Asymmetric Market Update™️ #26

Our thoughts on what is relevant in Crypto and Markets…

Crypto

In last month’s Market Update™, I asserted that the “easy money” was over. January proved rather difficult for traders and crypto investors, or at best, “choppy.” Even though Bitcoin finished up over 9% for the month, volatility in the crypto markets officially came back, in both directions, up and down.

But Joe, up 9% is pretty damn good, you say! Indeed, it is, but the broader crypto market was down. The “OTHERS” index (all coins not in the top 10 by market capitalization) was negative for January.

Why?

In a word: Trump.

Three days before Trump’s inauguration, the Trump organization decided to last their own memecoin, $TRUMP, and it was a wild success, arguably the most successful memecoin launch in history, achieving a fully diluted valuation of over $75B within 48 hours.

$TRUMP was also launched on Solana, not Ethereum or the dozens of L2s available, but on Solana, given its scalability and speed characteristics and favorability amongst memecoin traders. The chain suffered zero issues and hummed right along. Issues for users were at the wallet provider layer, with apps like Phantom scrambling to fix bugs, given the size and scale of activity.

Since $TRUMP was launched on Solana, new users needed to fund their Solana wallets and ultimately transact in $SOL. Consequently, $SOL achieved a new all-time high (ATH) of just under $300 a token, a +3750% increase from the lows just a couple of years back.

Right, so $SOL and $TRUMP were winners, but why did $OTHERS become losers? In short, liquidity.

When the $TRUMP memecoin launched, money was frantically rotating out of seemingly every other token and into $TRUMP and $SOL by proxy. The dispersion of negative returns across the broader crypto ecosystem was enormous - everything was red.

This raises, not begs, the question: where does all the new liquidity come from?

The headlines since Trump has taken office are historic by any measure, but as they relate to crypto, they are previously unfathomable.

Executive Order (EO) 14178, "Strengthening American Leadership in Digital Financial Technology," was not only pro-crypto, but it was an utter rebuke of the prior administration's attempts at crippling the industry.

This executive order outlines the administration's policy to support the responsible growth and use of digital assets and blockchain technology across all sectors of the economy. Key provisions include:

Revocation of Previous Policies: The order revokes Executive Order 14067 of March 9, 2022, titled "Ensuring Responsible Development of Digital Assets," and the Department of the Treasury's "Framework for International Engagement on Digital Assets" issued on July 7, 2022.

Prohibition of Central Bank Digital Currencies (CBDCs): It prohibits federal agencies from establishing, issuing, or promoting CBDCs within the United States or abroad, citing concerns over financial stability and individual privacy.

Establishment of the President's Working Group on Digital Asset Markets: The order creates a working group within the National Economic Council, chaired by the Special Advisor for AI and Crypto. This group is tasked with proposing a federal regulatory framework for digital assets within 180 days and evaluating the potential creation of a national digital asset stockpile.

Promotion of Dollar-Backed Stablecoins: The administration aims to promote the development and growth of lawful and legitimate dollar-backed stablecoins worldwide to uphold the sovereignty of the U.S. dollar.

Ensuring Access to Banking Services: The order emphasizes protecting and promoting fair and open access to banking services for all law-abiding individuals and entities, including those involved in the digital asset sector.

This is just the Executive Order.

In addition to the EO, David Sacks is leading the crypto and AI policy initiatives and has recently stated on the All In Podcast that a Stablecoin bill could be passed within “months” and the market structure bill (i.e., what are commodities, securities, collectibles, etc.) “sometime this year.”

Moreover, the heads of massive banks, from Bank of America to Morgan Stanley, have publicly stated they will offer “crypto services” to their customers.

A proliferation of ETF filings has filled the queue at the SEC, from obvious ETFs like Solana to memecoins like Dogecoin, Bonk, and even $TRUMP. In fact, the Trump Media and Technology Group has recently filed to trademark investment products targeting Bitcoin and others.

And I’m barely scratching the surface here. The number of positive headlines for crypto has never been this high.

That’s where your liquidity comes from.

For quite some time, crypto natives have mostly engaged in a player-versus-player (PvP) trading environment within the crypto ecosystem, with a “hot ball of money” rotating from one token or ecosystem to another. New money must come in for the industry to move away from a zero-sum environment and toward an expansive one.

With the repeal of SAB-121, banks can now functionally custody crypto on their balance sheets. This will have a 100x bigger impact than the Strategic Bitcoin Reserve.

With spot ETFs being filed and ultimately approved, retail investors who don’t want to (or know how to) set up a crypto wallet can buy memecoins like $BONK (via ETFs).

Stablecoin integration into payment systems and banking services can act as a trojan horse for increased mainstream cryptocurrency adoption.

Recently, Patrick Collison, the co-founder and CEO of Stripe, tweeted:

If you add all this up, an enormous amount of liquidity will enter the (crypto) system.

