Asymmetric Market Update #21

Our thoughts on what is relevant in Crypto and Markets...

Crypto

In the 1930s, during the Great Depression, farmers were dealing with one of the worst climate events of their time—the Dust Bowl. This period of severe drought ravaged the Great Plains of the U.S., exacerbated by poor farming practices that had stripped the land of its protective grass cover. Without rain and with soil erosion worsening due to strong winds, "black blizzards" of dust buried homes and farmland, rendering the area nearly uninhabitable.

Many farmers gave up during this time, abandoning their homes and farms as their crops failed and livestock perished. They migrated west to places like California in search of work, often facing hostile conditions and poverty along the way. However, those who remained through the darkest years held on to the hope that the land could be rehabilitated.

In 1939, the rains returned, and with new conservation efforts, such as those promoted by Hugh Bennett through the Soil Conservation Service, farmers began to see recovery. The Dust Bowl region, once nearly desolate, slowly returned to productivity. The capitulation of many farmers during this period mirrors the emotional and economic surrender often seen in financial markets, where despair signals the end of a downturn, eventually followed by recovery.

In capital markets, capitulation tends to mark market bottoms. Like many of the farmers during the Dust Bowl who simply gave up and “sold,” many in the crypto industry are doing just that.

Need some signs of capitulation?

How about a16z leaving Miami just two years after opening its doors? Or the recently announced yet tiny SEC settlements with Abra and Galois that have been years in the making?

Not a fan of cherry-picked anecdotes? Ok, let’s look at some math.

Let’s start with $ETH, an asset we have had the good fortune of not owning any of all year.

