Asymmetric Market Update™️ #25

Our thoughts on what is relevant in Crypto and Markets…

Crypto

The easy money has been made.

2024 was a historic year for myriad reasons, but as it relates to crypto, let’s review the performance of some cherry-picked data and why 2025 might not be as easy for my fellow crypto brethren and sistren.

Discarding USDT and USDC, the largest stablecoins by market cap, we observe that the best-performing major in 2024 was not Bitcoin or a Layer 1 protocol, but, yes, again, a memecoin.

No matter how many VCs (including myself) opine that the future of finance is driven by their bags, $DOGE outperformed all the majors.

I’ve written extensively over a year about why and how memecoins will continue to garner the attention of speculators (née gamblers) and financial nihilists.

It turned out to be true, and boy, did memecoins outperform. For example, $PEPE was up over 14x for 2024, and the total market cap of memecoins reached nearly $200B.

Let that sink in.

200 billion dollars worth of value for “assets” written off by academics and traditional finance as “worthless.”

On the other hand, what assets underperformed in the same year that the Bitcoin and Ethereum spot ETFs were launched?

Avid readers of the Asymmetric Market Update will not be surprised to hear my fundamental bearishness on Ethereum and Ethereum-adjacent assets. Beyond a tactical trade here and there, I still see no reason to own much of anything in the Ethereum ecosystem, particularly the failed scaling solution known as Layer 2s.

Ironically, Coinbase’s L2, Base, picked up an enormous amount of activity and interest…yet it doesn’t have a token.

Are L2’s a contrarian play for 2025? I think not.

Ethereum and its ecosystem currently lack any real catalyst on the horizon for 2025. There is the Pectra upgrade, an improvement to the network that will presumably “set the stage” for future scalability improvements which raises (not begs) the question - if Ethererum is going to be scalable what is the point of a L2?

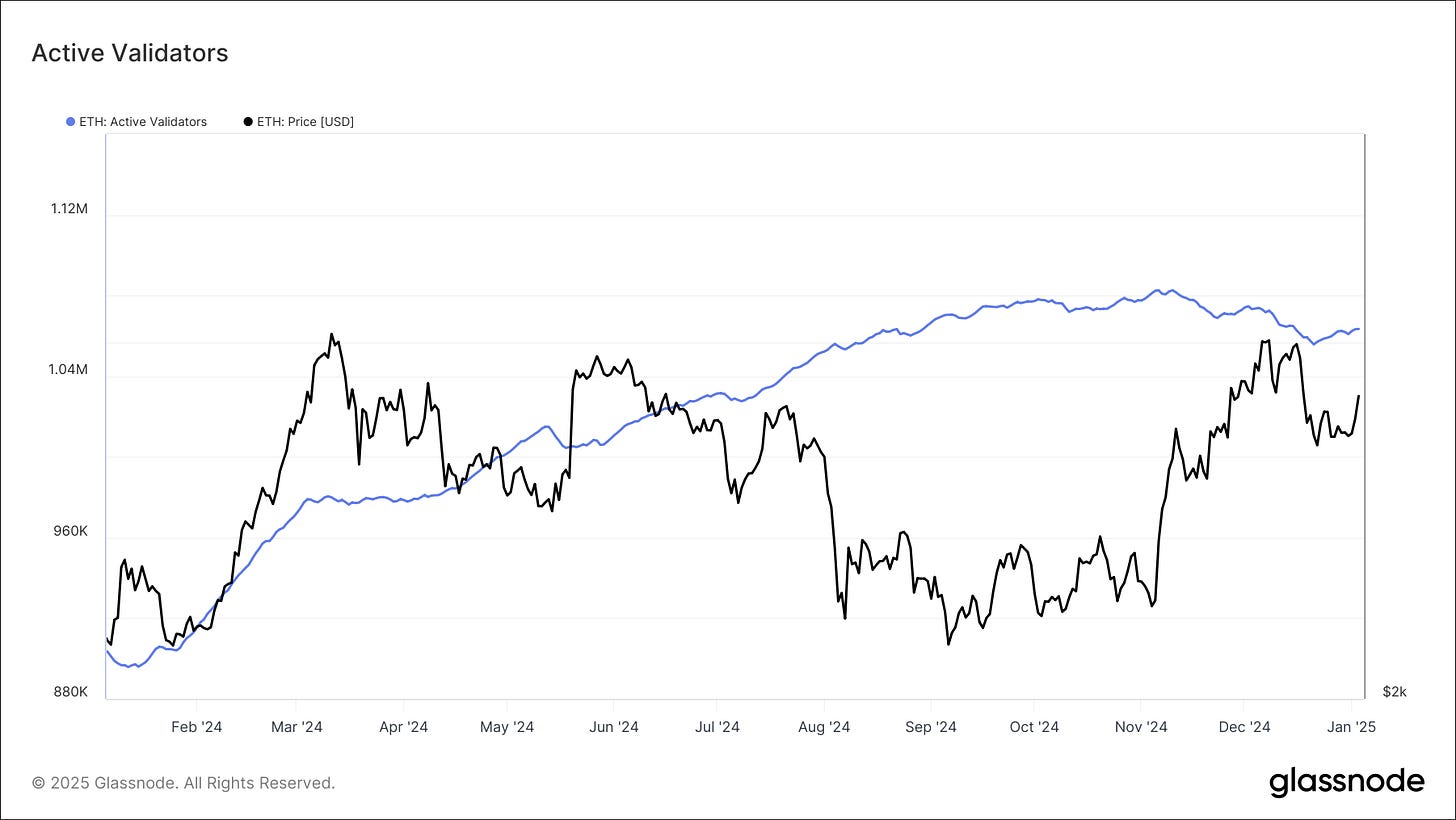

Moreover, the staking yield of Ethereum has dropped from 5.5% to 3.0% annualized since the Merge in September 2022. On Coinbase, the APY is less than 2%.

The one-month growth rate of active validators is now falling raising concerns that validators may be unstaking given the underperformance of $ETH and the paltry staking yield.

Is longing $ETH a contrarian play for 2025? Maybe.

It all comes down to flows.

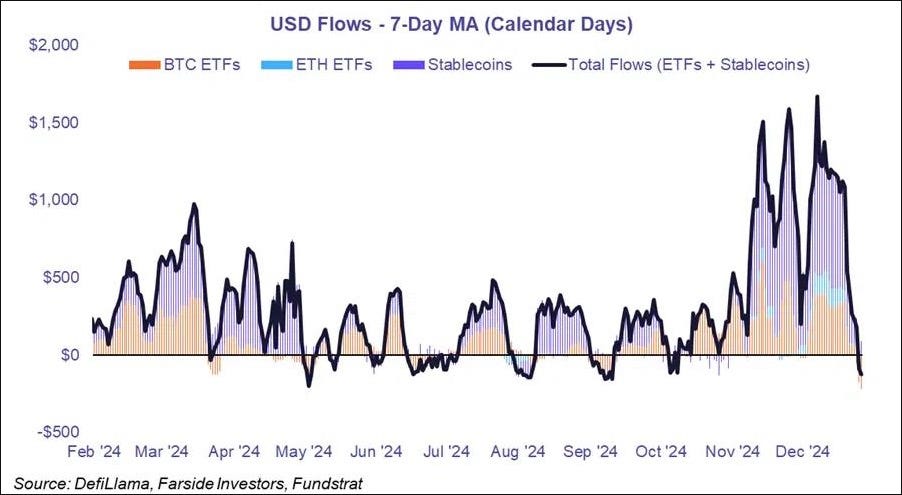

Bitcoin remains the king of crypto and 2024 was a year where its price action was largely dominated by one thing: ETF flows.

