Asymmetric Market Update™️ #22

Our thoughts on what is relevant in Crypto and Markets...

Crypto

In last month’s Asymmetric Market Update™️, we shared our perspective on how crypto was experiencing an episode of capitulation across the board, from market mechanics to sentiment and beyond. So far, it appears that the capitulative bottom was, in fact, in August as September, a historically negative month for Bitcoin and crypto overall, churned out a positive return, and many altcoins bounced from their recently depressed levels.

We forecasted back in early July that if the Federal Reserve didn’t cut 25 basis points (bps) in July, it would be forced to cut 50 bps in September.

The Fed did just that.

As the macro picture continues to play out as we envisaged, crypto values have not.

Q3 2024 Scores

BTC +1%

ETH -24.21%

SOL +4.2%

TOTAL -3.26%

TOTAL2 -8.76% (Crypto Total Market Cap Excluding BTC)

TOTAL3

OTHERS -4.06% (Crypto Total Market Cap Excluding Top 10)

Suffice it to say that Q3 was not what crypto natives expected, given the macro backdrop and during a quarter where the Ethereum spot ETF was approved and launched.

Even more frustrating for the “digital gold” (Bitcoin) advocates is that actual Gold has been ripping since Bitcoin’s new all-time-high was printed on March 13, 2024, and Gold is even outperforming the S&P 500 year-to-date (YTD).

YTD Scores

Gold +28.67%

S&P 500 +20.48%

BTC +46.72%

ETH +6.61%

SOL +40.88%

TOTAL +31.26%

TOTAL2 +15.89% (Crypto Total Market Cap Excluding BTC)

TOTAL3

OTHERS -0.25% (Crypto Total Market Cap Excluding Top 10)

So why hasn’t crypto kept up with Gold recently?

From our perspective, it has less to do now with the coordinated central bank cutting cycles we are set to witness over the coming months and more to do with one country.

China 🇨🇳.

China?

Yes, China.

China is the final boss for new crypto all-time highs.

Xi’s Conundrum

Since COVID, China has had a domestic demand problem, exacerbated by the United States' dominant economic machine and unapologetic monetary and fiscal policies.

“Our currency [US Dollar], but your problem,” were the words uttered by Treasury Secretary John Connally in 1971, referring to how a strong US dollar is good for America as it helps keep inflation low, attract foreign investment, and maintains the US dollar’s hegemony as the global reserve currency but also wreaks havoc on the rest of the world. When the U.S. dollar strengthens, inflation increases in other countries (imports from the U.S. are more expensive, especially commodities and food). It also makes it more difficult to service any USD-denominated debt when those receipts are in the local currency.

Moreover, a stronger USD has a litany of negative effects on emerging economies, including declines in output, investment, government spending, and consumption.

Connally’s words are still true today, and China has not been able to intervene enough in the foreign exchange markets to stop Team America.

