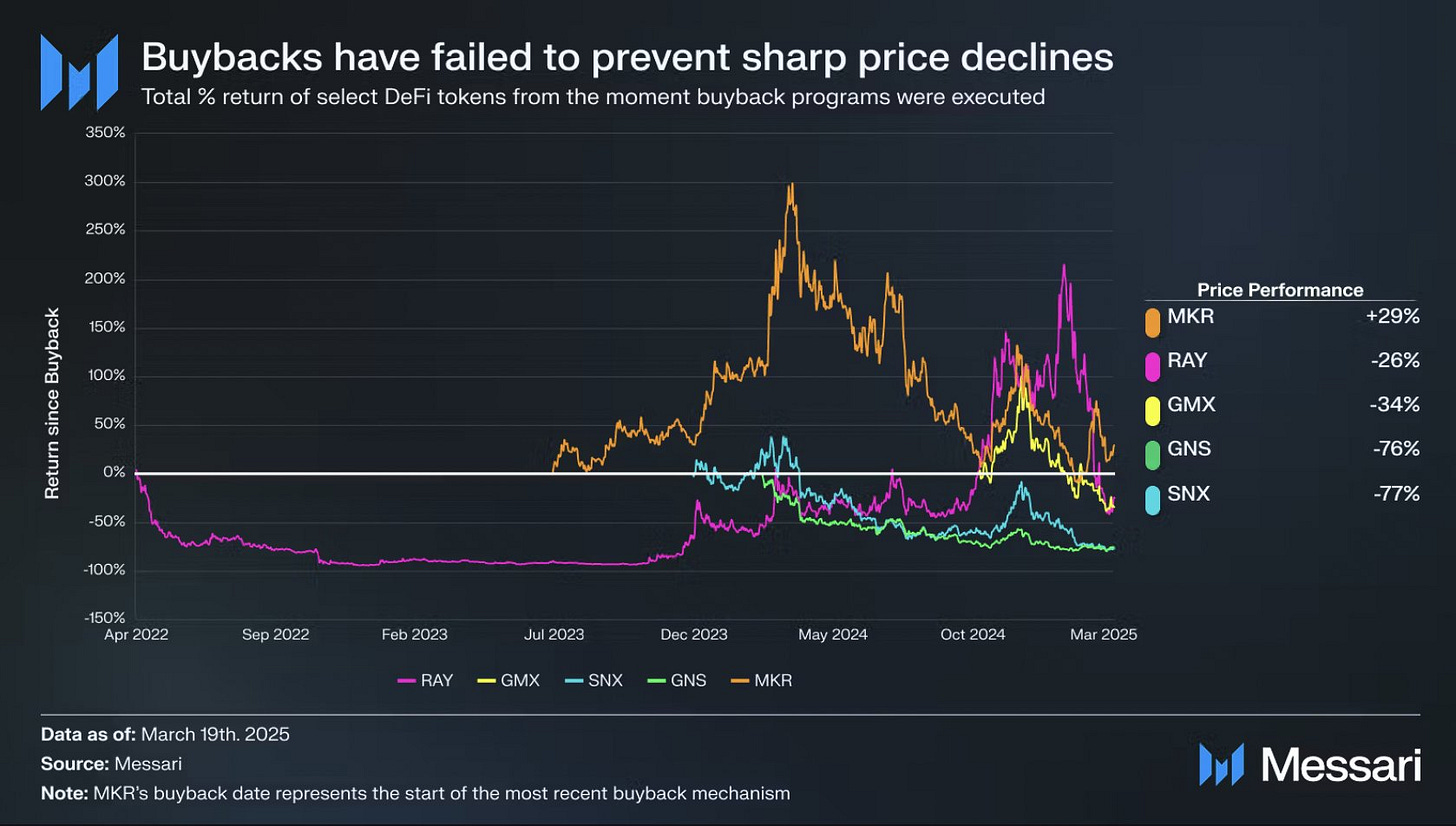

Announcing buybacks or dividends doesn't inherently make a token valuable. True worth stems from building high-growth compounders akin to traditional tech giants—companies that generate substantial cash flows, reinvest aggressively, and continuously expand their capabilities and market dominance.

The renewed focus on fundamentals is a welcomed evolution.

But let’s be clear—this isn’t the present reality. It’s a roadmap but not the current terrain we are on today. Today’s market is still driven by vibes more than valuation models and retail more than institutions. Fundamental analysis may be a key factor in the future of crypto, but for most of crypto, that future hasn’t arrived yet. We have not heard of JP Morgan or Goldman Sachs analysts reaching out about underwriting crypto startups yet.

To highlight this, let’s look at the performance of some of these crypto assets implementing buybacks.