How will it get there is the obvious question?

Consumer apps.

As I recently mentioned in my interview with the legendary Raoul Pal, the time for the consumerization of web3 is now. There has been an over-investment in “infrastructure” by many of my VC brethren, backing even more L1 protocols and proxies to them. The latest VC-backed infrastructure investment to “go public” is Berachain. Its token generation event was earlier this week, and the price is suffering the same fate as many other VC-backed infrastructure investments: down only.

In the 1990s, myriad VCs backed companies laying the physical infrastructure for the Internet itself. What were they doing in 2005-2009? Investing in apps like Twitter, Groupon, Square, Instagram, etc.

VCs have been investing in web3 infrastructure for nearly 10 years now…and for some reason, they keep investing in it today.

The $TRUMP memecoin launch was enough proof that the available infrastructure is “good enough,” the focus should be on applications, not infrastructure (beyond niche/specific infrastructure).

That’s why we at Asymmetric are launching crypto’s first-ever, early-stage VC fund explicitly focused on consumer applications. To bring all the new liquidity into the system, we believe the conduit for said liquidity will be consumer-facing applications, primarily on mobile phones, but not strictly limited to them.

An old adage I tend to live by as an investor is, “When everyone is looking in the same place for value, it is rarely there.” That could not be more true in the current infrastructure-focused VC community in web3 and is part and parcel of our desire to back the best founders focusing on apps, where the true value lies.

Macro

The Federal Reserve

As of early February 2025, the Federal Reserve (Fed) has maintained the federal funds rate within the target range of 4.25% to 4.50%, following a series of rate cuts totaling 100 basis points over the past three meetings. This decision reflects the Fed's assessment of a robust U.S. economy characterized by steady growth and a strong labor market. Fed Vice Chair Philip Jefferson emphasized that while inflation is expected to decrease gradually, there is no immediate need to rush further rate cuts. He advocates for a cautious approach, planning to reduce monetary policy restraint gradually.

On the other hand, Richmond Federal Reserve President Thomas Barkin recently stated that he “still leans towards cuts this year” and “sees no sign of the U.S. economy overheating.” Minneapolis Fed President Neel Kashkari recently stated, “If we see good inflation and the labor market stays strong, that would move me to support a further rate cut.”

The Fed's current stance aims to balance the dual mandate of promoting maximum employment and ensuring price stability. Despite recent rate reductions, the policy remains "meaningfully" restrictive, with the target range still above the long-run neutral estimate of 3.0%. This approach provides the Fed with flexibility to respond to evolving economic conditions, including uncertainties arising from recent tariff and immigration policies. We still maintain that rates are too restrictive, and the Fed will continue to cut in 2025.

China

China's economy faces challenges, with sluggish growth persisting into 2025. The nation has relied heavily on external demand and a weaker renminbi (RMB) to bolster export competitiveness. In response to recent U.S. tariffs, the People's Bank of China maintained the RMB's exchange rate at 7.169 per dollar, signaling an intent to defend the currency's value despite external pressures.

However, the benefits of a weaker RMB are diminishing. While it has historically aided export competitiveness, the depreciation has led to increased import costs, complicating the economic outlook for 2025. Chinese policymakers are cautious about significant currency appreciation, drawing lessons from historical precedents like the Plaza Accord, which adversely affected Japan's economy. Given the current economic conditions, China will likely maintain a weaker currency to support growth despite the associated challenges.

The Impact of Trump's Alleged Tariff War

President Donald Trump's recent imposition of tariffs—25% on imports from Mexico and Canada and 10% on Chinese imports—has escalated global trade tensions. These measures have prompted swift retaliatory actions from the affected countries, leading to concerns over disrupted supply chains and increased costs for businesses and consumers.

The economic implications of these tariffs are significant. Analyses suggest that the new tariffs could reduce overall U.S. imports by 15%, potentially leading to weaker GDP growth, higher unemployment, and increased inflation. Industries with complex cross-border supply chains, such as automotive and electronics, are particularly vulnerable to these disruptions.

Financial markets have reacted negatively to the escalating trade tensions. Major stock indices in the U.S., Europe, and Asia have experienced declines, reflecting investor concerns over the potential for a global economic slowdown. The tariffs have also led to increased volatility in commodity markets, with oil prices surging due to anticipated supply disruptions.

However, the history of Trump’s “trade war” suggests the opposite of the fear-mongering from many financial analysts. Government receipts rose significantly in the last trade war.

It is clear that Trump will be cutting taxes for Americans and businesses and will likely finance those cuts with increased tariff revenue and the effect of DOGE.

It is worth noting the macroeconomic differences this time around:

The thematic deltas are stark: inflation is much higher, the deficit much wider, and growth globally subdued.

The Impact of the Price of Oil

Recent geopolitical developments, particularly the imposition of U.S. tariffs on major oil exporters like Canada, have introduced volatility into the oil markets. The 10% tariff on Canadian oil imports is expected to disrupt supply chains, potentially leading to higher energy prices. This move could slow U.S. economic growth and contribute to inflationary pressures.