Q1 of 2024 was the genesis of Bitcoin spot ETFs, and flows dominated the price action. Q2 and Q3 were 6 months of boring, sideways action leading up to the U.S. Presidential election, where Trump won in historic fashion.

Flows ramped significantly after his win only to turn drastically negative the last two weeks of the year when Jerome Powell gave a hawkish press conference, triggering one of the most bizarre moves in recent memory - a 74% rise in the VIX on the day where the Federal Reserve cut 25 basis points.

Huh?

I ran an analysis going back to the inception of the VIX (1993) and the percentage move of the VIX when the Fed cut 25 basis points or more.

The move in the VIX on December 18th, 2024, was a 6.9 standard deviation move.

To put that type of move into perspective, the odds of a nearly seven sigma move are 1 in 191.6 trillion in a Gaussian distribution of outcomes, virtually impossible to observe, yet it happened, but what followed was more telling.

Funding spreads for equity index futures collapsed.

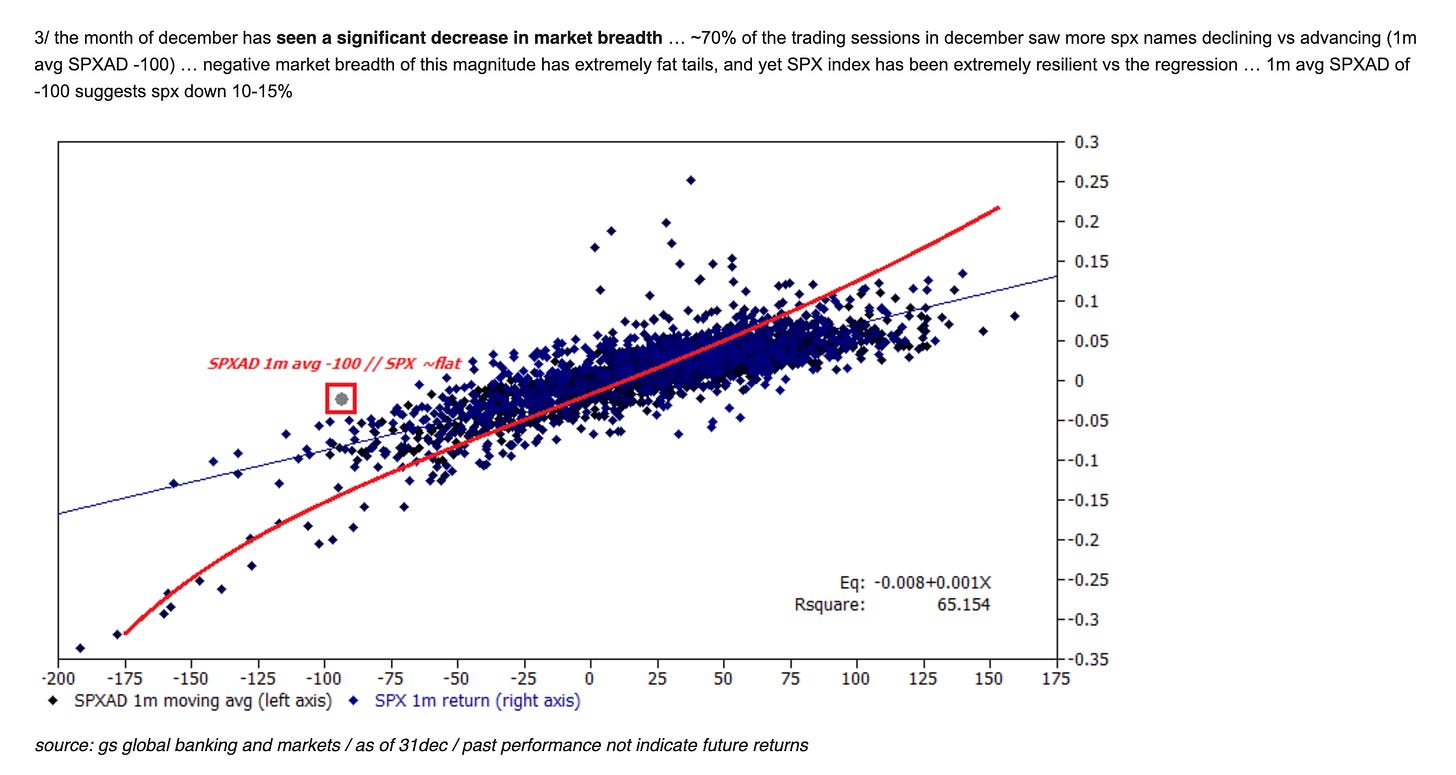

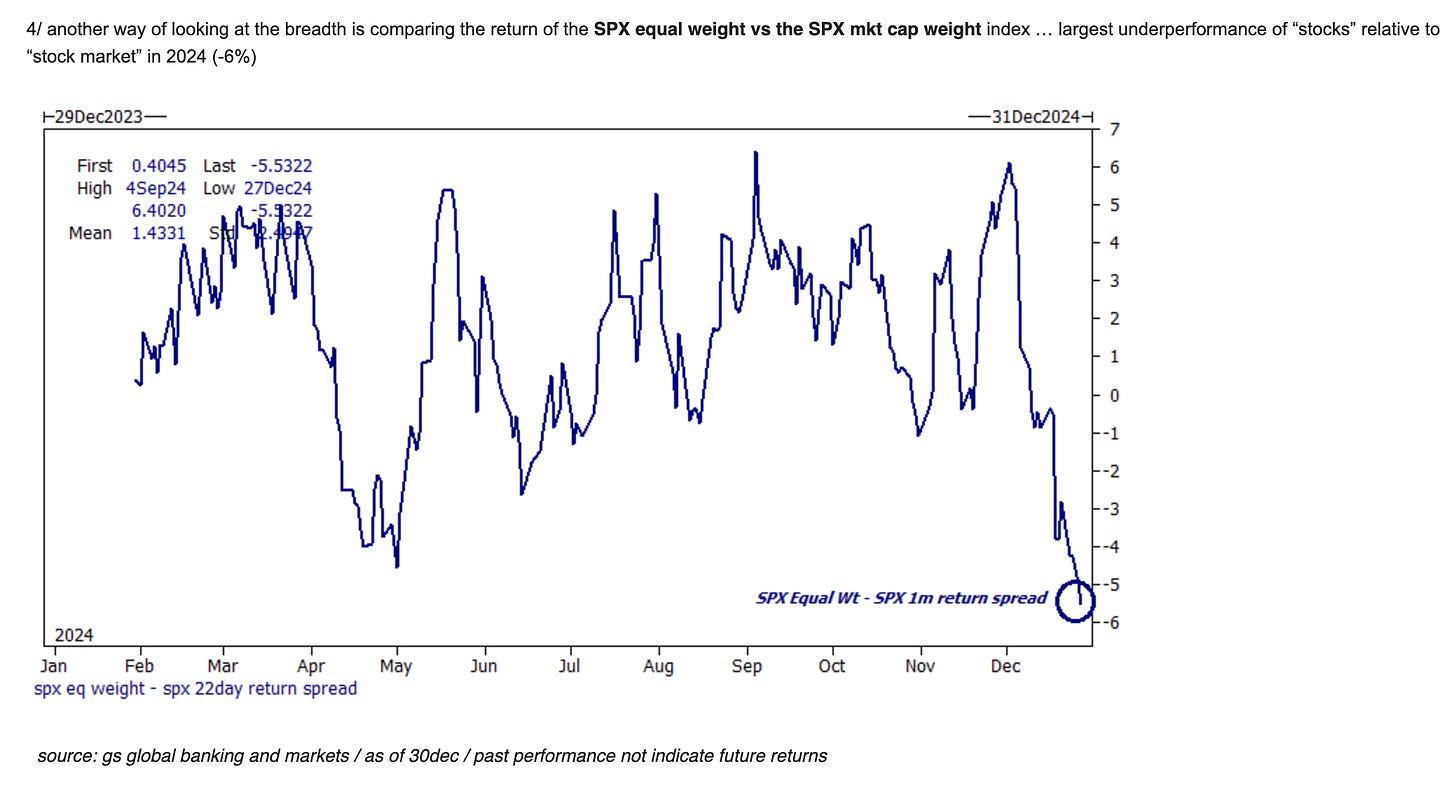

Stock market breadth was horrendous.