While it is unfair to show this chart without noting that the entire crypto market cap is down -17 % YTD, I am doing it anyway to show that issuing buybacks or dividends will not save a dying startup. We are not suggesting that any of the above are bleeding a slow death; in fact, a few of the above are in the top 10 earnings crypto startups. Announcing buybacks is a good start, but the fact is: buybacks ≠ number go up.

It is great that market participants are starting to look at these assets more as businesses; however, there’s a danger in being right too early. Investors like Pantera have been directionally correct in calling for fundamentals, but execution has lagged. Most tokens still trade more like fashion than financial instruments. Until institutional flows arrive—and tokenomics mature—expect fundamentals to influence, not dominate. Still, the winners will be those preparing for that shift now, not chasing it once it's already priced in.

VC

Crypto VC in the Trump Economy: Risks, Opportunities, and the Road Ahead

President Trump’s economic strategy is reshaping market conditions, and crypto venture capital (VC) is not exempt from the turbulence. With aggressive tariffs, mass federal layoffs, and a deliberate push toward an economic slowdown, investors are navigating a landscape that is both high-risk and full of strategic opportunities.

If this administration is, as some analysts suggest, taking a Paul Volcker-style approach to economic restructuring—deliberately triggering short-term pain for long-term stability—then VC firms must adapt to survive the turbulence and position themselves for the next cycle.

Short-Term Headwinds: Economic Uncertainty and Crypto VC Contraction

The most immediate impact of Trump’s policies is increased market volatility, which historically leads to a contraction in venture capital deployment. Risk capital tends to dry up in uncertain macro environments, and early-stage funding is often the first to be affected. GDP growth has already turned negative, with the Atlanta Fed projecting a contraction of 2.8% for Q1 2025. The combination of new tariffs and mass layoffs suggests that the broader economic environment will continue to favor a risk-off sentiment among investors.

Bitcoin and Ethereum are now trading with high correlation to macroeconomic trends. This means that uncertainty around tariffs, layoffs, and inflation will likely continue to impact price action. Crypto venture capital, in turn, will be affected by how institutional investors allocate capital in response to these conditions.

Venture capital relies heavily on liquidity, and an extended period of high interest rates could make it difficult for speculative investments to attract significant funding. If the cost of capital remains high, firms will likely shift investment criteria toward sustainable, revenue-generating projects rather than speculative early-stage ventures. Many venture funds may choose to wait for macroeconomic stabilization before committing large amounts of fresh capital to crypto startups.

Institutional investors, including pension funds and sovereign wealth funds, have already been hesitant to allocate capital to the crypto sector following the regulatory uncertainty and market downturns of the past two years. The Trump administration’s policies have not yet provided the stability needed to reverse this trend. While the administration has dropped several SEC enforcement actions and created the Crypto 2.0 Task Force under Hester Peirce, there is still uncertainty about how deep regulatory relief will go. The government’s push for a strategic cryptocurrency reserve, which includes Bitcoin and Ethereum, signals support for the sector. Still, many venture investors will likely wait for clearer policies before making significant capital commitments.

Long-Term Strategic Opportunities: Crypto VC’s Next Move

Despite these short-term challenges, there are several factors that could create long-term opportunities for crypto venture capital. The administration’s shift away from regulatory hostility suggests that U.S.-based crypto startups may have an easier time securing funding than they did over the past three years. The SEC’s new stance under the Crypto 2.0 Task Force is likely to lead to clearer pathways for tokenized assets, decentralized finance (DeFi) projects, and blockchain infrastructure companies.

Market downturns tend to eliminate weaker projects, leaving only the strongest teams and most sustainable business models. This was the case in 2018-2020 when the last major bear market cycle forced out underfunded projects and created opportunities for long-term winners in L1 protocols, DeFi, and NFT marketplaces. Venture capital firms that deploy capital into distressed assets, secondary sales, and undervalued crypto startups over the next year could see significant upside when macroeconomic conditions improve.

Bitcoin’s role as a macroeconomic hedge is also likely to expand. If tariffs and mass layoffs accelerate global de-dollarization efforts, Bitcoin could emerge as an even stronger store of value. The U.S. government’s strategic crypto reserve policy, which prioritizes Bitcoin and Ethereum, is a major institutional validation that could drive increased adoption at the sovereign and corporate levels. This would likely create new venture capital opportunities in Bitcoin-related infrastructure, including L2 scaling solutions, Ordinals and NFT ecosystems, and staking innovations.

While the current economic contraction presents challenges, the broader market cycle suggests that venture capital will eventually pivot back to risk-on investments. If Trump’s policies successfully stabilize inflation and create a more sustainable fiscal environment, institutional investors will likely reallocate capital to high-growth sectors by 2026-2027. The next Bitcoin halving in 2028 could also act as a catalyst for renewed investment in the sector, following historical patterns of market cycles that tend to align with Bitcoin’s supply reductions.