On the global stage, U.S. sanctions on countries like Iran aim to reduce their oil exports to zero, further tightening the global oil supply. Iran's oil minister has warned that such sanctions will destabilize energy markets, emphasizing the need to depoliticize the oil market to ensure energy security.

However, the market is showing the opposite. Trump is focused on decreasing oil prices and has made it a priority for the U.S. to extend its lead as the world’s largest energy producer. Crude oil is hovering just above $70 a barrel, and the latest build-up of oil inventories suggests that oil prices are going lower…much lower.

It’s difficult to experience a re-acceleration of inflation with oil prices falling.

The U.S. Dollar

The U.S. dollar exhibited notable strength in early 2025, reaching a 20-year high against the Canadian dollar following the announcement of new tariffs. This appreciation reflects investor confidence in the U.S. economy and the dollar's perceived safe-haven status amid global trade uncertainties.

However, the dollar's strength presents a mixed bag of economic implications. While a stronger dollar benefits U.S. consumers through cheaper imports and more affordable foreign travel, it poses challenges for U.S. exporters by making their goods more expensive in foreign markets. This dynamic can reduce export competitiveness and potentially widen the trade deficit.

The Trump $DXY and 10Y U.S. Treasury fractals are finally beginning to repeat. This bodes well for risk assets overall.

The Credit Cycle

The credit cycle appears mid-expansion, with economic indicators suggesting this trend could continue into 2025. Accommodative central bank policies, stronger corporate profits, and improved productivity have contributed to a favorable growth environment.

In this context, banks are exhibiting a renewed readiness to lend. A stable economic outlook and a cautious yet accommodative monetary policy environment have bolstered banks' confidence in extending credit to businesses and consumers. This resurgence in lending activity is expected to support ongoing economic expansion, facilitating investment and consumption that drive growth.

Overall, the mid-expansion phase of the credit cycle, supported by favorable economic indicators and a cautiously accommodative monetary policy, positions banks to actively participate in fueling economic growth through increased lending activities.

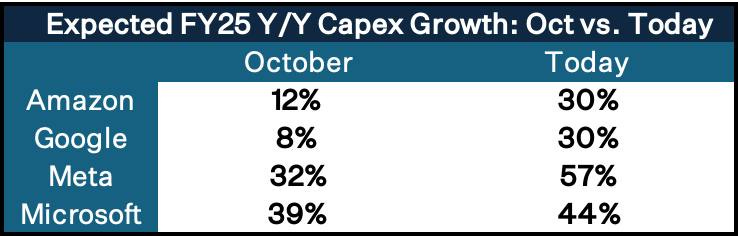

CapEx and AI

In recent years, U.S. corporations, particularly within the technology sector, have significantly escalated their capital expenditures (CapEx), with a pronounced focus on artificial intelligence (AI) infrastructure. This surge in investment underscores the strategic importance of AI in driving innovation, enhancing competitiveness, and shaping the future trajectory of these companies.

Tech Giants Leading the Investment Charge

Several major technology firms have announced substantial CapEx plans centered on AI development:

Alphabet (Google's Parent Company): In 2025, Alphabet plans to invest $75 billion in capital expenditures, a notable increase from the $52.5 billion spent in 2024. This investment is primarily directed toward AI infrastructure, including the expansion of servers and data centers, to support the growing demands of AI applications.

Microsoft: Microsoft has reaffirmed its commitment to AI by planning to spend approximately $80 billion during its current fiscal year on AI-enabled data centers. These facilities are designed to train large language models and deploy AI and cloud-based applications, reflecting Microsoft's strategic focus on integrating AI across its product and service offerings.

Meta (formerly Facebook): Meta has projected capital expenditures between $60 billion and $65 billion for 2025, with a significant portion allocated to AI infrastructure. This investment aims to enhance Meta's AI capabilities, particularly in areas such as content recommendation algorithms and virtual reality applications.

Strategic Drivers Behind Increased AI Investments

Several strategic considerations drive the heightened focus on AI-related capital expenditures among U.S. tech corporations:

Competitive Pressure: The rapid advancements by competitors, including emerging firms like China's DeepSeek, have intensified the race to develop more efficient and powerful AI models. DeepSeek's recent achievements in creating advanced AI models at lower costs have prompted U.S. tech giants to accelerate their investments to maintain a competitive edge.