And crypto was not invincible to the whims of the stock market.

Flows completely collapsed from December 18th into year-end, and prices followed.

I would be remiss not to mention the decoupling of crypto from global liquidity in Q4 as well.

I have been and continue to be in the same camp as Michael Howell and Raoul Pal, who state that global liquidity is the only game in town regarding risk assets and their rise and fall. I also share their view that at some point in 2025, global liquidity is set to peak - this timing is precarious and incredibly difficult to forecast.

Although 2024 started off the year with a rise in global liquidity, Q4 saw continued weakness and has plunged the 3-month annualized percentage change to levels not seen since late 2022.

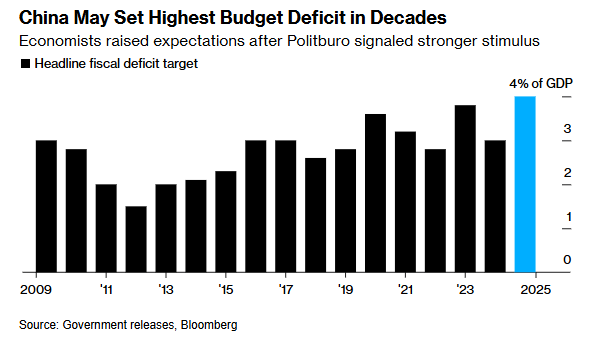

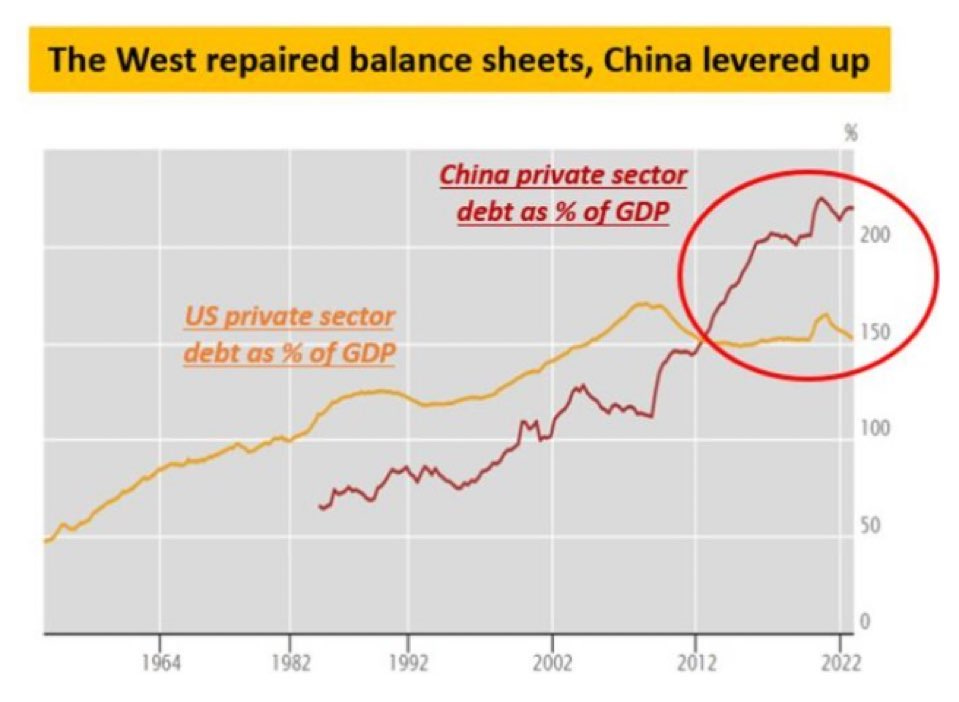

As I wrote about in October 2024’s Asymmetric Market Update™️, China continues to be the final boss, in my opinion, as it relates to Bitcoin’s continued rise…and for good reason: they are in a liquidity trap.

At the time of this writing, the 10-year Chinese Government Bond (CGB) yield has recently dropped to a record low of 1.592%, marking a decline of 7 basis points over a span of 48 hours. This decline has widened the spread against the 10-year U.S. Treasury yield to 295 basis points.

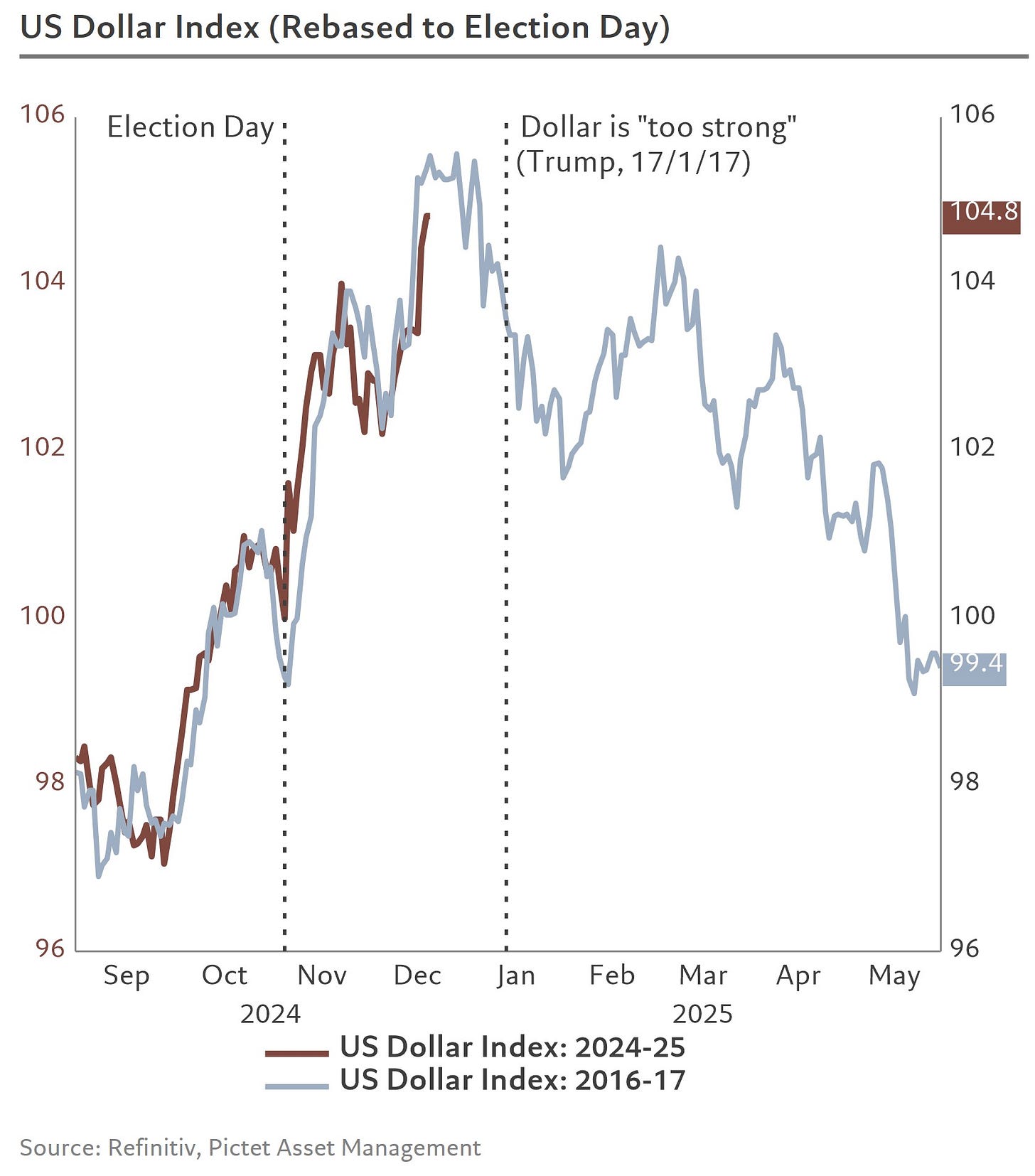

The Yuan continues to weaken as a result of the successful weaponization of the U.S. Dollar as demonstrated by a continually weak Japenese Yen.