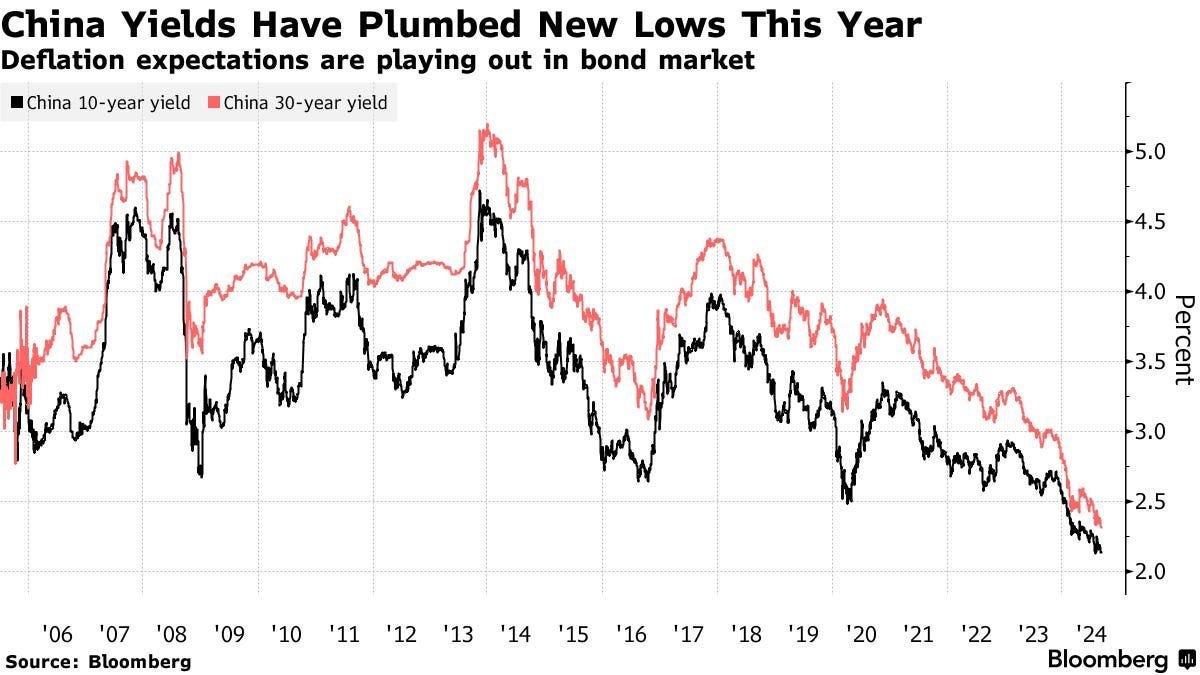

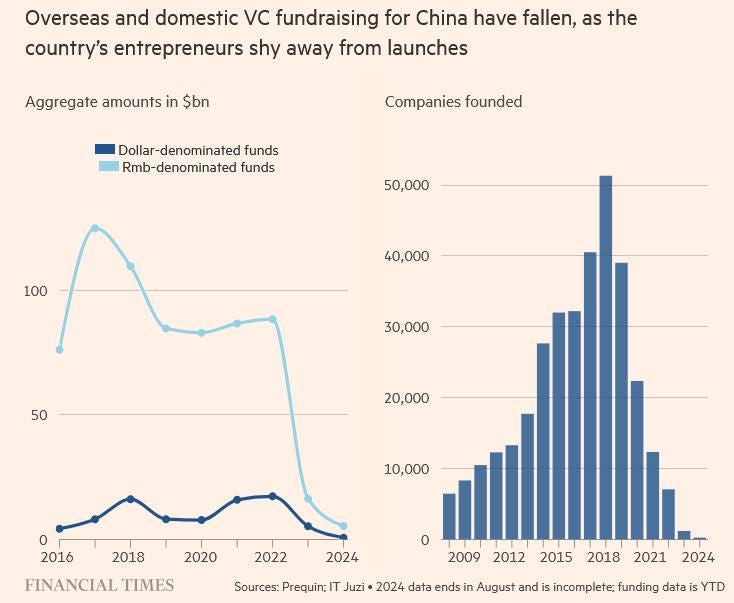

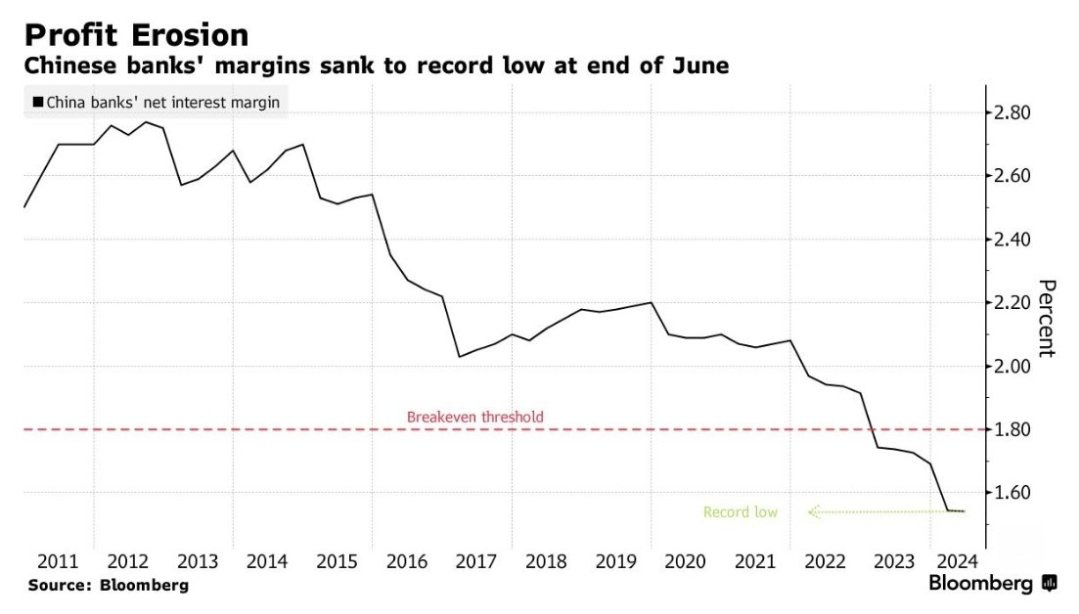