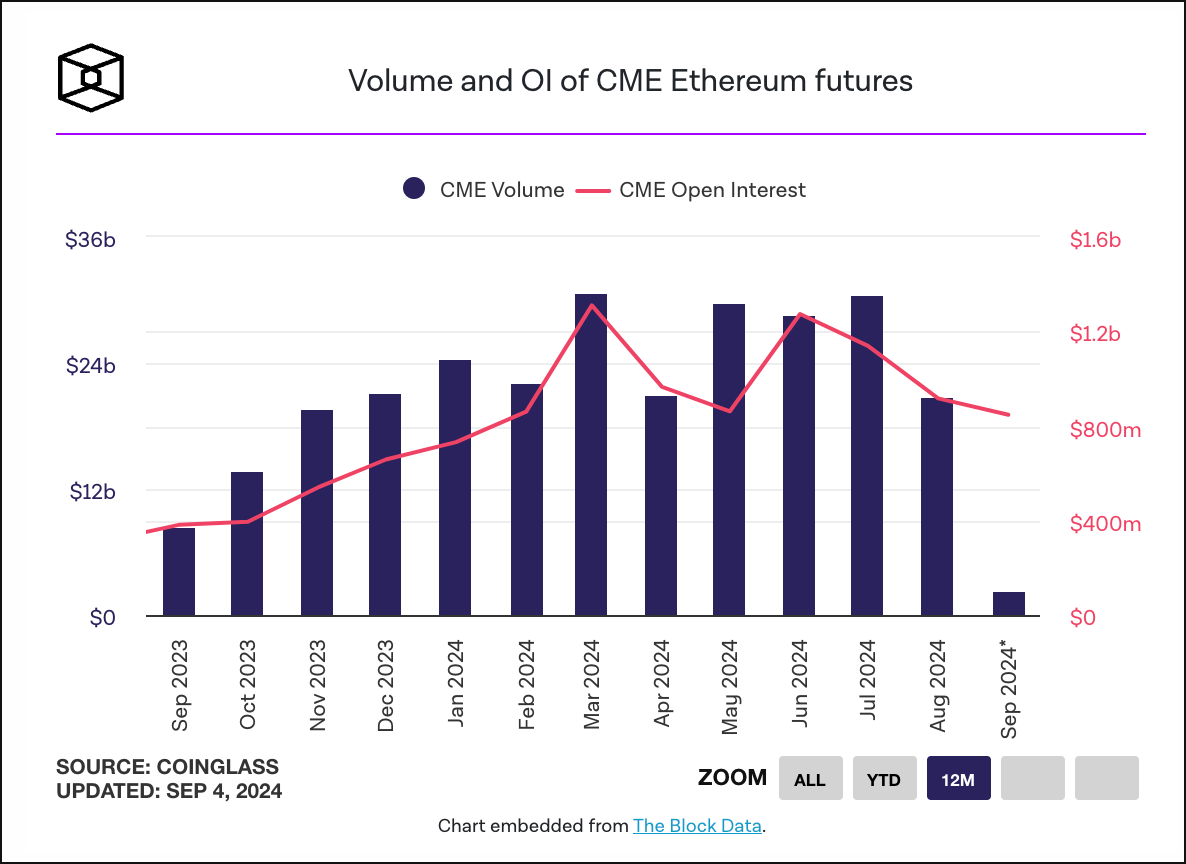

CME futures trading hits a 9-month low.

Spot ETF volumes for $ETH have fallen off a cliff.

And in fact, with the enormous outflows from Grayscale’s ETHE 0.00%↑ total netflows for all $ETH ETFs are negative.

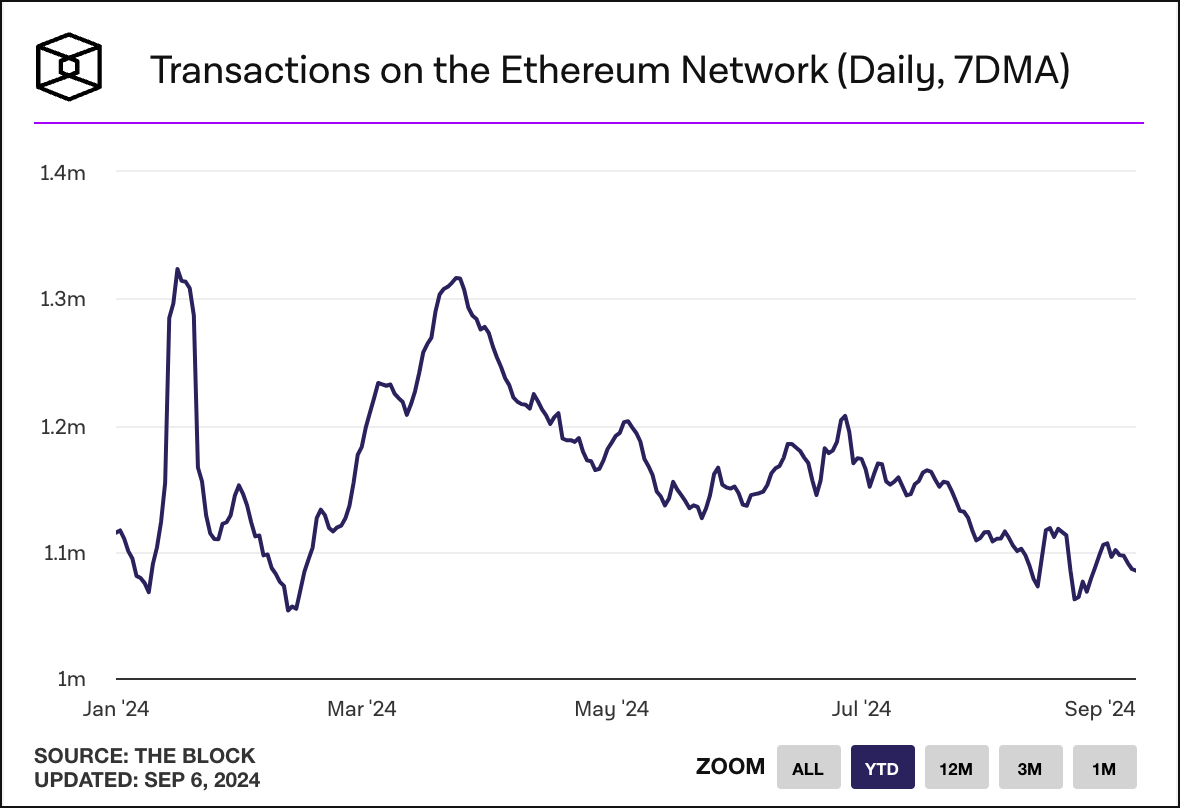

On-chain activity for Ethereum’s has plummeted as well.