How Crypto VC Should Navigate This Cycle

The next 12 to 24 months will be defined by volatility and uncertainty, but these are also the periods when the most significant investment opportunities emerge. Venture capital firms that focus on late-stage investments in projects with strong cash flow and adoption will be best positioned to weather the downturn. Investing in distressed deals and secondaries will allow firms to enter high-potential projects at discounted valuations. The growing role of Bitcoin as a macroeconomic asset suggests that BTC-focused investments, including infrastructure, DeFi integrations, and staking models, could be key areas of growth.

Regulatory shifts, such as the government's move toward a more permissive stance, may also create opportunities for U.S.-based crypto startups. If macroeconomic conditions stabilize, capital will eventually flow back into growth sectors, and the firms that positioned themselves strategically during the downturn will be best prepared to capture the next wave of investment.

Despite the immediate challenges, crypto VC remains one of the most dynamic and high-upside asset classes. The firms that navigate this period with discipline, strategic capital deployment, and a long-term thesis will shape the next wave of blockchain innovation. History favors those who invest when others hesitate. The question now is who will play it right.

Bitcoin DeFi

The Evolving Bitcoin DeFi Ecosystem

While only 0.3% of BTC’s market cap is currently active in DeFi – compared to Ethereum’s 30 – we’re seeing unmistakable signals that the tide is turning. A new wave of Bitcoin-native innovation is emerging across L2s, metaprotocols, token standards, and interoperability layers, each unlocking more composability, usability, and capital efficiency for BTC.

Recent developments highlight just how fast the ecosystem is evolving:

1-click DeFi vault strategies from BOB (Asymmetric PortCo) now make it possible to access yield opportunities directly from leading Bitcoin wallets, abstracting away complexity and onboarding new users with minimal friction. Link.

ckBTC on ICP continues to demonstrate the potential of native Bitcoin programmability, offering developers an alternate path to interact with BTC via canister smart contracts – demonstrating that existing chains are focusing on creating and executing on their Bitcoin DeFi strategies. Link.

The launch of BRC-20 2.0 signals a maturation of Bitcoin token standards. Moving beyond the limitations of its ordinal-based predecessor, this programmable metaprotocol aims to bring a new era of on-chain logic and token-level flexibility to Bitcoin. Link.

Meanwhile, non-custodial BTC bridges are arriving on Solana, using MPC networks to create a secure and user-friendly path to bring native Bitcoin into Solana’s high-speed DeFi ecosystem. Link.

Developers are also exploring Near Chain Signatures leveraging MPC networks to unlock cross-chain interoperability for Bitcoin. Link.

Together, these shifts mark the beginning of a new design space – one that moves away from custodial wrapped assets and instead embraces decentralized, trust-minimized primitives that remain faithful to Bitcoin’s ethos.

We are seeing strong momentum in the development of ecosystems across various Bitcoin L2s, with teams actively building infrastructure, applications, and liquidity. The race remains open, with multiple contenders, including existing ETH L2s, vying to become the go-to environment for deploying smart contracts and facilitating complex interactions anchored to Bitcoin's security.

Notably, StarkWare (which has created the Ethereum L2 StarkNet) recently announced plans to evolve into a hybrid chain settling on both Ethereum and Bitcoin - link. While this move highlights growing interest in bridging the two ecosystems, it's worth noting that BOB, an Asymmetric portfolio company, has been pioneering this concept for some time. BOB is making strong progress using BitVM to enable trust-minimized Bitcoin settlement, positioning itself at the forefront of this emerging design space.

Source: BOB

Bitcoin DeFi is far from reaching its potential as only 0.3% of Bitcoin’s market cap is active in DeFi right now compared to 30% for Ethereum. As long-term aligned investors, we’re encouraged to see the Bitcoin L2 ecosystem entering a maturation phase where fundamentals, thoughtful design, and true alignment with Bitcoin’s architecture are beginning to matter more. While early entrants often ported over Ethereum-based technologies without fully adapting them to Bitcoin’s unique constraints and values, we’re excited by the conviction and technical depth of the teams we’ve chosen to back such as Bitlayer and BOB which consistently lead in TVL and network activity month over month.

Source: BitcoinEcoTK

Metaprotocols

Fractal Bitcoin emerged as one of the most successful examples of a metaprotocol-first approach on Bitcoin. Initially leveraging the BRC-20 token standard to spark experimentation and user engagement, the Fractal ecosystem rapidly scaled, eventually justifying its own dedicated merge-mined blockchain. Today, Fractal is secured by over 500 EH/s — more than 50% of Bitcoin’s total hashrate — and consistently ranks in the Top 10 by daily PoW activity according to f2pool, with mining support from major pools like Antpool, Binance Pool, Luxor, and others.