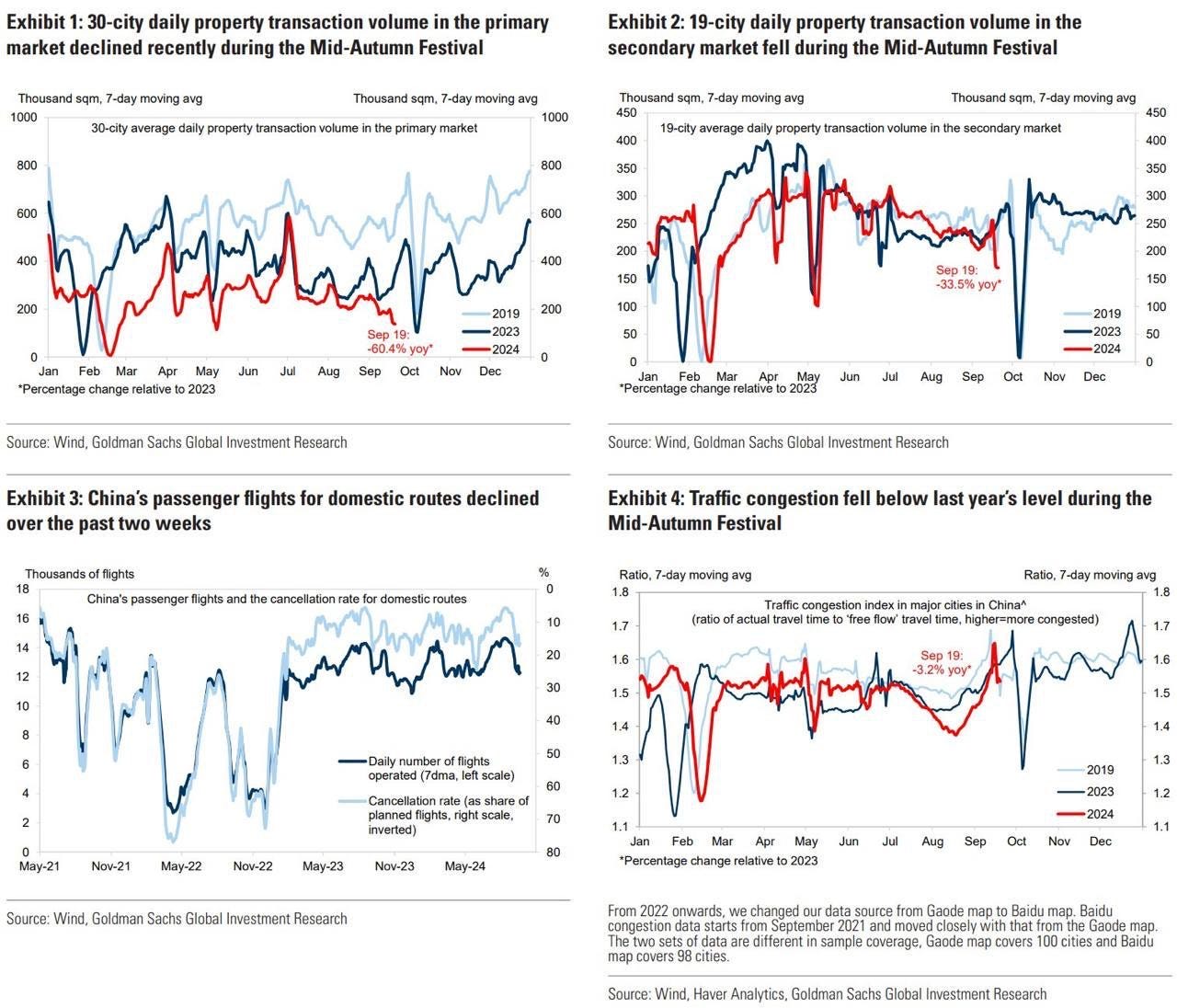

Need some proof? Have a look at some of these eye-watering charts.