A crystal clear sign of capitulation is the huge number of on-chain liquidations for the month of August.

Ethereum is not alone. Bitcoin also shows serious signs of apathy and capitulation. Annualized basis is again trading at some of the lowest levels of the year with open interest at or near the lows.

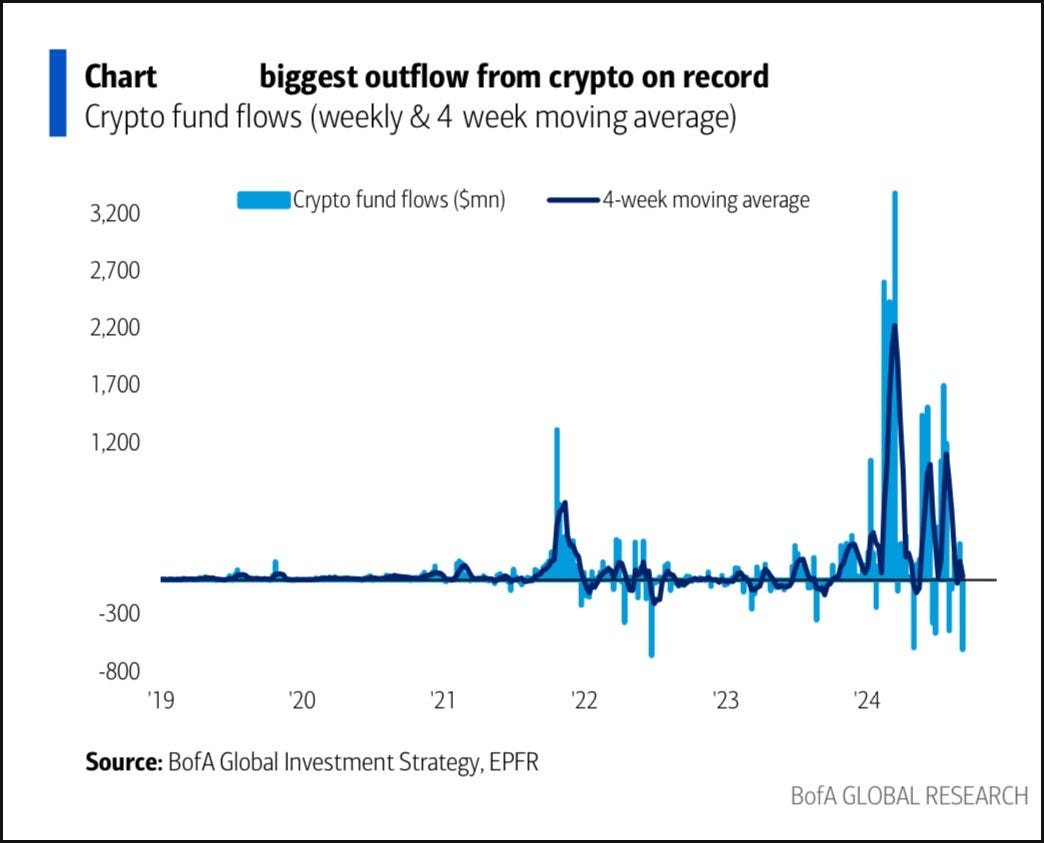

And just in the past week, across all crypto products, we witnessed the largest outflow on record.

But wait, there’s more. Capricole’s “Speculation Index” is at the lowest levels of the year.