All the while, the People’s Bank of China (PBoC) is still not injecting liquidity into their system.

On the one hand, a weaker China is bearish for global growth but beneficial to U.S. exceptionalism, as well as a strong U.S. Dollar.

Yet historically, a stronger Dollar is bearish for Bitcoin.

What is one to do?

Now, many potential catalysts for Bitcoin (and crypto generally) will rise in 2025. Here are a few:

A Strategic Bitcoin Reserve (at the U.S. Federal level)

Strategic Bitcoin Reserves (at the U.S. State level)

Strategic Bitcoin Reserves (for other countries globally)

The removal of SAB-121

Clear regulations out of the SEC and CFTC on crypto

The Stablecoin Bill

The Market Structure Bill

U.S. banks offering prime brokerage and trading services

The consumerization of web3/crypto (adoption)

A Chinese Bazooka of liquidity

However, these potential catalysts are just that - potential. In the meantime, one must continue to observe the flows, and for better or worse, those flows are dominated in the U.S, as witnessed by the Coinbase Premium.

The Coinbase Premium (or Discount) is the spot price of Coinbase versus the spot price on Binance and the delta between the two for an asset, in this case, Bitcoin.

We at Asymmetric have open sourced the Coinbase Premium indicator for TradingView users.

The Coinbase discount in notional terms can appear wide given the rise in Bitcoin’s price, so one must consider the price of Bitcoin in relation to the discount. A better metric is the percentage discount or premium to get a better sense of how deep the discount/premium is on a relative basis.

If we look at the discount in relative terms, we'll see that at year-end, the discount was, in fact, the widest since the FTX collapse, or nearly 25 basis points.

Clearly, the FTX collapse was a catalyst for the discount to widen, but Terra Luna's collapse was even more impactful, given the discount was even wider on May 12, 2022.

Now, the difference is not a negative idiosyncrasy driving a wide discount but is due to something much easier to understand - Bitcoin ETF flows.

Since the Bitcoin ETFs launched in 2024, the Coinbase Discount/Premium has been driven almost entirely by ETF flows. On days when the ETFs see major inflows, a Premium is observed, and the opposite is also true.

Since the FOMC meeting on December 18th, U.S. ETF holders have been selling their Bitcoin ETFs at a rapid pace.

Given the aforementioned, shouldn’t we simply buy Bitcoin when a Coinbase Premium is observed and sell when a Discount shows up?

In 2024, yes. That was the easy money.

Now, the easy money is over.

Macro

The final month of December was one of the more bizarre Decembers in recent history, providing a 2025 outlook that can only be described as being “clear as mud.”

FOMC

Jerome Powell’s communications on the U.S. presidential election could not have been more different in the final two months of 2024.

November FOMC: Regarding the recent U.S. presidential election, Powell stated that the election would not directly factor into monetary policy decisions in the near term.

December FOMC: Powell noted that the incoming Trump administration has shifted expectations for the next year, and some Fed officials have started incorporating potential new policies into their forecasts. However, the exact policies and their impact remain uncertain.

It is difficult to comment on that outrageous 180-degree change and its incoherence.

The election will not change policy expectations.

The election did change some people’s policy expectations even though “exact policies and their impact remain uncertain.”

Left speechless, we digress.

Clear as mud.

Treasury

There was an expectation that the Treasury General Account (TGA) would be drawn down towards the end of the year, over $800B USD. The election changed that.

Like it or not, Yellen evaporated in a malaise that can only be described as shell-shocked and pouting. Apparently, her civic duty wasn’t politically agnostic as the mantra would have us believe.

The debt ceiling turned into a debacle with the pork-barrel bill on incoherence for the final grift by the outgoing administration that was killed by Elon Musk and his (alleged) crusade against government largesse.

US TREASURY SECRETARY YELLEN: THE TREASURY EXPECTS TO REACH NEW LIMIT BETWEEN JANUARY 14 AND JANUARY 23, AT WHICH TIME IT WILL BE NECESSARY FOR TREASURY TO START TAKING EXTRAORDINARY MEASURES.

“Extraordinary Measures” simply refers to running down the TGA to fund government operations as a stop-gap. One way or another, the TGA has to be legally entered for the fiscal year. However, delaying that from q4 to q1 had an impact on market liquidity and, hence, asset prices.

Government Spending

You can’t consider the debt ceiling without discussing government spending.