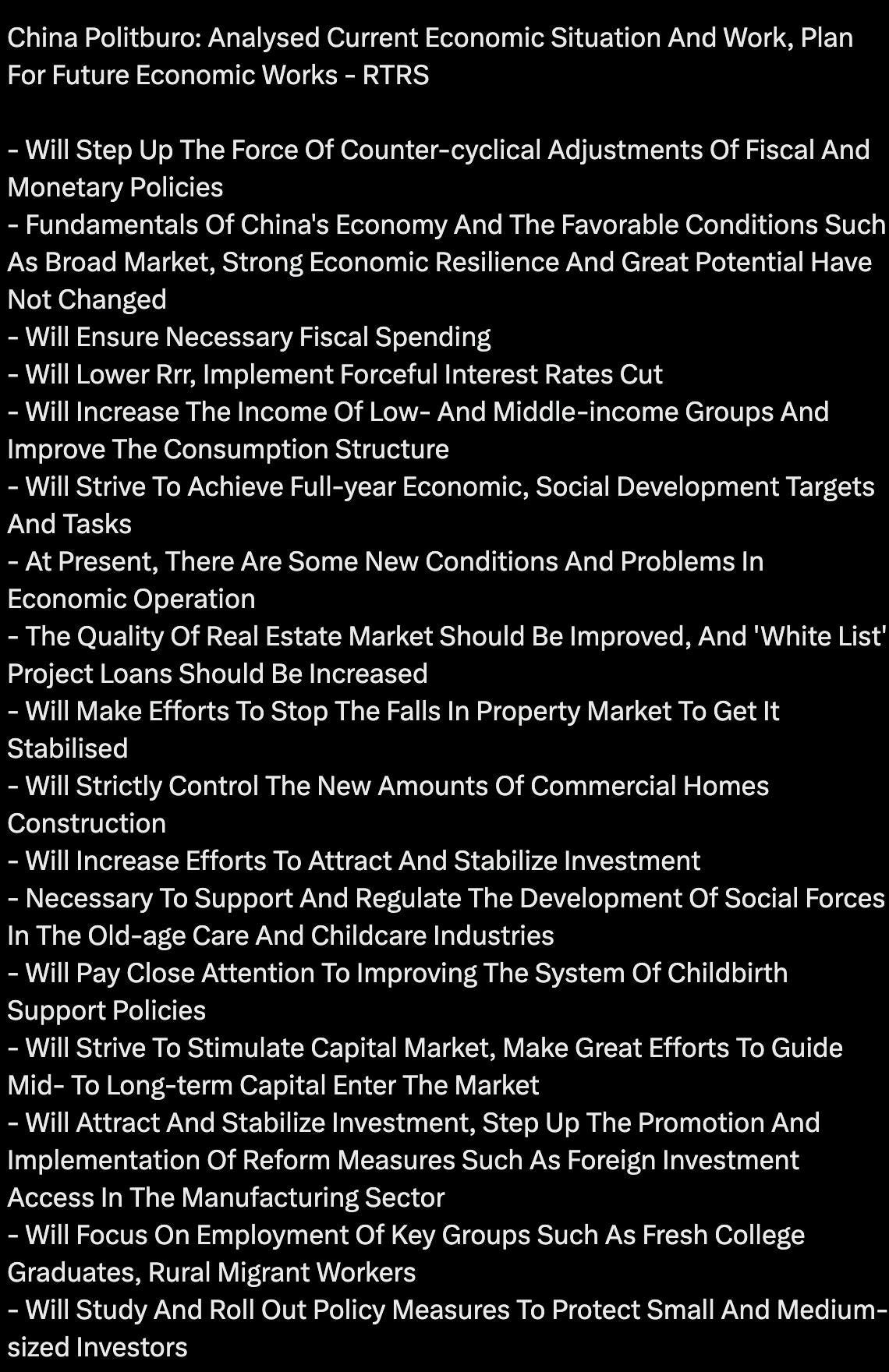

And then, on September 24th, the cavalry arrived. The PBoC enacted several stimulative measures totaling about 2 trillion Yuan, and the Politburo laid out a fairly comprehensive economic plan.

Chinese and Hong Kong stocks and indices ripped higher to levels unseen in some measures in 10 years.

Even infamous U.S. hedge fund managers like David Tepper were on television clamoring to “buy everything” in China.

And Chinese citizens are not going to miss the “party” either. People are waiting in line to open brokerage accounts in China.

Unfortunately, rising stock prices for Chinese-listed companies do not mean the economy will recover because the Hang Seng Index is up. Recent attempts at propping up the Chinese stock market have ultimately failed.

Rising stock prices are fine and all, but they won’t materially affect the domestic demand issue, the risks to their export-driven economy with their massive inventories, and the risk of a Trump win, which could lead to heftier tariffs.

The Chinese government must stimulate the economy with a large fiscal package and full-on quantitative easing (QE).

Recently, Goldman Sachs suggested that fiscal stimulus isn’t enough to catalyze demand and stimulate the economy in the long term; China must also do QE.

The biggest drag on China’s GDP is its cratering real estate market, which is why it must enact QE so that “riskier borrowers” have access to credit to stimulate domestic demand for housing. Failure to enact QE meaningfully will only create a bigger issue next year.

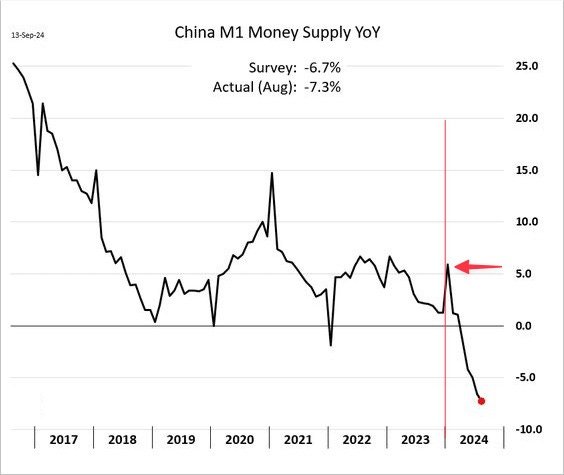

As it relates to crypto, have a look at the Chinese M1 money supply chart.

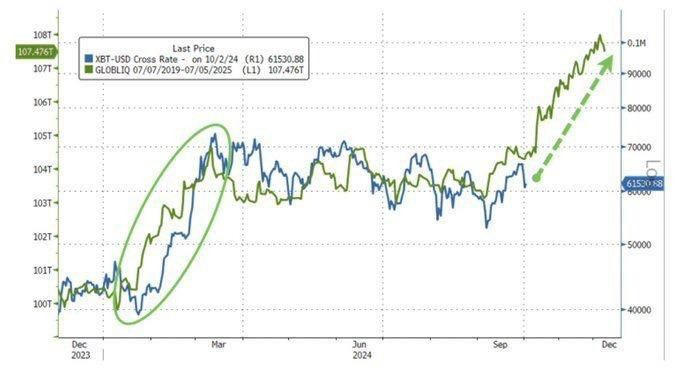

You’ll notice that M1 ticked up dramatically at the beginning of the year…right around when Bitcoin took off. Of course, the Bitcoin ETF news brought a good bit of flow into the market, but let’s be clear: Bitcoin has done next to nothing in terms of price since China’s M1 reversed and has since turned negative for the first time in years.

When, not if, China loads up the money-printing “bazooka,” be ready for shock and awe for Bitcoin (and crypto more broadly) should digitally reprice given the explosive impact of such a dramatic expansion of China’s money supply.

Macro

Mark-to-Market and Mark-to-Imagination

Let’s take a moment to recap some of our highest conviction macro views from recent months.