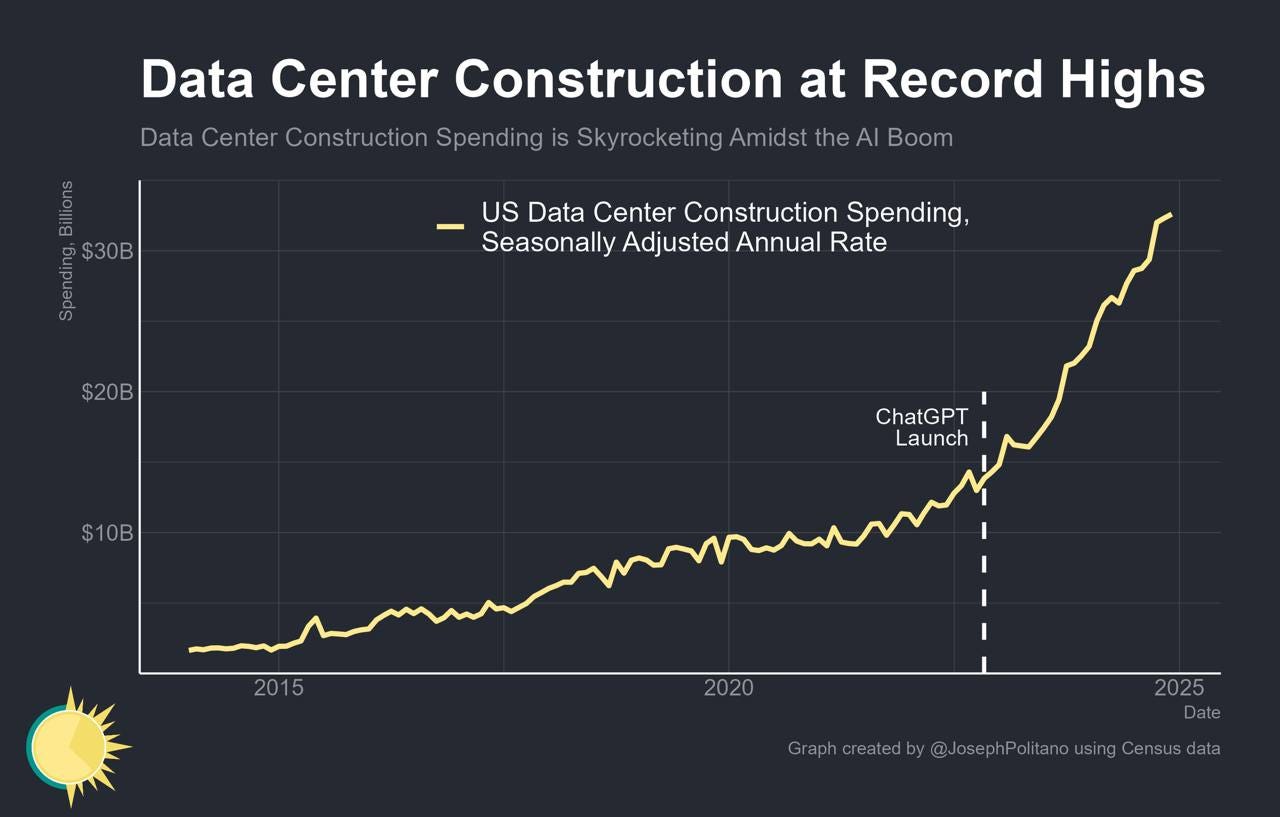

Infrastructure Expansion: The growing demand for AI applications necessitates substantial investments in infrastructure, particularly in data centers equipped with high-performance computing capabilities. Companies are scaling up their infrastructure to support the training and deployment of complex AI models, which require significant computational resources.

Long-Term Value Creation: Investments in AI are viewed as pivotal for long-term value creation, enabling companies to innovate, improve operational efficiencies, and open new revenue streams. Companies aim to enhance user experiences and drive growth by embedding AI into products and services.

Broader Economic Implications

The substantial increase in AI-focused capital expenditures by U.S. tech corporations has several broader economic implications:

Supply Chain Impact: The surge in demand for AI infrastructure components, such as advanced semiconductors and specialized hardware, is influencing global supply chains. Companies like Nvidia, known for their high-performance GPUs essential for AI workloads, are experiencing increased demand, leading to strategic partnerships and supply chain adjustments.

Labor Market Dynamics: The expansion of AI initiatives contributes to job creation in specialized fields, including data science, machine learning, and AI research. Additionally, the construction and maintenance of new data centers generate employment opportunities in various sectors.

Regulatory Considerations: The rapid growth in AI capabilities and investments is attracting attention from regulators concerned about data privacy, ethical AI use, and market competition. Companies may need to navigate evolving regulatory landscapes as they expand their AI operations.

The increased capital expenditures by U.S. corporations, especially within the tech sector, underscore a strategic commitment to advancing AI capabilities. These investments are poised to drive innovation, shape competitive dynamics, and have far-reaching implications for the broader economy.