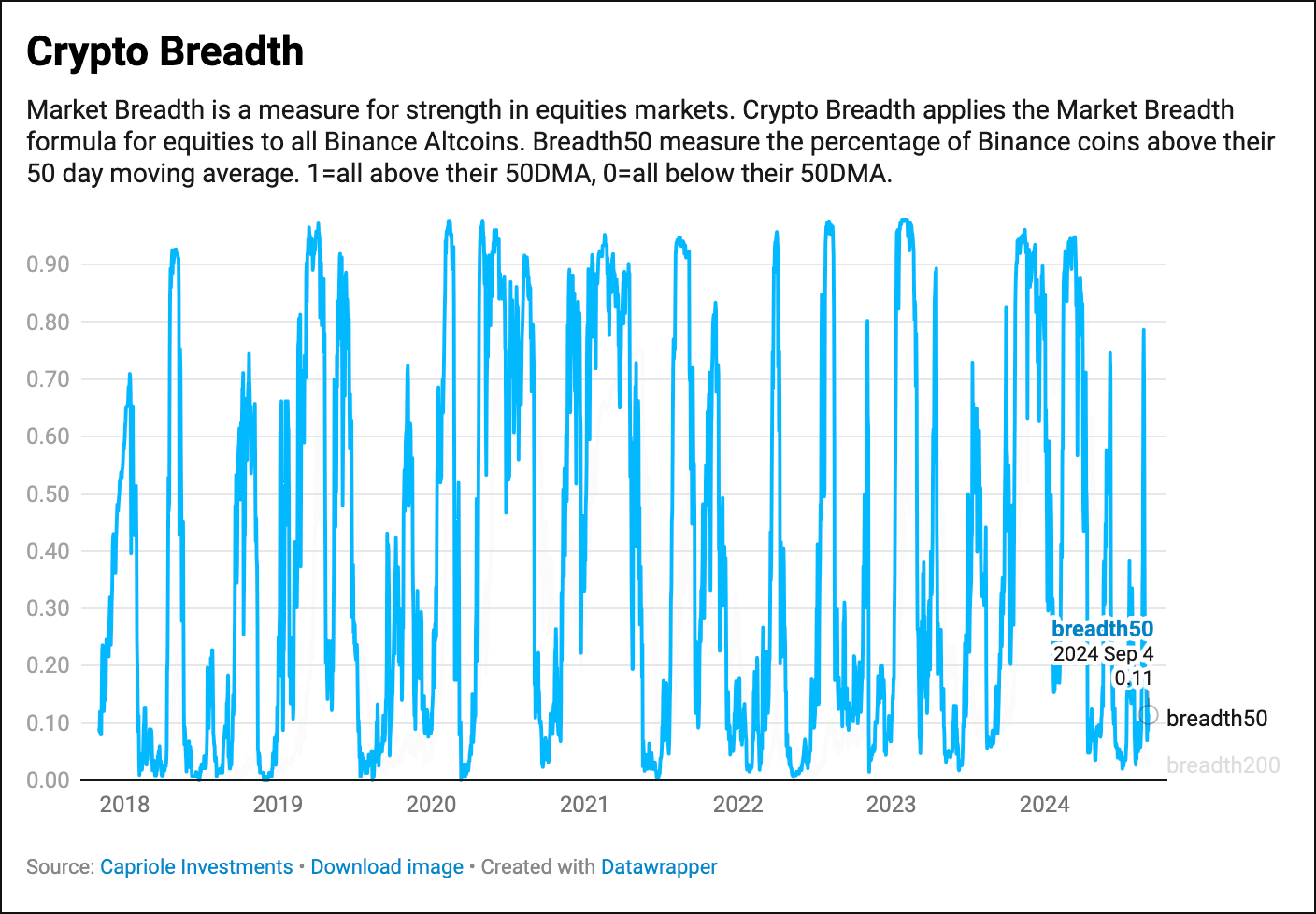

And breadth is nonexistent.

If we look at the performance in August for cryptoassets and total market cap measures , we see even more signs of capitulation.

$BTC -8.73%

$ETH -22.25%

$SOL -21.15%

$TOTAL -10.98%

$TOTAL2 -13.89%

$TOTAL3 -8.63%

“When one is picking bottoms, one ends up with stinky fingers.” — Old Trading Proverb…probably.

It’s very difficult to look at the month of August and even the first week of September and assume a bottom is in, but if we weigh the probabilities it does feel like we’re getting close.

That being said, the crypto asset class has some serious headwinds ahead of it, namely that they have been trading with a positive correlation when U.S. equities go down and a negative correlation when U.S. equities go up.

Equities in the first week of September dropped precipitously as market leaders like semiconductors took a beating, down nearly 12% for the first week, but even rate-sensitive indexes like the Russell 2000 were down nearly 6% on positive news for lower rates. Crypto trades in lockstep with these down moves.