Shanghai Accord 2.0 - We wrote an entire piece discussing the Shanghai Accord 1.0 (and Janet Yellen’s fingerprints all over it) and the extreme similarities between that period and the current period. The take-home points in summary:

USDJPY needed to stop going higher as it was pressuring Asia EMFX with particular pressure on CNY of interest).

US real rates had to come lower to assist with Asia EMFX (USD weaker).

US real rate reduction would then enable China to enact a stimulus (financial, fiscal, etc.) of its own without the extreme fear of excessive CNY devaluation.

The FOMC would cut 25bps in July or 50bps in September. We got 50bps in September. This is important because it sets the tone and shows the Fed’s mindset. They turned the corner and are normalizing real rates (cutting rates) even with a strong economy.

Given Janet Yellen’s partisan disposition (see our May newsletter where we highlight and site her anti-trump rhetoric), she would further assist in this “choreography” by deploying the TGA in an impactful and timely way to keep yields contained and liquidity increasing into the election.

All of these things happened. So, either we have a grasp of the drivers and reaction functions of the global financial power structure, or we are just lucky over and over again. Understanding the choreography is very valuable at this point in the cycle and heading into a consequential presidential election.

The Next FOMC is after the election. So, though there will be no monetary policy changes from the Fed before the election, the data will undoubtedly drive the market’s perception and market pricing for the FOMC after the election. Discussing the data and the Fed’s reaction function in a vacuum (ignoring the presidential race winner and divergent expectations of those two outcomes) is a cleaner way to start thinking about monetary policy implications and outcomes. Let’s look at some data.

US Employment and Inflation Data

The most recent NFP beat expectations, with 254k jobs created (and 77k jobs revised up from the previous two months).

The most recent Unemployment Rate dropped from 4.2% to 4.1% (deactivating the Sahm rule).

US September reported inflation was 0.2% MoM and 2.5% YoY.

US GDP reported on September 25th was 3% annualized QoQ.

At a high level, this paints a very rosy picture of the US economy. We have discussed on multiple occasions the government largesse adding considerable tailwinds to the economy, but that is neither here nor there for now. Given the state of the public and private sector, it is what it is.

The Rest of the World…

Most recent Inflation data released as of the end of September:

Canada CPI MoM -0.2%

Canada CPI YoY 2.0%

EU CPI MoM 0.1%

EU CPI YoY 2.2%

Germany CPI MoM -0.1%

Germany CPI YoY 1.9%

China CPI MoM 0.4%

China CPI YoY 0.6%

Most recent Inflation data released since October 1st, 2024:

EU CPI MoM -0.1%

EU CPI YoY 1.8%

Switzerland CPI MoM -0.3%

Switzerland CPI YoY 0.8%

As you can see, inflation in many major economies is low and trending lower (not dissimilar to the evolution of US inflation). So, what is the implication of the aforementioned?