VC

Infrastructure Overinvestment: A Critical Reflection for 2025

In previous market updates, we advocated a new paradigm shift for crypto Ventures, stressing the importance of innovation in front-facing Web3 applications and user adoption. In order for that shift to occur, VCs need to take a hard look at infrastructure and ask some serious questions. For several years now, billions of dollars have poured into layer-1 blockchains, cross-chain solutions, wallets, custody providers, and various middleware projects. While this influx of capital has undoubtedly advanced the crypto ecosystem, it has also created an oversaturated landscape. The question today is: Are we funding progress, or are we funding redundancy?

The Infrastructure Boom: Context and Challenges

Between 2020 and 2024, crypto infrastructure funding reached unprecedented levels. Buoyed by the bull market and the promise of Web3, venture capitalists raised massive funds to support startups building the backbone of the decentralized economy.

Projects like Solana, Avalanche, and Aptos received hundreds of millions of dollars (Messari), while newer entrants like Monad, a high-performance layer-1 blockchain, raised $225 million in a single round. The numbers are staggering, yet they beg the question: how many blockchains and infrastructure layers does the market truly need?

Take layer-1 blockchains (L1’s) as an example. Ethereum remains a significant force, and other chains like Solana and Binance Smart Chain continually carve out vital niches (Solana recently became the first chain to pass $200B in DEX volume).

However, many new chains struggle to differentiate themselves, often touting marginally faster transaction speeds or lower fees—features that existing chains are also working to improve (Decrypt). Meanwhile, cross-chain solutions have proliferated, with protocols like Wormhole, Axelar, and LayerZero leading the pack (The Block). While interoperability is critical, the sheer number of similar projects raises concerns about overlapping functionality and diminishing returns.

Exhaustion Creeps Up

Slowing Innovation: Many recent projects feel iterative rather than revolutionary. The emphasis on minor technical improvements rather than groundbreaking use cases suggests that the low-hanging fruit of infrastructure innovation has been picked.

User Adoption Lagging Behind: Despite significant advancements in infrastructure, user adoption of decentralized applications (dApps) remains limited. Infrastructure has outpaced the development of compelling applications that can attract and retain mainstream users (DappRadar).

Funding Fatigue: Data from 2024 indicates that venture funding in crypto infrastructure began to decline, with fewer deals and lower average check sizes (Crunchbase). This suggests that even investors are starting to recognize the saturation point.

Bubble Risk: Similar to past tech booms, speculative hype has driven overfunding in some sectors, creating a market where only a few key players will ultimately emerge as winners. This mirrors Howard Marks' cautionary view that optimism leads to pricing errors, particularly in emerging technologies like AI and crypto.

Take Warning

Investors should be wary of VC funds that continue to allocate heavily to infrastructure projects. The ecosystem’s foundation is robust; further investments risk fueling redundancy rather than growth. Instead, VCs must critically evaluate whether new infrastructure proposals address genuine market gaps or merely rehash existing solutions.

Take Monad as an example. Despite its impressive $225 million raise, questions remain about its differentiation in a market already crowded with high-performance blockchains. There have been criticisms regarding Monad's substantial funding and the perceived lack of deliverables. Notably, Andre Cronje, co-founder of Sonic, addressed such concerns this past month. He criticized Monad for not conducting basic investigations and for changing its narrative—initially promising a parallel Ethereum Virtual Machine (EVM) but failing to meet performance goals. Cronje highlighted Monad's delays and lack of tangible progress despite significant funding. Additionally, industry observers have noted the challenges Monad faces in delivering on its promises. For instance, achieving a nine-figure valuation before the Monad blockchain has even launched has been described as "quite surprising," indicating skepticism about the high valuation in the absence of a live product. The risk of overfunding similar projects could divert resources away from more impactful innovations.

Where We Go From Here

We hold a position that a shift in attention from infrastructure to applications and real-world use cases is in order. The following areas are only a handful of examples but represent more promising opportunities:

Consumer-Ready dApps: Gaming, decentralized social media, and NFT-related platforms have shown potential to attract mainstream users. Projects focusing on user experience and tangible value propositions deserve more attention (CoinDesk).

Regenerative Finance (ReFi): Innovative financial models that integrate environmental and social impact with blockchain technology are gaining traction. These projects can align with broader global priorities and offer both utility and sustainability (Medium).

Enterprise Solutions: While retail adoption has been the primary focus, enterprise-grade blockchain solutions remain underexplored. Supply chain, identity verification, and data security are areas ripe for blockchain disruption (Forbes).

Capital Efficiency: Rather than funding new infrastructure projects, VCs should focus on scaling existing solutions to improve usability, security, and integration with traditional finance systems.

Wrapping Up

The crypto industry has made tremendous strides in building a resilient and scalable infrastructure. However, as 2025 gets underway, the focus must shift. The time for investing in every new infrastructure project has passed, and anyone bullish about infrastructure in 2025 is spinning their wheels. Instead, we must direct resources toward applications and use cases that can drive real adoption and deliver value to users. By doing so, we can ensure that the capital flowing into the crypto ecosystem fosters meaningful progress rather than unnecessary duplication.