Moreover, as you’ll see in the following Macro section, the U.S. Presidential election is quickly becoming less of a tailwind for crypto and more likely a headwind, especially if Harris wins the election. I don’t actually believe it matters too much who wins, but it’s hard to see a scenario where crypto doesn’t improve under a Trump administration and crypto maintains it’s challenging steady state under Harris.

Bottoms form when the last seller has sold.

With so many signs of farmers leaving their dying crops, it does seem like we are almost ready to harvest in Q4. All of the macro is lining up for risk assets to rally into year end, but there’s a severe drought of market participants willing to take on any risk before the flood comes. When the deluge arrives, they will all have to chase the price of these assets higher. It’s a tale as old as time.

Macro

Once upon a time, the world of finance found itself at a crossroads, anxiously awaiting the decision of one powerful institution: the Federal Reserve. The September FOMC meeting loomed large on the horizon, and traders, investors, and economists alike found themselves asking one critical question: Would the Fed cut rates by 25 or 50 basis points?

Real yields had surged to 3% and showed no signs of slowing. Copper, once a symbol of industrial strength, had fallen nearly 20% from its peak. Oil, too, had plunged, down almost 25%, and gasoline prices were trading at three-year lows. The economic landscape was shifting, with unemployment quietly ticking upward, a stark contrast to the robust growth of previous years.

And yet, inflation—the Fed's ever-watchful nemesis—had retreated faster than anyone had expected, falling below the Fed’s target according to forward market projections. Even so, the Fed continued its quantitative tightening, a process that seemed out of step with the data at hand. With the next rate-setting meeting in November nearly two months away, the financial world held its breath.

Despite all signs pointing to a clear course of action, the Fed’s indecision left many questioning its approach. Had the institution strayed too far from data-driven policy? The debate raged on, with whispers of "bad signaling" and accusations of political interference clouding what should have been a straightforward decision. It was argued that cutting rates by 50 basis points in the shadow of an upcoming election might be seen as political. Ironically, it even suggested that it seemed to politicize the process.