Source: F2Pool

The momentum from its BRC-20 roots catalyzed the growth of a vibrant ecosystem. From DeFi apps like PizzaSwap and stablecoins like sUSD, to community-driven governance, NFTs, and atomic swaps, Fractal is proving how Bitcoin-native experimentation at the metaprotocol layer can evolve into full-fledged L1 innovation.

Much like BRC-20 experimentation was enabled by the Fractal team, we are excited to see that a significant portion of CAT Protocol development is taking place on Fractal Bitcoin, which has OP_CAT enabled, an important opcode not yet activated on Bitcoin mainnet. This makes Fractal a natural sandbox for building and refining the Covenant Attested Token (CAT) Protocol, a novel UTXO-based token standard that is fully enforced by Bitcoin Script at Layer 1.

Unlike existing token protocols on Bitcoin that rely on off-chain indexers, CAT tokens are miner-validated and consensus-enforced, with all token logic and data stored directly on-chain. This architecture eliminates centralization risks, while unlocking powerful features like modularity, programmable minting, SPV compatibility, and cross-chain interoperability. With support for both fungible (CAT20) and non-fungible (CAT721) tokens, the CAT Protocol introduces a composable foundation for smart contract applications – such as AMMs, lending, and staking – built entirely within Bitcoin's security model. Fractal’s early adoption of OP_CAT is positioning it as a proving ground for the future of trustless tokenization on Bitcoin.

Source: Fractal

Bitcoin Staking

Institutional interest in Bitcoin staking is on the rise, as evidenced by CoreDAO's recent partnership with Maple Finance, CopperHQ, BitGo, and Hex Trust to introduce lstBTC, an institutional-grade liquid staking Bitcoin solution: link. Notably, institutional investors are already deeply integrated with custodians – and in many cases, this is the only compliant and risk-managed way they can gain exposure to Bitcoin due to regulatory requirements, internal risk frameworks, and operational mandates.

Source: BitcoinEcoTK

The demand for yield on Bitcoin is clearly growing, as users seek ways to make their BTC productive rather than letting it sit idle. As shown in the latest yield data, a variety of protocols – including Pendle, Indigo, Umami, and Yearn – are offering competitive APYs. For instance, LBTC (CORN) on Pendle currently leads with an 18.8% APY, followed by iBTC on Indigo at 17.9% and GMWBTC on Umami at 16.9%. These yield opportunities span across different wrapped and tokenized forms of Bitcoin, signaling a broader ecosystem of Bitcoin-backed assets being deployed in DeFi protocols to generate returns.

Source: BitcoinEcoTK

dApps

One of our portfolio companies, Satflow (Bitcoin DEX) launched ‘Satflow Week’ a multi-day campaign highlighting a wave of product upgrades, new user incentives, and marketing initiatives aimed at accelerating platform growth as they have been iterating on their product in stealth over the last few months. One of the most meaningful updates is the introduction of creator royalties and affiliate rewards – enabling 0.5% fees to be paid out instantly and trustlessly to creators and referrers on every trade. Combined with Satflow’s continued 0% marketplace fee model, this creates a more positive-sum and creator-aligned ecosystem that may inspire more artists, collectors, and influencers to list and trade on Bitcoin.

Another major milestone is the rollout of cross-marketplace aggregation, allowing users to view real-time floor prices and listings from competing marketplaces like Magic Eden and buy those assets directly through Satflow’s UI. Users can also list their own assets across marketplaces with fee-adjusted pricing in just one click, simplifying execution and unlocking better liquidity. This move positions Satflow not just as a standalone marketplace, but as the default trading terminal for Bitcoin-native assets.

We’re excited to see the team continue to grow the scope of their roadmap and push the boundaries of what’s possible in Bitcoin-native trading.

Team Updates

Crypto 101 featured Joe in the 644th episode of their podcast “Trading Insights During this Volatile Market with Asymmetric's Joe McCann”.

Joe was mentioned in AMB Crypto article “TRUMP, MELANIA, LIBRA, and more – Are memecoins now all about ‘influence for sale?’”.

Watch Joe on Unchained’s podcast “Joe McCann on Why Bitcoin Is the King and Memecoins Are Over—For Now”.

Joe was back on Bits and Bips: “Why the Stock Market Wipeout Might Not Achieve What Trump Wanted”.

Joe’s commentary was highlighted in Coin Bureau’s article by Jasir Jawaid “Crypto's Crossroads: Has the Industry Lost Its Way? Experts Weigh In”.

Joe will be speaking at Binance in Abu Dhabi and TOKEN2049 in Dubai at the end of April.

Don’t miss Joe’s commentary in CNBC’s article “Bitcoin-related startup deals soared in 2024 alongside crypto prices, research shows”.

All Market Updates

Please let us know if you have any questions or comments.

As always, thank you for your support.

– Asymmetric

Excellent piece of work. Thank you.