The infrastructure race is over; the race for utility begins.

Bitcoin DeFi

The Evolving Bitcoin DeFi Ecosystem

With over 80 projects in development, the Bitcoin L2 race is hotly contested. Asymmetric’s portfolio companies—Bitlayer, BOB, and Mezo—are at the forefront, collectively surpassing $850M in TVL. BitLayer and BoB are live on mainnet, while Mezo has amassed $242M TVL in testnet. Multiple TGEs and mainnet launches expected in Q2-Q3 2025 will further accelerate adoption.

As interest in Bitcoin’s Layer 1 ecosystem grows, teams are developing metaprotocols that abstract a separate execution layer, enabling smart contracts on Bitcoin without the need for bridging. This approach ensures seamless integration with wallets and native assets. Asymmetric has backed Arch Network in this space, with another investment announcement forthcoming.

Bitcoin staking is gaining institutional traction, with Babylon Labs securing over 58,000 BTC ($5.9B TVL) as a core economic security layer for PoS chains. SatLayer (Asymmetric PortCo) is pioneering Bitcoin restaking, integrating with projects like Pendle and Morpho to unlock yield opportunities for BTC holders.

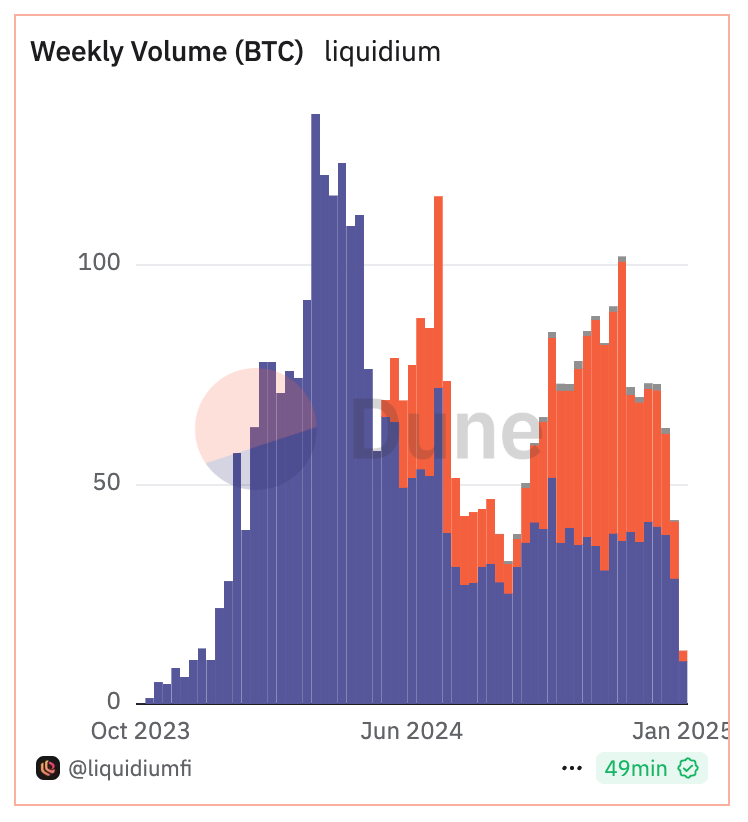

Bitcoin-native dApps like Liquidium (Asymmetric PortCo), which allow for folks to borrow Bitcoin using their Ordinal asset as collateral are driving DeFi innovation. While January’s loan volume was down, the launch of instant loans is expected to boost activity by simplifying access to liquidity.

Bitcoin L2s

At the start of 2024, there were few Bitcoin L2s. This sector has since seen explosive growth, with over 80 Bitcoin L2s currently in development. Asymmetric has invested in three key players—Bitlayer, BOB, and Mezo—positioning itself at the forefront of this emerging market (marked in red below). Many Bitcoin L2s are expected to launch their mainnets or TGEs by 2025.

Asymmetric’s portfolio companies continue to lead in this sector, with Bitlayer ($396M) and BOB ($224M) already live on mainnet. Meanwhile, Mezo, despite still being in testnet, has amassed $242M in TVL, cementing its position as a dominant player within the Bitcoin L2 ecosystem. A large reason for their lead in TVL is due to their focus around creating trust-minimized bridge designs for Bitcoin to their respective networks. Bitlayer and BOB are focusing on BitVM applications, while Mezo is leveraging their Threshold Network.

Bitlayer has announced the design of their bridge, called the Finality Bridge, built on BitVM Alliance research, which enables secure, trust-minimized cross-chain transactions. Designed for Bitlayer, it mints YBTC, a 1:1 pegged, yield-bearing asset, for use within its ecosystem.

BOB is making grounds with their R&D and partnership with Fiamma. The prototype leverages BitVM2 to enable complex smart contracts on the Bitcoin network without requiring protocol changes, thereby unlocking new use cases and scalability. Separately, we are excited for the integration of Chainlink for oracles on BOB which enable data feeds necessary in DeFi applications.