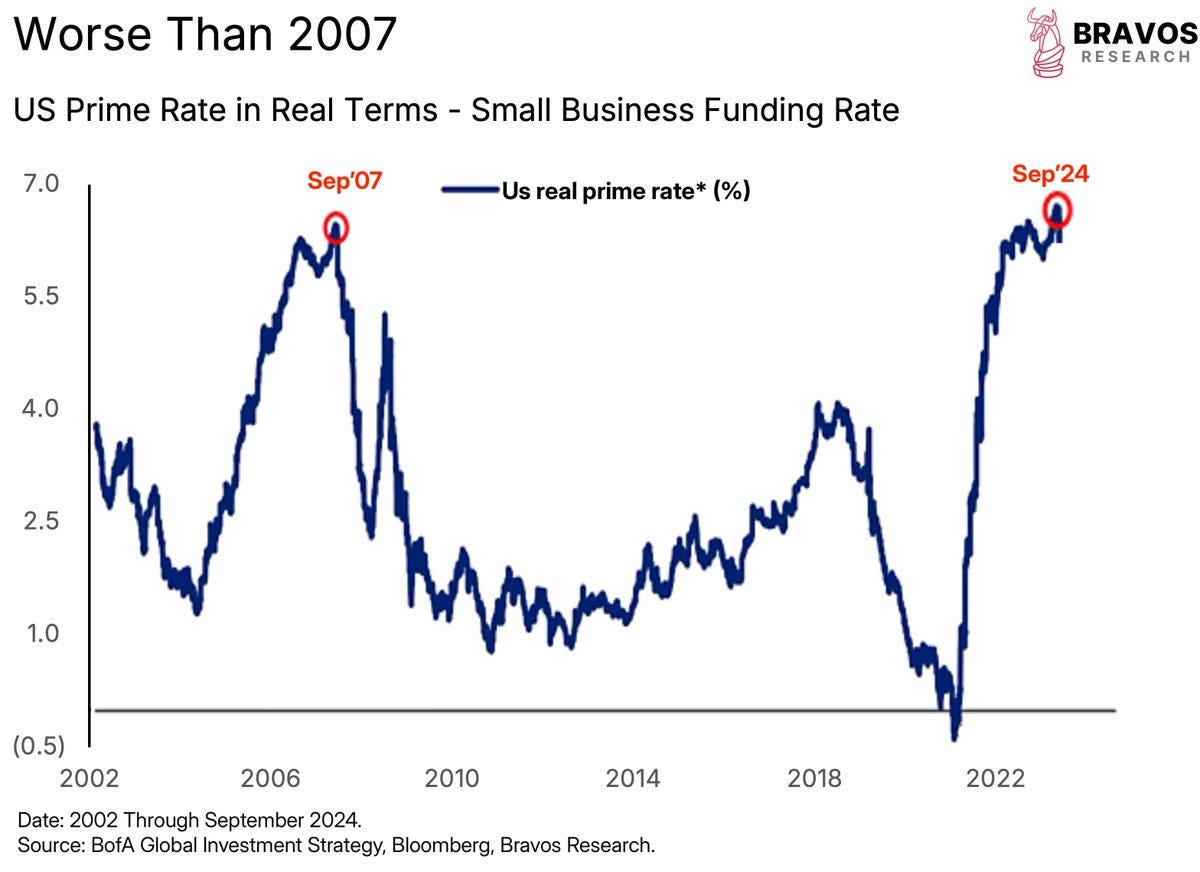

Given the plethora of central bank rate cuts, where does the US stand in its rate-cutting cycle?

By this metric, the US has barely begun normalizing real rates. There is a potentially long way (many cuts) to go.

The Bad Comes with the Good

As we pointed out earlier in the Crypto section, China has domestic demand issues and a manufacturing contraction. But Germany is the dominant EU (and a top global) exporter and is suffering a material contraction in manufacturing.

Global manufacturing PMI has contracted for the 3rd straight month in September.

New export orders dropped globally at the fastest rate in 11 months.

Data points to global trade volumes falling 3-4% year-over-year, the most since COVID.

Conclusion

The US appears to be in very good shape (government spending assisted) from a growth and employment perspective. Given the global backdrop, US real rates are too high by any historical metric.

At the same time, global inflation is coming down aggressively, allowing central banks to begin material-cutting cycles. However, global manufacturing is in contraction.

So, the US will cut rates to support strong domestic growth, low domestic and global inflation, and an increasing global liquidity environment.

Can you imagine anything being more bullish for risk assets?

VC

Crypto’s Glaring Problem

In 2000, Steve Krug published "Don't Make Me Think," a web usability and design textbook. Its central thesis is that a well-designed website or interface should be so intuitive and straightforward that users can navigate and understand it without consciously thinking about what they’re doing. The user experience (UX) should be seamless, minimizing cognitive load and reducing the need for users to figure things out as they go.

One of crypto’s most significant hurdles to adoption is its complexity. Most retail traders, especially new ones, don’t want or need the hassle of understanding blockchains, managing wallets, or navigating various protocols. Yet, here we are, deep in complexity, making people think about every move they must make, thus turning many off from the space. Chain abstraction aims to remove these barriers, making blockchain-based services as easy to use as traditional apps. As such, it is one of the critical components to crypto’s survival as a legitimate financial and technological tool.

Complexity ad infinitum

As the blockchain ecosystem has evolved, a multichain landscape has emerged, offering greater scalability and new applications but also introducing significant challenges, particularly in liquidity fragmentation and user experience. Once concentrated on a few major chains, liquidity is now scattered across multiple layers and blockchains, complicating the ecosystem. Users and developers must manage multiple wallets, seed phrases, and gas tokens. Bridging assets between chains adds further complexity, often resulting in poor user experiences, long wait times, and security exploits.

The Potential of Abstraction

Chain abstraction aims to comprehensively tackle these issues by aggregating liquidity across chains and simplifying the user experience. This approach is not just about efficiency; it’s about making blockchain technology accessible to a broader audience.

Liquidity Fragmentation & User Experience

In a brilliant report, Kunal Goel of Messari highlights that while the multichain ecosystem has solved some scaling issues, it has fragmented liquidity and deteriorated user experience. Traditional cross-chain solutions have been piecemeal and ineffective. Chain abstraction offers a holistic solution. One example is Polygon’s AggLayer, which stands out in liquidity aggregation because it provides a neutral, open-source solution that doesn’t extract rent and charges fees in ETH. It provides a more harmonious approach to liquidity aggregation, addressing the inefficiencies of previous attempts. However, its success will depend on its ability to connect chains, which cannot be proven with ZK technology.

Liquidity aggregation is one-half of the equation. The other half rests with master accounts. These offer a solution to poor user experiences by allowing users to manage and transact across multiple blockchains with a single account. Master accounts use cross-chain infrastructure like intents and account abstraction to aggregate balances, abstract gas fees, and execute complex transactions—solutions like NEAR’s account aggregation and Instadapp’s Avocado aim to simplify blockchain interactions like Web2 apps. Master accounts like OneBalance introduce "Credible Accounts," offering the benefits of Smart Contract Accounts (SCAs) without relying on global consensus for every transaction. These innovations allow faster, cheaper transactions across chains, improving usability in a multichain world. However, adoption could be slowed due to users' attachment to traditional wallets and the risks associated with new solutions.

VC’s Role

Since early 2024, chain abstraction technology has emerged as one of the fastest-growing sectors within blockchain, gaining substantial traction. Between January and August 2024, the number of projects adopting chain abstraction surged by over 150%, with total investments surpassing $1 billion. This reflects both the rapid adoption of the technology and the market’s recognition of its long-term potential.