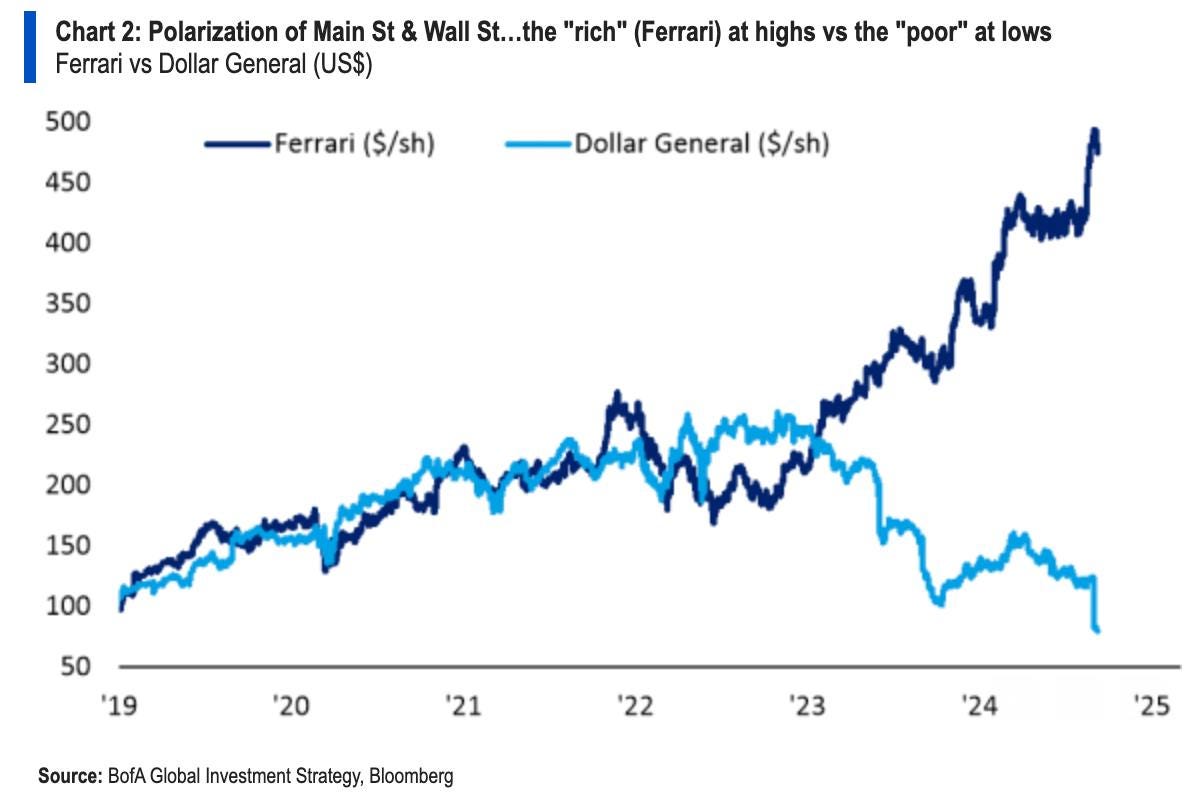

Just a month earlier, the economy had been described as existing in a bimodal state—an uneasy balance between the current data and the actual state of the economy. Scott Bessent, a potential future Treasury Secretary, captured this contradiction in a single statement: while the wealthier benefited from rising equities and real estate prices, lower-income groups struggled under the weight of stagnating wages and soaring costs for essential goods. It was a tale of two economies, where the rich grew richer, and the poor faced ever-growing financial pressures, evidenced in a single chart.

In this uncertain environment, the question lingered: What would the Fed do? For many, the answer seemed obvious—cut 50 basis points, providing the economy with some breathing room before the election. But if they opted for a more modest cut of 25 points, any hiccup in the data could send the markets spiraling into recession fears, especially with liquidity drying up as investors waited for election results.

As the countdown to September’s meeting ticked on, market participants considered their next moves. What if Kamala Harris emerged victorious in the upcoming election? Her policies were expected to largely mirror the status quo, with little to no seismic shifts. The more radical ideas, like taxing unrealized gains, seemed unlikely to materialize. Capital gains taxes and corporate tax increases were similarly distant prospects. The outlook for stocks under a Harris administration was clear—things would likely stay the same, with a potential risk of a negative tail outcome.

But what if Donald Trump returned to power? His campaign had already telegraphed some key differences. Under Trump, oil production would surge, pushing prices lower. Deregulation would flow like oil through newly approved pipelines, and foreign wars—particularly the conflict in Ukraine—might come to a swift end, easing inflationary pressures on food and energy prices. Immigration, too, would take a sharp turn, with large-scale policies poised to reduce wage pressures and potentially stalling economic growth.

With these contrasting futures on the horizon, traders plotted their course. A Trump victory signaled deflation, real growth, and reduced geopolitical uncertainty. In such a world, stocks would likely rise, bond yields might steepen, and oil could fall. And then there was crypto. Once aligned with macroeconomic forces like interest rates and liquidity, it had since become politicized—Trump’s loud endorsement of digital currencies had forever linked their fate to his electoral success.

As September’s FOMC meeting drew near and the election season began to heat up, the financial world found itself at the mercy of forces far beyond its control. Would the Fed deliver a 25- or 50-basis-point cut? Would the election reshape the markets? Only time would tell, but one thing was certain—nothing in the world of finance was ever as simple as it seemed.

VC

August Dips

Overall, CryptoVC funding dipped slightly in August. Funding was down ~15.06% from the previous month to close at $943M. YTD, deal count was at its lowest level, down 7.5% from July to 111. August has been a “quieter” month for the past three years. However, this August’s numbers didn’t retract nearly as much as they have in the past. If anything, funding has been within a stable range since March.

Source: CryptoRank

Crypto VC has reportedly slowed as firms focus on more stable assets like Bitcoin and Ethereum, which offer higher returns with lower risk than early-stage Web3 startups. Adam Cochran, partner at venture capital firm Cinneamhain Ventures, noted that VC firms prefer these safer bets over riskier, innovative ventures, citing the burnout of trends like NFTs and DeFi. Despite some billion-dollar months in 2024, overall funding is down compared to 2022's highs, signaling cautious investment approaches in the Crypto VC space.