Source: BitcoinEcosystemTK

Bitcoin L2s are experiencing strong growth in TVL, highlighting the increasing demand for DeFi on these networks as liquidity hubs.

Metaprotocols (Ordinals, Runes, BRC-20s)

While Bitcoin does not have a universally accepted fungible token standard, Runes are still the most active transaction type on Bitcoin, surpassing BRC-20, and Inscription/Ordinals (NFTs). Since their late April launch, Runes transactions have been the primary driver of Bitcoin’s network fees, even exceeding those from Ordinals (NFTs). There has recently been a resurgence of interest around BRC-20 in the last few months as discussions continue around BRC-20 2.0 which introduces programmability modules, which we are tracking closely.

Source: BitcoinEcoTK

We are highly optimistic about new metaprotocols that abstract a separate consensus mechanism which enable seamless interactions directly from the Bitcoin base layer—without the need for bridging. This approach ensures the most native and frictionless experience while providing direct access to Bitcoin’s vast user base.

Extending natively from the base layer offers several advantages:

No need for users to leave Bitcoin, ensuring native security and liquidity.

Seamless wallet integration with platforms like Xverse, MetaMask, and Phantom, delivering a familiar UX.

Leveraging Bitcoin’s strong network effects, tapping into $2B+ in native assets as programmable collateral.

As Bitcoin’s ecosystem continues to evolve, so too does our definition of what a programmability on Bitcoin should look like. There are now many flavors of metaprotocols ranging from some that focus on security and Bitcoin alignment such as Glittr (an Asymmetric PortCo), ensuring all data is settled directly on Bitcoin’s L1, and those which abstract a separate consensus mechanism like Arch Network (an Asymmetric PortCo) for smart contracts but are natively interoperable with Bitcoin L1, which sacrifice decentralization for functionality.

We are excited to share future investments within this category within the coming months.

Bitcoin Staking

In January 2025, institutional interest in Bitcoin staking continued to grow, driven by the maturation of L2s and the development of staking protocols. Platforms like Figment have been instrumental in providing secure, institutional-grade staking infrastructure, supporting the expansion of Bitcoin staking ecosystems, more details: here.

A key highlight was the growing integration of Bitcoin restaking through SatLayer (Asymmetric PortCo), allowing BTC holders to secure additional networks while earning rewards.

Babylon Labs remains a leader in Bitcoin staking, with over 58,000 BTC staked, representing $5.9 billion in Total Value Locked (TVL). Following the closure of deposits after Cap-3 in December, Babylon is expected to launch its mainnet this quarter, potentially reopening deposits with a capped limit on Bitcoin.

Additionally, EigenLayer could introduce BTC restaking opportunities using wrapped Bitcoin, further expanding staking-based yield strategies.

Source: DefiLlama

dApps

Liquidium (Asymmetric PortCo), a leading NFT and fungible lending platform on Bitcoin, is leveraging the Internet Computer Protocol (ICP) to enable vaults for Bitcoin, allowing users to access instant loans seamlessly. By integrating ICP's advanced smart contract capabilities, Liquidium enhances the efficiency and security of Bitcoin-backed lending, providing a trust-minimized solution for borrowers seeking liquidity without needing intermediaries. The liquidity in these vaults—managed through ICP canisters—can then be accessed directly from the Bitcoin base layer, ensuring a seamless and decentralized lending experience. This innovation strengthens Liquidium’s position at the forefront of Bitcoin DeFi, offering a scalable and efficient solution for unlocking Bitcoin liquidity.

To see this in action, check out the demo here: Liquidium Demo.

While loan volume for the month of January is down, we anticipate that the launch of instant loans will be a significant product iteration that drives more activity on the platform. By streamlining the borrowing experience, instant loans eliminate the need for users to wait for a lender to accept their loan request in a peer-to-peer model. Instead, borrowers can access liquidity with a single click, greatly simplifying the user experience and making Bitcoin-backed lending more accessible and efficient. This enhancement is expected to increase engagement and adoption, reinforcing Liquidium’s role as a leading innovator in Bitcoin DeFi.

Source: Dune

Law & Regulations

Donald Trump has made it clear: he wants the U.S. to be the "crypto capital of the planet." His vision includes a Bitcoin strategic reserve, a revival of crypto mining, and a move towards deregulation. These are bold ideas, and if realized, they could dramatically reshape the landscape of digital assets in the U.S.

But does deregulation truly mean progress? And how much of this vision will translate into tangible policy changes?

Deregulation: More Clarity, Not Just Less Regulation

Crypto leaders are hoping for a shift away from regulation by enforcement. The industry needs clear, thoughtful policies—not just a regulatory pause that could be undone by the next administration.