Capital inflows drive the market performance of chain abstraction. Numerous projects have closed funding rounds ranging from several million to tens of millions of dollars. Notable venture capital firms are backing these initiatives, underscoring their confidence in the technology’s long-term viability. This financial support is critical to enabling rapid development and scaling across the sector. Innovations such as Agglayer and Everclear Protocol are pivotal in creating a more integrated and user-friendly crypto ecosystem, and their financial backing is vital.

The Invisible Future of Blockchain

The ultimate goal of chain abstraction is to make blockchain technology invisible and intuitive, similar to how the internet works today. Successful chain abstraction will ultimately improve user experience, onboarding more capital and users into the crypto ecosystem, particularly benefiting modular chains and intent-based infrastructure. This is a key component to crypto's survival and further legitimizing globally. New ventures in this area have been appearing in recent months. We will surely see more funding for abstraction projects aiming to solve one of crypto’s biggest and necessary challenges.

Bitcoin DeFi

Venture Funding Slows Down, but Our Conviction Continues

Bitcoin-focused venture funding slowed down in September. To us, this is no surprise, as August is usually one of the slowest months in crypto venture financing.

Source: Root Data

Despite the slowdown, in August, we invested in an early-stage Bitcoin metaprotocol, which we are excited to share in a future update when it is announced publicly.

Liquid Staking Wars are Heating Up

Bitcoin growth themes are rhyming with prior Ethereum themes. Much like Ethereum and its numerous Liquid Staking Tokens (LSTs), which allow a holder to earn a yield on the underlying asset, have led to a significant amount of active ETH on EVM chains being the LST variant, Bitcoin is experiencing a similar trend with its own LST variants.

Currently, Lombard leads with 5,681 LBTC ($368M) now minted (as of Sept. 22), allowing users to earn points for staking their LBTC in DeFi vaults on Ethereum, such as liquidity pools on Uniswap and lending protocols like Zerolend.

Points farming appears to be a sustainable strategy when teams approach GTM planning in DeFi, as it is a commonly understood terminology for liquidity providers. Historically, points have led to token airdrops for early adopters.

Source: CoinWire

Early Signs Indicate that Bitcoin L2 Ecosystems Will Flourish

The excitement to build on Bitcoin continues to grow. The renewed interest in Bitcoin, especially through wrapped Bitcoin solutions like cbBTC, is attracting dormant Bitcoin that has remained idle on exchanges. Recently, popular Web3 dApps such as Pendle (yield-protocol), Curve (stable-swap), and Aave (lending-protocol) have shown interest in adopting wrapped Bitcoin, validating the demand for Bitcoin DeFi. These Ethereum-based dApps excite us with their potential to redeploy on leading Bitcoin L2s like BitLayer, Mezo, and Bob (which are all Asymmetric PortCos), positioning them to capture larger on-chain TVL.

However, the even greater potential for unlocking TVL lies in two future catalysts:

Unlocking idle, self-custodied Bitcoin through trust-minimized, trustless solutions made possible by innovations like BitVM2 and the OP_CAT Bitcoin soft fork.

Employing game-theoretic strategies on Bitcoin L2s, such as BitLayer, Mezo, and Bob, especially in their pre-Token Generation Event (TGE) phase.

Unlocking idle self-custodied Bitcoin remains challenging because current wrapped Bitcoin solutions still carry elements of trust, which many Bitcoin holders view as risky. Innovations like BitVM2 and the OP_CAT soft fork offer the potential for a trust-minimized, secure way to bridge Bitcoin. In a recent post, Alexei Zamyatin, co-founder of Bob, recently outlined how BitVM2 works. Its immediate benefit is that it does not require any changes to Bitcoin's code, allowing a seamless integration once the design is finalized and implemented.

Source: BitVM2 Whitepaper

On the other hand, OP_CAT would require a Bitcoin soft fork to re-enable the OP_CAT opcode, which was disabled in 2010 by Satoshi Nakamoto to streamline Bitcoin’s development. Scaling solutions like Fractal Bitcoin (another Asymmetric portfolio company) have already integrated this opcode, inspiring further exploration of what can be achieved with it. While the timeline for an OP_CAT soft fork remains unclear, its progress and growing support among Bitcoin core developers give us optimism for its eventual approval.

In addition to technical innovations, the pre-TGE phase of Bitcoin L2s presents an opportunity to shape user behavior through game-theoretic strategies. By deploying points and tokens in go-to-market (GTM) frameworks, these L2s can incentivize early user adoption and create a self-reinforcing growth loop. This makes value accrual more transparent as liquidity events approach. These strategies, combined with trust-minimized innovations like BitVM2 and OP_CAT, are poised to unlock significant TVL on Bitcoin L2s, aligning more closely with Bitcoin’s ethos than Ethereum L2s, which rely on custodial Bitcoin wrappers. This alignment strengthens Bitcoin's native appeal, creating a secure and decentralized ecosystem ready to capture substantial TVL as scaling infrastructure matures.

Despite Bitcoin's traditionally conservative stance, these advancements reflect steady progress and signal a massive leap forward in Bitcoin’s development.

Law & Regulations

Navigating Legal Challenges in Application Token Economic Models

The economic models for infrastructure tokens—such as those powering Layer 1 and Layer 2 networks—are relatively well understood. These tokens, driven by supply and demand for block space, have clear economic frameworks, as seen with Ethereum’s EIP-1559 base fee-burning mechanism. However, the landscape for application tokens, which support smart contract protocols and decentralized "businesses," remains uncharted territory in both economic and legal terms.