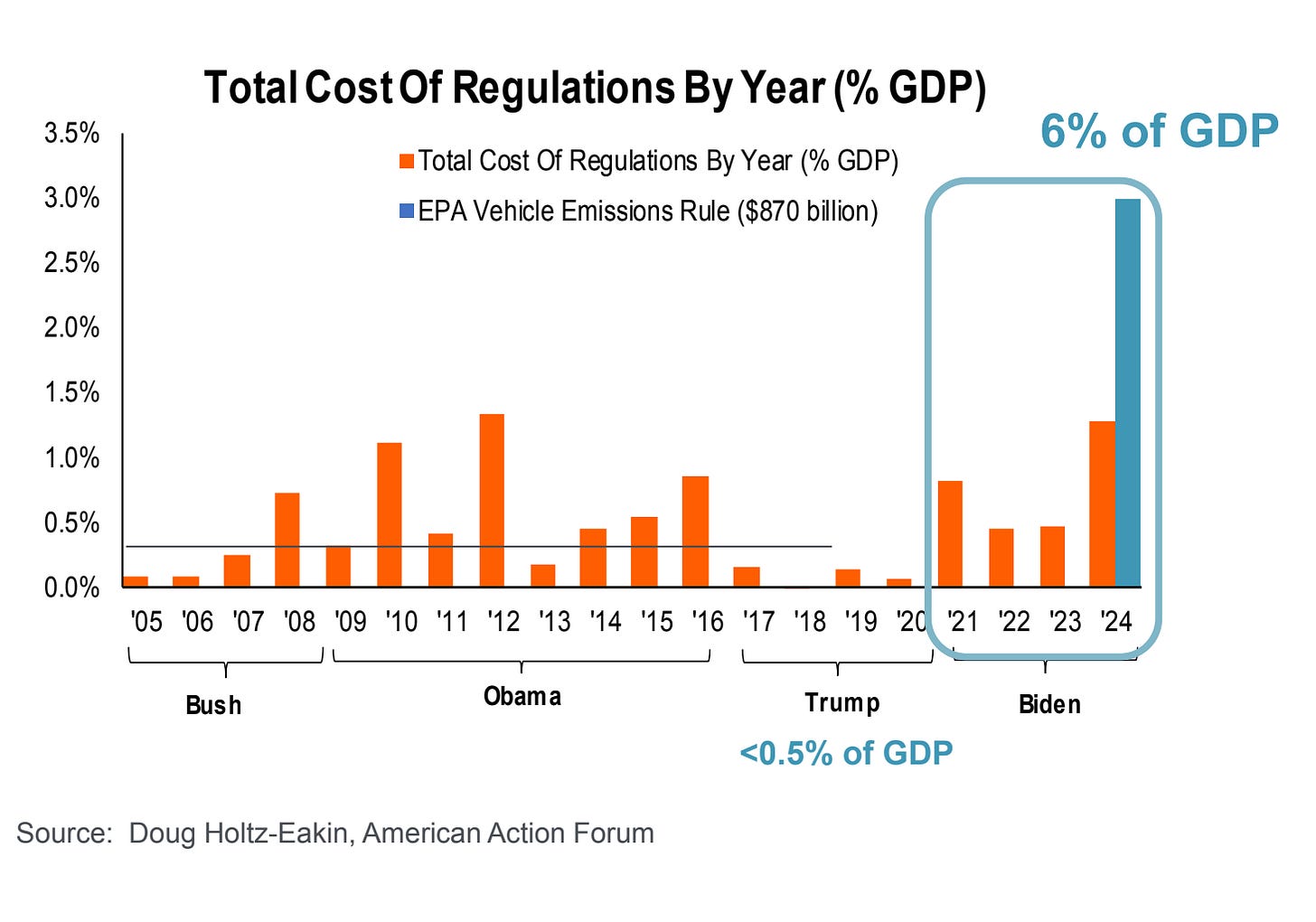

We have repeatedly written about outsized US government spending as the primary driver of the above-trend GDP under Biden. Some expect this to continue or increase under Trump. That is in direct opposition to the newly created Department of Government Efficiencey (DOGE), Elon Musk and Vivek Ramaswamy’s mandate. So, are we removing government waste or continuing/increasing the multi-decade path? Clear as mud.

Immigration Policy

If exceptionally large immigration is generally accepted as a driver of GDP/growth plus inflation in housing, food, etc., then what does the end of mass immigration (net deportation, in fact) mean?

Clear as mud.

Deregulation

Deregulation is clearly pro-growth. That said, history has shown deregulation to be unequivocally deflationary. That opposes inflationary impulses that the market seems to expect with the Trump administration.

Clear as mud.

Artificial Intelligence (AI)

AI's impact and true use cases are mostly left to the imagination at this point. No one knows the precise implications of AI. One can argue about efficiency gains for corporate profitability, potential job losses, etc. (all sound like deflationary impulses). All we can say for certain is the AI boom has led to massive capital expenditures (CapEx) by large corporations thus far.

Even AI itself is under attack from competition and deflationary impulses. The comedy of self-cannibalization could be a glimpse into what AI will mean at a high level. Nothing about that is inflationary.

ALIBABA'S CLOUD UNIT: ANNOUNCES PRICE CUTS OF UP TO 85% ON LARGE-LANGUAGE MODELS

US Interest Rates

Unacceptable inflation readings leading to inflationary impulses…that would have to overwhelm the deflationary impulses discussed above, right?

Continued massive government deficit spending?

Or was December’s move in rates just year-end liquidations and balance sheet constraints?

Not to beat a dead horse, but when one can’t examine the market and even define the narrative driving the price action, the picture becomes clear as mud.

Foreign Exchange (FX)

US Dollar FX could imply similar stories to US Fixed Income but has an added wrinkle. FX, by definition, is relative to another currency.

Is the US particularly strong?

Is every other currency that weak?

The result of both is a broadly stronger USD. But, the market outcomes of those two scenarios are very different.

Strongest Q4 for USD Since 2016

Quantitative Tightening (QT)

On December 27th 2024 Andreas Steno Larsen commented, “with SOFR spiking to 4.53% yesterday and the SOFR-Fed Funds spiking to approx 20bps, we may end up surpassing the quarter-turn stress in September/October. The NY Fed Desk has obviously added repo auctions to ensure that the situation remains under control, but it goes to show that we are only a few hundred billion from reaching more permanently critical liquidity levels in the US, as this is a window-dressing turn spike caused by inflows to the ON RRP.”

It is impossible to know the true “excess reserves” as they involve a human behavioral component at the balance sheet/risk management level. But given evidence like the aforementioned SOFR behavior, we are getting close to the end of the road for QT. We do not think it is a bold statement to say that funding rate spikes in conjunctions with USD FX spikes are standard indicators of tightening USD liquidity. Between the lack of draw down in the TGA, Powell speaking in an incoherent hawkish manner, plus QT ongoing, it is not a big leap to infer USD liquidity is getting tight. In this case, it is more like vodka than mud.

China

We have written extensively on the liquidity trap in China. They have added some support to their stock market. Thus far, they have done relatively little on the fiscal side, which, as Japan clearly showed in the past, is the only way to end the negative feedback cycle and move into a pro-cyclical growth reinforcing stance. Is 2025 more words and limited actions by China like 2024?

Clear as mud.

CHINA'S 10-YEAR GOVERNMENT BOND YIELD DROPS 3 BASIS POINTS TO 1.64%, HITTING A NEW HISTORICAL LOW.

A Silver Lining?

We believe that growth will hold up while inflation stays tame (if not drift to the target of the next year or more). In that scenario, real rates can easily come down to 1.5% (or lower), which enables another 100bps of cuts without too much imagination. As this comes to fruition, money will again flow from wealth preservation assets to wealth creation assets.

All one needs to know about that is the following:

*US MONEY-MARKET FUND ASSETS HIT RECORD $6.85T AS OF DEC. 31

Conclusion

There is incredible monetary policy uncertainty (US and foreign). Given a new administration, that is not surprising.

Will DOGE be effective?

How much deregulation gets done?

What will the administration’s position be on running continued large deficits?

Does the efficiency boom continue?

What will China do?

That said, given our view on the economic data, we are broadly constructive assets over the course of the year.

We think front-end fixed income is a buy on any weakness.

If history is any guide, the USD is about to peak cyclically, in line with our interest rate view.

We think Bitcoin (assuming the Trump rhetoric is delivered) is a clean buy over the course of the year. We could envision some early-year weakness for technical reasons. But any dip is a buy to hold for much higher levels later this year.

Analysts suggest the Federal Reserve can’t stop Donald Trump from creating a US Bitcoin Reserve via an executive order using the Treasury’s Exchange Stabilization Fund. Polymarket is pricing approximately a 25% chance of an SBR being implemented relatively quickly. If this were to move to 100% (i.e., it happens with a reasonable time to implementation), then we believe Bitcoin’s price moves up to $150,000 and then swiftly to $250,000 in 2025 with little effort.

VC

A Strong 2024 Closing

2024 began with a wave of optimism. Unfortunately, that optimism was not reflected as well as we all hoped. Signs of life in the CryptoVC space came in February but otherwise stabilized through Q3. The fourth quarter, however, marked a decisive turnaround culminating in December’s impressive $3.08B raised across the highest number of fundraising rounds for the year. This sharp Q4 resurgence underscores renewed investor confidence, driven by larger deal volumes and a more favorable market outlook. The alignment between the number of rounds and total capital raised highlights the growing momentum in the crypto space as 2024 came to a close.

Crypto Venture’s Outlook for 2025

The crypto Venture capital predictions for 2025 are coming in hot. Top forecasts highlight a decisive shift toward user-facing applications, stablecoin adoption as a tool to lower business transaction costs, and significant advancements in infrastructure scalability. While venture capital has historically focused heavily on infrastructure and decentralized finance (DeFi), this trend is gradually shifting. Foundational technologies like zero-knowledge proofs (ZK) and modular blockchains still attract considerable investment, but the recognition of over-allocation to these sectors is driving a recalibration toward user-centric solutions. For example, VanEck’s predictions highlight stablecoins’ growing role in global commerce, with daily settlement volumes projected to reach $300 billion by the end of 2025.

Meanwhile, Coinbase reports that stablecoins settled an impressive $27.1 trillion in transactions through November 2024, underlining their utility in global capital flows and commerce.