The key issue here is the outdated regulatory framework. U.S. securities laws are structured around traditional asset classes like debt and equity, but crypto often falls into a grey area. The infamous Howey test, used to determine whether something is a security, wasn't designed for digital assets. This lack of clarity has led to a patchwork of enforcement actions rather than consistent rules.

Deregulation isn’t about removing guardrails entirely—it’s about ensuring that crypto projects know what rules they’re playing by. Otherwise, any reprieve under Trump could be short-lived if future administrations bring back heavy-handed enforcement.

Enforcement: Striking the Right Balance

One of the biggest shifts could come from Trump’s expected nomination of Paul Atkins, a well-known crypto advocate, as SEC chair. If confirmed, Atkins would likely steer the SEC away from aggressive enforcement actions against legitimate crypto companies and focus on actual bad actors—Ponzi schemes, fraudsters, and outright scams.

The issue of primary vs. secondary sales is a critical one. Some court rulings, like Judge Analisa Torres’ decision in the Ripple case, suggest that once tokens hit secondary markets, they shouldn’t be considered securities transactions. If Trump’s SEC embraces this stance, it could remove one of the biggest roadblocks for U.S. exchanges trying to compete with their offshore counterparts.

However, regulatory clarity is still needed on airdrops, play-to-earn tokens, and other novel distribution methods. If these are treated as securities sales, many crypto projects will continue operating in legal limbo.

The Role of Crypto Exchanges: Beyond Broker-Dealer Regulations

One of the biggest lessons from the FTX collapse was that exchanges need better oversight—but not necessarily through securities regulations. Many argue that consumer protections under money transmission laws would have been more effective than forcing exchanges into broker-dealer frameworks.

Japan offers an interesting case study. Its financial authorities regulate crypto more like money than securities, which meant that Japanese customers were largely protected when FTX imploded. The U.S. could learn from this approach rather than forcing crypto assets into a regulatory structure that doesn’t fit.

NFTs, Tokenized Assets, and Stablecoins: Avoiding the Securities Trap

Another area of interest is how the Trump administration will handle NFTs, tokenized real-world assets, and stablecoins. Unlike speculative crypto assets, these categories often fail the Howey test and shouldn’t be treated as securities.

However, regulators have often taken a broad-brush approach. Clear guidelines could encourage more innovation while protecting investors. Trump’s own campaign embraced NFTs, so there’s a strong incentive for his administration to provide this clarity.

Custodial Services: Unlocking Institutional Growth

One of the most damaging SEC policies in recent years was the requirement that public companies holding crypto on behalf of customers record those assets as liabilities on their balance sheets. This has made it nearly impossible for banks and other financial institutions to offer crypto custodial services at scale.

Congress passed a bipartisan repeal of this rule, but President Biden vetoed it. If Trump reverses this policy, it could open the floodgates for institutional adoption of crypto.

What Comes Next?

The crypto industry has long asked for clear, predictable rules. If Trump follows through on his promises, his administration could provide the clarity that has been missing for over a decade.

Congress also seems ready to move forward, with stablecoin legislation and broader crypto regulatory frameworks gaining momentum. If these proposals can avoid a presidential veto, they may finally bring the legal certainty the industry needs.

Of course, promises made on the campaign trail don’t always translate into policy. But for the first time in a long time, there’s real hope that the U.S. could take a leadership role in crypto innovation rather than driving projects offshore. The next few years will be critical in determining whether the U.S. truly becomes the “crypto capital of the planet” or continues to lag behind more forward-thinking jurisdictions.

Team Updates

Joe was interviewed by Bloomberg’s Suvashree Ghosh in “Bitcoin Retakes $100,000 as Congress Set to Certify Trump Win”

Raoul Pal hosted Joe on his Real Vision podcast “Solana, Dogecoin & Beyond: What’s Driving Crypto Innovation?”

Catch Joe’s commentary in The Block’s article “Ahead of Trump's inauguration, experts weigh in on a 'pivotal moment' for crypto”

Benzinga quoted Joe in their article “Trump Inauguration To Trigger $250K Bitcoin Rally Or A Plunge Below $100K: Analysts Weigh In”

CBS featured Joe in their article “Donald and Melania Trump debuted meme coins, $Trump and $Melania. Here's what to know.”

Joe was mentioned in MarketWatch’s article “Bitcoin needs to see these catalysts to hit $120,000”

Check out Joe in The Street Roundtable’s article “Pro-crypto voices highlight risks of Trump family crypto projects”

Read Joe’s commentary in the Markets Insider article “Why Solana could be the big winner of the meme-coin frenzy”

Joe was interviewed by David Kushner, of Business Insider, for “How a shady hustler in Dubai turned celebrity meme coins into a crypto grift”

Joe and Dan were in Dubai for Satoshi Roundtable XI

All Market Updates

Please let us know if you have any questions or comments.

As always, thank you for your support.

– Asymmetric

great distilation, thanks guys

Thanks for this amazing write-up. Very insightful and helpful.