Much of what is occurring in Crypto VC is the same as its traditional counterpart—the Financial Times recently reported that over 60% of startups have failed, particularly those who raised cash in 2021-22. The bankruptcy rate is now seven times higher than five years ago. TVPI remains strikingly low, falling dramatically every year over a five-year period.

Source: Carta

Both spaces see longer durations between rounds, notably Seed, Series A, and Series B funding. Valuations are excessively high as well. In the traditional space, this is attributed to the fervor over AI. Many of the high valuations in crypto are related to FDV and tokenomics (discussed below).

Lastly, exits remain relatively low, achieving only pre-2021 levels. Fewer exits, longer durations between funding rounds, and excessive valuations appear to contribute to a slight pause for would-be LPs.

There is a lot of bearish sentiment here, but there may be too much backward-looking, “remember when” scrutiny. Many investors and analysts compare everything to the 2021-22 cycle, often forgoing the circumstances that led to it and the devastating cacophony of fraud that contributed to its collapse. The repercussions are still being felt, and we will unlikely return to such numbers soon. Instead, investors must look ahead. Innovation in crypto continues, and while memecoins distract retailers a little longer, many startups entering the space have projects focused on adoption and accessibility. We may soon see a shift to products and services that capture real-world value. The projects that succeed in that respect could be the biggest winners. A VC cool-down would not be extraordinary, given the sentiment of the overall market right now. However, with rate cuts on the horizon, optimism is growing that sidelined LPs will start injecting more liquidity into the CrytpoVC ecosystem. Q4 will be anything but boring.

VC Tokens Battle The Storm

Tokens backed by venture capital (VC tokens) have been navigating rough waters. In previous updates, we commented on VC-backed token launches, noting that the best projects poised for successful TGEs have done the work to create real value well beforehand. Markets have recently stagnated and revealed several issues that could alter how startups launch a token and how VCs back them.

Specifically, the most significant factors have been inflated valuations, the need for clarity in utility, and poor governance structures. Numerous VC-backed tokens are underperforming, with many failing to maintain initial hype and struggling to attract retail investors. Market data shows these tokens often have low liquidity and trading volumes, indicating a lack of sustained interest. Some of the most prominent examples include EOS, Tezos, and Filecoin.

Filecoin 1YR Real Volume

Source: Messari

Are You a Low-Floater?

Token launches experienced a resurgence this year, bolstered by numerous projects utilizing a low-float, high-FDV strategy. Led by a high valuation and buildup around its potential, a project launches a token, and a small percentage of the total supply (aka the float) goes to the market. By releasing only a small portion of the supply, the token can more easily maintain a high valuation in the short term. However, as more tokens are released into circulation, the price often falls as selling pressure increases. In other words, it dumps. While broadly criticized, the strategy has been simply irresistible for projects needing attention.

How Did We Get Here?

One contributing factor may be the relationship between venture-backed Web3 companies and CEXs (centralized exchanges). CEXs are essential to a token’s launch. Founders and VCs want to maximize profits. Thus, the goal is to get listed on the exchanges with the highest volume and liquidity, thus increasing trading activity and improving market positioning.

The top CEXs are highly selective. Until recently, high valuations were among their primary selection criteria (next to frustratingly high listing fees). High valuations, specifically token FDVs, were signs of a successful raise, making their token launch more attractive. While this strategy was successful in the past, some VCs, especially those with excess funds, saw a highly profitable opportunity. And profit they did. However, the floodgates have opened, and now the space is witnessing token after token launch with excessively high valuations.

One of the immediate repercussions is that retail (what little there is) is bowing out. Without sufficient upside, the risk isn’t worth it for retailers, especially for short-term traders seeking quick profits. Even with transparent tokenomics, retail investors have pulled back from most of these projects. Interestingly, this created a gap naturally filled by memecoins.

Some chatter in the space posits that memecoins have killed VC tokens. While that is an extreme point of view, the success of the memecoin space is contributing to their stagnation. Memecoins have been crushing it because they offer the potential for massive returns, attracting the very investors that VC tokens have lost. More importantly, they capture the cultural side of crypto, eloquently highlighted in our December ‘23 update.