Firms like Andreessen Horowitz (a16z) forecast advancements in AI-managed wallets and decentralized autonomous chatbots, further emphasizing the importance of usability and engagement in the crypto landscape. These trends underscore the industry’s maturation and its focus on solving real-world problems through innovation.

Crypto is now at a pivotal moment. Venture capital in the space is poised to shift focus, with trends pointing toward increased emphasis on user-facing applications, stablecoin adoption, and improved user experiences. Here are the key themes we will be watching in the coming year.

The first major area of focus is the rise of user-facing applications. While the crypto ecosystem has made significant strides in building robust protocols and infrastructure, user adoption remains a challenge. As we have noted in previous updates, complex interfaces and fragmented ecosystems have created barriers for new users. To bridge this gap, venture capital will likely prioritize projects that simplify onboarding processes and offer intuitive user interfaces. Applications with clear value propositions, catering to both retail and institutional audiences, will take center stage. Examples include wallets with seamless fiat-to-crypto transitions, decentralized finance (DeFi) platforms featuring intuitive dashboards, and NFT marketplaces integrating social and gaming features. These innovations will be instrumental in driving mass adoption.

Another pressing topic for 2025 is the role of stablecoins in reducing transaction costs. Many businesses, especially in e-commerce and cross-border payments, grapple with high fees imposed by traditional financial systems. Stablecoins provide a compelling alternative, offering lower costs, faster settlements, and greater transparency. Businesses are expected to increasingly adopt stablecoins for operational efficiency and to mitigate currency volatility. Such a trend may attract significant venture investment into solutions like payment gateways and treasury management tools, further integrating stablecoins into the global financial landscape. The Coinbase report also highlights how stablecoins are enabling compliance-friendly cross-border payments, which are steadily becoming important for businesses operating internationally.

In parallel, key performance indicators (KPIs) will shift. The crypto industry’s focus will transition from speculative token trading and Total Value Locked (TVL) to more adoption-driven metrics such as daily active users (DAUs), transaction volumes, and user retention. Projects that align their growth strategies with user-centric KPIs will gain a competitive edge. DAOs, gaming platforms, and cross-chain protocols that incorporate loyalty rewards and community incentives will demonstrate the power of these new benchmarks.

Cross-border business enablement represents another promising frontier. Crypto ventures have an unparalleled ability to address inefficiencies in areas like remittances, supply chain transparency, and international payroll. Regulatory clarity, anticipated in major jurisdictions by 2025, will enable compliant and scalable solutions. Startups focusing on regulatory-friendly stablecoin payment systems and identity verification tools can help businesses navigate multiple jurisdictions, unlocking new opportunities for global operations. Additionally, the adoption of decentralized identity systems streamlines compliance and Know Your Customer (KYC) processes, further enhancing cross-border efficiency.

Meanwhile, the importance of infrastructure upgrades for scalability and security cannot be overstated. Despite ongoing advancements, issues such as network congestion and security vulnerabilities continue to hinder mainstream adoption. To address these challenges, investments will continue to flow into Layer-2 solutions, zero-knowledge proofs, and modular blockchain architectures. These innovations will enhance throughput, ensuring that applications can scale seamlessly while maintaining decentralization and security. As infrastructure strengthens, users will enjoy frictionless experiences, paving the way for broader adoption. Moreover, the tokenization of real-world assets (RWAs) is poised to transform financial markets, with projections indicating growth to $2-30 trillion in the next five years, presenting another lucrative opportunity for venture investment.

Alongside technical improvements, cultural and behavioral shifts will play a pivotal role in shaping the industry. Cryptocurrency markets' speculative nature will gradually give way to applications that deliver tangible everyday value. Education will be critical in this transition. By highlighting crypto's practical benefits—such as financial inclusion, cost savings, and global accessibility—the industry can foster greater trust and engagement among users.

2025 holds immense promise for the crypto industry. Focusing on user-facing applications, stablecoin adoption, and infrastructure development underscores the sector’s commitment to solving real-world problems. Crypto ventures have a unique opportunity to onboard the next billion users by prioritizing simplicity, accessibility, and utility. For venture capitalists, the coming year represents a chance to back builders who deliver scalable, secure, and impactful solutions—reshaping the narrative for crypto’s mainstream breakthrough.

Bitcoin DeFi

The Evolving Bitcoin DeFi Ecosystem

Ordinals, Runes, and BRC20 continue to drive growth in the Bitcoin ecosystem, totaling $2.6B in market value. Fractal Bitcoin (Asymmetric PortCo), has processed over 1 billion transactions and now secures 60% of Bitcoin’s hashrate, establishing itself as a core scaling platform for Bitcoin assets.

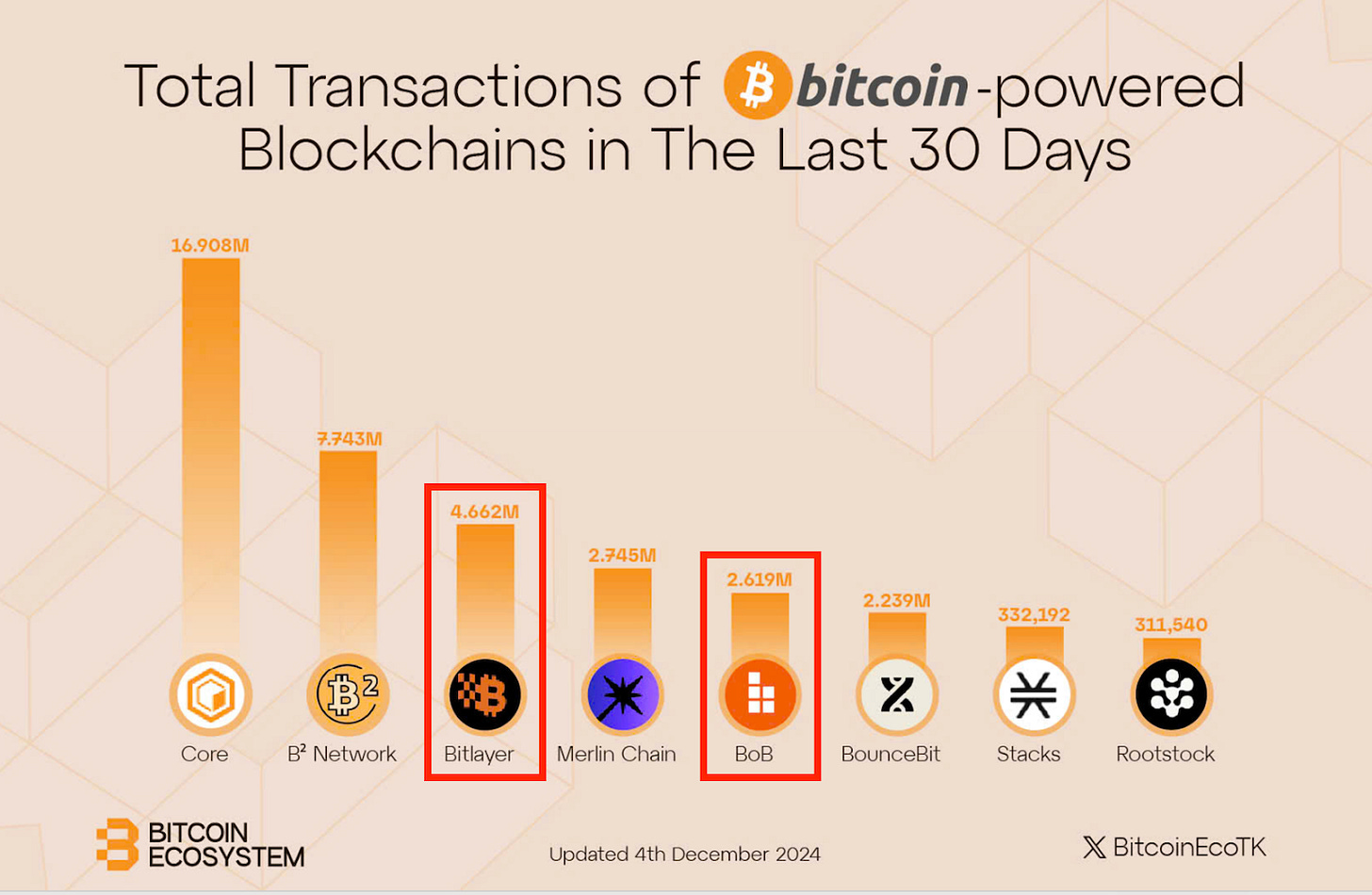

Bitcoin L2s are growing rapidly in TVL, with Asymmetric’s BitLayer, BoB, and Mezo leading the charge. BitLayer and BoB have processed millions of transactions, and several Token Generation Events (TGEs) in Q1 2025 are expected to boost this ecosystem further.