As application tokens increasingly power decentralized exchanges, DeFi platforms, and decentralized social apps, designers and developers must confront the complex legal challenges of this new frontier. This blog unpacks these challenges, focusing on strategies to design application token models that are both economically sound and legally compliant.

1. Governance Challenges: Minimizing Legal Risks

Decentralized projects typically rely on Decentralized Autonomous Organizations (DAOs) for governance, which can introduce significant legal risks. In the U.S., DAOs that control protocol revenue or intermediate economic activities may expose themselves to regulatory scrutiny. This risk becomes even greater if governance over economic decisions is centralized within the DAO.

To mitigate these risks, minimizing governance in economic decision-making is a crucial strategy, for DAOs that cannot completely eliminate governance, structures such as Wyoming’s Decentralized Unincorporated Nonprofit Association (DUNA) can help. DUNA provides legal recognition to DAOs and offers solutions for mitigating tax and compliance challenges, reducing potential regulatory exposure.

2. Value Distribution and Securities Laws

A core legal issue revolves around how application tokens distribute value to their holders. Traditional models, such as token buybacks or pro-rata distributions, closely resemble stock buybacks and dividends, which raises concerns under U.S. securities law. These models may cause application tokens to be classified as securities, triggering stricter regulatory oversight.

To avoid these pitfalls, projects should explore alternative value distribution mechanisms that emphasize stakeholder contributions instead of direct financial rewards. For example, rewarding users for operating frontends (like Liquity), participating in the protocol (like Goldfinch), or contributing collateral to safety modules (like Aave), allows positive-sum participation without the risk of being classified as securities.

3. Regulated Activity and Fee Structures

Many application tokens facilitate regulated activities, such as trading derivatives on decentralized exchanges. The challenge lies in designing fee structures that reward tokenholders while ensuring compliance with regulations across different jurisdictions. Failing to ensure compliance could expose tokenholders to legal risks, especially if fees are generated from non-compliant frontends.

To mitigate this risk, projects can implement a fee traceability system. This system ensures that only compliant frontends generate fees for tokenholders. A two-step process ensures traceability and compliance:

Step 1: Map the fees to the specific frontend using cryptographic methods.

Step 2: Distribute those fees to tokenholders who stake to compliant frontends, ensuring they are insulated from illicit activities. This approach provides a flexible, compliant framework that allows tokenholders to participate without legal risk while maximizing protocol revenue.

4. Fee Traceability and Compliance

A key legal challenge for application tokens is ensuring that the fees tokenholders receive come from compliant activities. Without a traceable fee mechanism, tokenholders could inadvertently profit from non-compliant actions, exposing them to regulatory action. By implementing fee traceability, projects can ensure that only fees from compliant frontends are distributed to tokenholders.

Cryptographic methods can map domains to public/private key pairs, ensuring that fees can be traced back to the frontend responsible. This traceability not only reduces legal risks but also simplifies compliance without increasing governance burdens. Curators or validators can manage staking pools, ensuring that tokenholders only receive fees from legal, compliant frontends.

5. Minimizing the Governance Burden

One of the biggest challenges DAOs face is managing compliance across multiple jurisdictions. Rather than forcing DAOs to assess compliance for each jurisdiction, the burden can be outsourced to curators who manage compliance. Curators can ensure that only compliant frontends generate fees, allowing the DAO to focus on governance without legal exposure.

Curated staking pools offer an efficient solution for balancing decentralization with compliance. By allowing tokenholders to stake their tokens with curated frontends, projects can maintain legal compliance without increasing the governance load on DAOs.

Conclusion: Designing Legal-First Application Token Models

As the ecosystem continues to evolve, application tokens must address the unique legal challenges they face. Projects can build compliant and resilient economic frameworks by focusing on governance minimization, alternative value distribution models, and fee traceability. These strategies will ensure that application tokens thrive within international legal boundaries while fostering innovation in decentralized applications.

For developers and legal teams, the path forward lies in designing token models that are as flexible as the software they represent while navigating the complex regulatory landscape of the global financial system. By doing so, application tokens can realize their full potential without compromising compliance or decentralization.

Team Updates

Joe co-hosted a couple more Bits and Bips podcast episodes.

Joe spoke with Midcurve about “Technology, Capital, and Culture”

Joe was featured on an episode of Crypto Banter with José Macedo and Meltem.

An interview with Maria Aspan, from NPR, and Joe, was heard on All Things Considered.

Joe talked about fed rate cuts in a Cointelegraph interview.

Joe spoke at Token2049 in Singapore alongside Iggy Azalea, Imran Khan, and Ansem in “The Virality of Value: Memecoins in the Attention Economy”

Ran Neuner’s interview of Joe is featured in Crypto Banter’s Token2049 recap video (skip to 7:55 in the video).

Joe also spoke at Breakpoint 2024 in Singapore with Arthur Cheong in “Fireside: Where’s The Alpha: Liquid or Venture?”

Iggy Azalea announced her online casino, Motherland, alongside business partner Joe McCann.

All Market Updates

Please let us know if you have any questions or comments.

As always, thank you for your support.

– Asymmetric