Babylon Labs remains a leader in Bitcoin staking with over 58,000 BTC staked (representing 0.3% of all Bitcoin). Its partnership with SatLayer (Asymmetric PortCo) facilitates restaking across multiple blockchains, with BTCfi seeing adoption in protocols like Pendle and Morpho, generating yield and liquidity for users.

Bitcoin-native dApps like Liquidium (Asymmetric PortCo), which leverages Ordinals and Runes as collateral for lending, are gaining traction. Liquidium has seen sustained volumes, with fungible tokens outpacing NFTs in loan activity for the second consecutive month.

December highlighted Bitcoin’s ongoing evolution towards becoming feature-equivalent to other blockchains like Ethereum.

Metaprotocols (Ordinals, Runes, BRC-20s)

Ordinals (Bitcoin NFTs), Runes, and BRC20 (both Bitcoin Token standards) are currently the most widely adopted metaprotocols in the Bitcoin ecosystem. Collectively, they represent a total market value of $2.6B. This has led teams such as Fractal Bitcoin (Asymmetric PortCo) to build native scaling solutions enabling additional expressivity and scalability of Bitcoin and its growing assets.

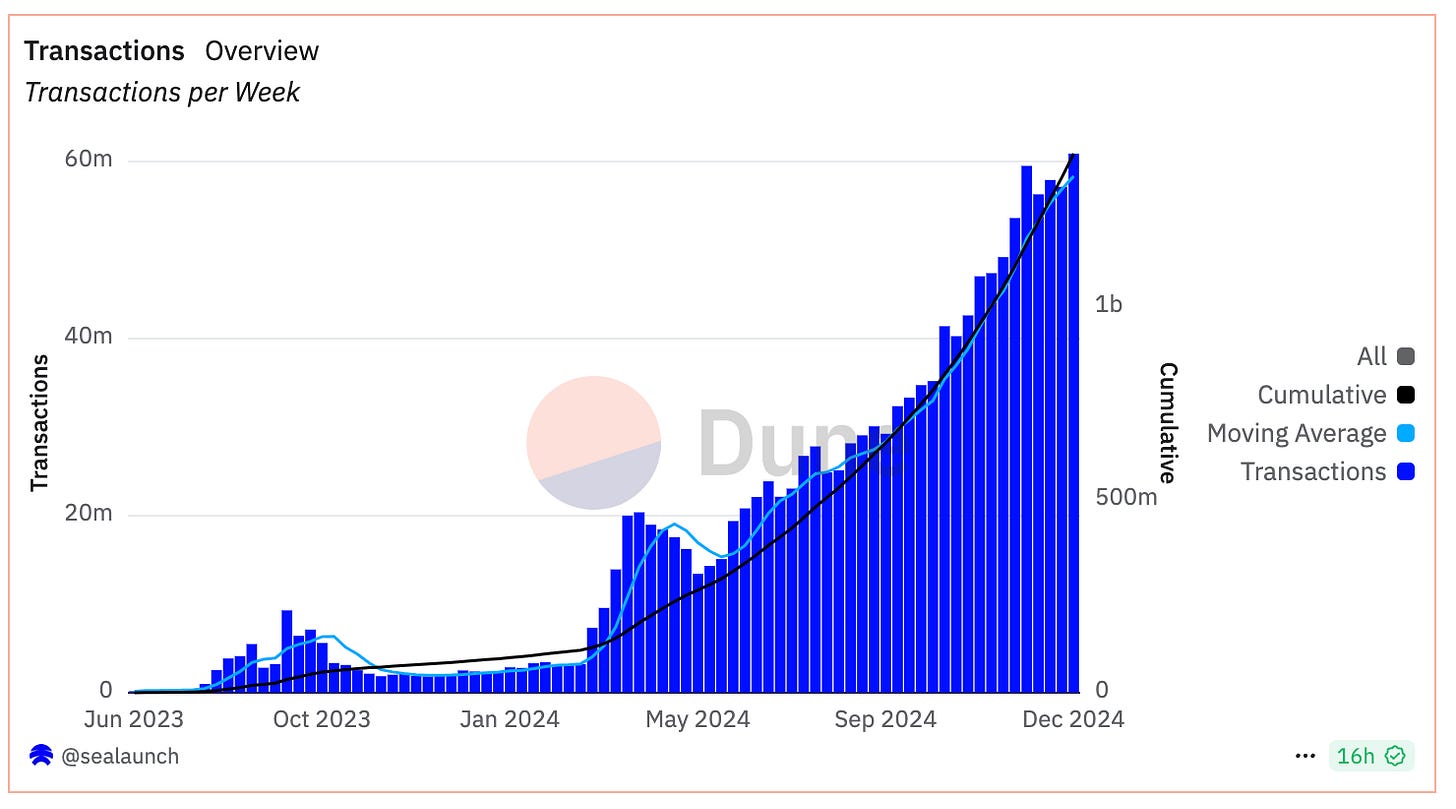

Since the mainnet launch three months ago, the platform has rapidly emerged as one of the leading forces within the Bitcoin ecosystem. Achieving impressive milestones, Fractal has solidified its position as a key player in Bitcoin’s expanding landscape:

60% of Bitcoin's hashrate is now merged-mining Fractal, underscoring its critical role in securing the network.

Fractal has processed over 1 billion transactions, a testament to its scalability and robustness.

The platform has amassed 186 million unique addresses, indicating strong adoption and interest from the Bitcoin community.

As the ecosystem continues to grow, an increasing number of projects are building on or integrating with Fractal, positioning it as a foundational layer for the future of Bitcoin. Among the most prominent assets on Fractal are: CAT20, BRC20, and Runes.

With its increasing adoption and expanding ecosystem, Fractal Bitcoin continues to be a powerful force driving innovation on the Bitcoin blockchain. By providing a seamless platform for developers and users alike, Fractal is unlocking new possibilities for tokenization, decentralized finance, while maintaining the security and immutability of the base layer.

Source: BTCEcosystem

Bitcoin L2s

Bitcoin L2s are showing strong growth in TVL, demonstrating the demand for DeFi on L2s as liquidity hubs. Asymmetric’s portcos continue to lead in TVL. Both BitLayer ($520M) and BoB ($256M) have both had their mainnet launches and while still on testnet, Mezo ($285M) is also a dominant player in TVL within the L2 category.

Source: BTCEcosystem

Transaction volumes on L2s have surged in 2024. Notably, Bitlayer (Asymmetric PortCo) has processed 4.6 million transactions, while BoB (Asymmetric PortCo), has seen 2.6 million transactions. This growth is driven by the expanding DeFi ecosystem on these networks. As more apps launch on Bitcoin L2s, these platforms are becoming vital to Bitcoin’s scalability. The rise in transaction volumes on Bitlayer and BOB highlights their critical role in the broader Bitcoin L2 ecosystem.

Source: BTCEcosystem

As we move into Q1 2025, the L2 ecosystem is poised for several high-profile Token Generation Events (TGEs) expected to bring increased awareness and interest to these solutions. These TGEs are anticipated to draw attention to the rapidly expanding Bitcoin L2 space, showcasing their innovation.

Bitcoin Staking

Babylon Labs continues to be a leader in Bitcoin staking, with over 58,000 BTC staked, representing $5.4B in Total Value Locked (TVL). The new inflows are a result of the opening of cap-3, which, unlike prior caps, is a time-based cap rather than a Bitcoin-based cap.

Asymmetric is an investor in SatLayer, Babylon’s exclusive restaking partner, enabling users to use their Bitcoin LSTs (currently staked within Babylon) to secure critical pieces of infrastructure such as app chains, oracles, and bridges. SatLayer has $31M in LSTs restaked across three blockchains: Ethereum, BNB Smart Chain, and BitLayer (Asymmetric PortCo). More recently, they announced that support for the Sui Network is coming soon, which will enable BTCfi on the chain (link).

Source: DefiLlama

Additionally, BTCfi has been adopted by protocols such as Pendle, which is tokenizing the principal token, the LST, and the yield token, which can then be sold to market participants. Users are trading future token yield directly for immediate cash flow. Of the $4.8B in staked assets within Pendle, $585M is related to BTCfi LSTs, or 12.1%. Users can generate up to 10.5% in fixed yield on their deposits (1.1% from swap fees and interest, with the remainder in token incentives).

Another DeFi protocol that has adopted BTCfi is Morpho, a borrow-lend marketplace that optimizes yields for both lenders and borrowers through a peer-to-peer matching mechanism. While not directly adopting LSTs, Morpho enables the staking of Bitcoin wrappers, which constitute $138M of the $4.9B in deposits, or 2.8%. Users can generate up to 7.1% in yield on their deposits (1.2% from borrow fees, with the remainder in token incentives).

Yield-bearing opportunities for Bitcoin are also starting to emerge on Stacks, a Bitcoin L2, through the recent launch of sBTC (Stacks native Bitcoin wrapper), with borrow-lend platforms such as Zest offering up to 6.1% yield, primarily provided in token incentives to help bootstrap activity.

dApps

The L1 ecosystem continues to evolve with the growing prominence of Ordinals and Runes, catalyzing the development of innovative dApps directly on the Bitcoin blockchain. Asymmetric is an investor in Liquidium (lending/borrowing dApp) and SatFlow (marketplace/DEX).

Although we have not seen the peak volumes of March 2024, when Ordinals assets reached record trading volumes and higher values, growth in this category remains robust. Weekly volumes for both Bitcoin NFTs and Bitcoin tokens have sustained momentum into December, with fungibles leading the way in loan volume for the second month in a row. This emerging sector presents substantial opportunities for teams with strong first-mover advantages and effective distribution strategies, positioning them for continued innovation and expansion in Bitcoin-native DeFi

Source: Dune

Law & Regulations

The IRS Crypto Rule: What You Need to Know About the Delay and Its Impact

The IRS’s crypto reporting rule and the introduction of Form 1099-DA stirred significant debate. Designed to increase transparency and compliance, the rule quickly became controversial due to its broad scope, particularly its focus on DeFi and unhosted wallets. Now delayed until 2026, the rule raises questions about the balance between regulation and innovation. Let’s breakdown what the rule aimed to achieve, why it was delayed, and how its potential overreach could have impacted the crypto ecosystem.

What Is the Rule?

Under the proposed regulation, anyone classified as a “broker” would need to report crypto transactions to the IRS and users via Form 1099-DA. This form captures essential details like:

When the asset was acquired (acquisition date).

How much it cost (cost basis).

When it was sold or swapped (disposition date).

How much was earned (proceeds).

While this aligns with how stockbrokers report trades, applying the same framework to the crypto space—particularly DeFi—created major challenges. For example, if you use a DeFi lending platform like Aave or Compound, there’s no central entity managing transactions. The platform operates entirely through smart contracts, which don’t know your name, let alone how much ETH you’ve deposited. Asking a DeFi protocol to file a tax form for you would be like asking a vending machine to issue you a receipt and send a copy to the IRS.

The rule also sought to classify wallet providers as brokers. So, if you used MetaMask to swap ETH for DAI on Uniswap, the IRS might expect MetaMask to report your trade. But MetaMask doesn’t have access to your personal information; it’s just a tool to interact with the blockchain. This would force wallet providers to collect data they’ve intentionally avoided, compromising user privacy and trust.

DeFi and the Practical Realities

The broad definition of “broker” posed a serious problem for DeFi platforms, as well as self-custody wallets. Let’s say you transferred Bitcoin from Coinbase to your Ledger hardware wallet. This kind of self-transfer isn’t a taxable event—it’s just you moving your assets. But under the proposed rule, Coinbase might need to track and report it as a transaction. For Ledger, compliance would be impossible without compromising its core principle: putting control entirely in the hands of the user.

Now imagine using Uniswap to swap tokens. You’re not signing up for an account or providing any personal information. You connect your wallet, make the trade, and the blockchain records the transaction. But the IRS’s rule could have required Uniswap—or worse, your wallet provider—to report details of your trade. It’s not just impractical; it fundamentally misunderstands how DeFi operates.

This overreach didn’t stop at wallets or protocols. Concerns were raised that even smart contract developers—people who write code for decentralized platforms—might fall under the definition of a broker. That’s like holding a car manufacturer responsible for traffic violations committed by drivers.

Why the Rule Was Delayed

Facing significant pushback from the crypto industry, lawmakers, and even some regulators, the IRS delayed implementation until 2026. The ambiguity around who qualifies as a broker was a key issue. While centralized exchanges like Coinbase might reasonably fit the bill, the inclusion of DeFi protocols, wallet providers, and developers created logistical and ethical headaches.

The delay also acknowledges the impracticality of enforcement. DeFi platforms don’t have the tools—or the centralized authority—needed to collect and report user data. Instead of fostering compliance, the rule risked driving innovation offshore, as platforms and developers sought to escape the burden of overly broad regulations.

What the Delay Means

For now, DeFi platforms and wallet providers can breathe a sigh of relief. But the delay doesn’t mean the rule is gone—it’s just postponed. Here’s what this means for different players:

For Developers and Platforms: They have more time to advocate for clearer rules that don’t lump decentralized protocols into the same category as centralized exchanges. This could lead to more balanced regulations that encourage innovation rather than stifle it.

For Users: You’re still responsible for tracking your own transactions, especially if you’re using DeFi. Tools like crypto tax software remain essential, as Form 1099-DA won’t cover most decentralized activity, even when it’s eventually implemented.

For Regulators: The delay provides an opportunity to refine the rule’s scope. A narrower definition of “broker” could ensure that reporting requirements apply only to centralized entities that actually have access to user data.

Final Thoughts

The IRS crypto rule isn’t just about improving tax compliance—it is a sweeping measure that risked undermining the core principles of DeFi and self-custody. The delay is a chance to get it right.

Team Updates

Watch Joe on Fox Business: “Bitcoin is a ‘digital representation’ of gold: Joe McCann”

Joe was interviewed by Jenn Sanasie from Coindesk MarketsDaily - “Why Wall Street is Missing the Cultural Wave”

Catch Joe on Money Untold in “Don't Let This Happen To You During This January Bitcoin Dip... Joe McCann Reveals Insider INF”

Joe was featured on Yahoo! Finance again “Bitcoin prices could re-ignite in 2025 from DeFi uses, Trump admin”

All Market Updates

Please let us know if you have any questions or comments.

As always, thank you for your support.

– Asymmetric

love this. thank you! 🙏