Pump.fun, which enables anyone to create and distribute tokens, surpassed ETH in 24-hour revenue this past July.

Source: DeFiLlama

Memecoins have the potential to moon in short periods, something VC tokens haven't been able to match. Yes, most memecoins lack intrinsic value beyond the meme and, as a result, have shorter lifespans. Yes, many plummet into worthlessness, and there are way too many now (1.7M new tokens launched on pump.fun since January). However, a key takeaway is understanding how a memecoin can express the culture du jour where a startup’s token can’t and what, if anything, startups can learn from them.

Some exchanges are now pushing back on high valuations, preferring to admit projects that offer investors realistic valuations and genuine value, though listing fees remain astronomically high. Veteran startup investor Natalie Luu authored a superb “how-to” for getting tokens listed. Startups and their VCs should take these cues to heart and work to create real value and learn from the successes and failures of memecoin culture.

A Call for Change

The crypto space has begun calls for a new approach to the low-float model, including a market-derived FDV through DEX trading. The theory is that market-based FDV will reduce speculation and cultivate a community of long-term participants. However, it could also result in slower initial growth or undervaluation. Another alternative calls for refocusing the industry on distribution and utility while deliberately avoiding price speculation. Some protocols like FRIEND are experimenting with this approach, launching with a 100% float and distributing all tokens to the community from day one. Yet another idea is to revisit ICOs. Unfortunately, these ideas currently throw a lot of shade on VCs. Where and how they exist in all this is vague at the moment.

While the space works itself out, startups must focus on the now and recognize the challenges and risks they face if they intend to launch a token at an artificially inflated valuation. Moreover, they should partner with reputable crypto funds that know the space and can offer added value through advice and guidance. The message here is two-fold. To VCs, ensure your support includes the right expertise to provide your portfolio companies. Don’t just throw money at them. To startups, partner with experienced and knowledgeable VCs who are ready and willing to assist. And if they offer help, take it. Choosing not to could be your biggest mistake.

Bitcoin DeFi

Venture Funding

Bitcoin-focused funding has continued to accelerate in August, with well over 100 financing transactions related to the Bitcoin ecosystem so far in 2024.

Funding highlights from June to August show over $215M in notable venture capital being allocated.

Note: sorted in no particular order by CoinWire; outlined deals indicate Asymmetric PortCos

Source: CoinWire

Bitcoin DeFi is now BTCfi

With the emerging interest in building around Bitcoin, Bitcoin DeFi has recently been referred to as BTCfi. Historically, Bitcoin’s utility was confined to a store of value, lacking financial applications that made other chains much more attractive. Emerging themes such as Bitcoin staking (made available through Babylon) expand the surface area of Bitcoin to secure other PoS blockchains. At the same time, Liquid Staking Token ‘LST’ protocols like Lombard aim to bring yield-bearing Bitcoin multi-chain. As a byproduct, Bitcoin can become an active asset across many existing ecosystems.

The Wrapped Bitcoin Wars

With the recent surge of interest in BTCfi, we are tracking the amount of Bitcoin on other chains such as Ethereum, Bnb, and Bitcoin L2s, otherwise referred to as ‘Wrapped Bitcoin’. More notably, Coinbase has indicated that they are developing a wrapped Bitcoin similar to BitGo’s wBTC, called cbBTC, which may be used to leverage the company's layer-2 blockchain, Base.

The wrapped Bitcoin industry is highly competitive, and more recently, the decision of wBTC’s custodian (BitGo) to transfer control of the asset to a joint venture consisting of itself and BiT Global (a partnership with Justin Sun, a controversial founder of the Tron blockchain), has created a greater need for trustless/trust-minimized Bitcoin alternatives to avoid centralized custodian risks.

As of Aug. 31st, over 253k Bitcoin is wrapped in Bitcoin. We expect this number to grow once new trustless/trust-minimized bridges from Bitcoin to L2s are enabled by BitVM (currently in the research stage) and OP_CAT (Bitcoin soft fork).

Source: CoinWire

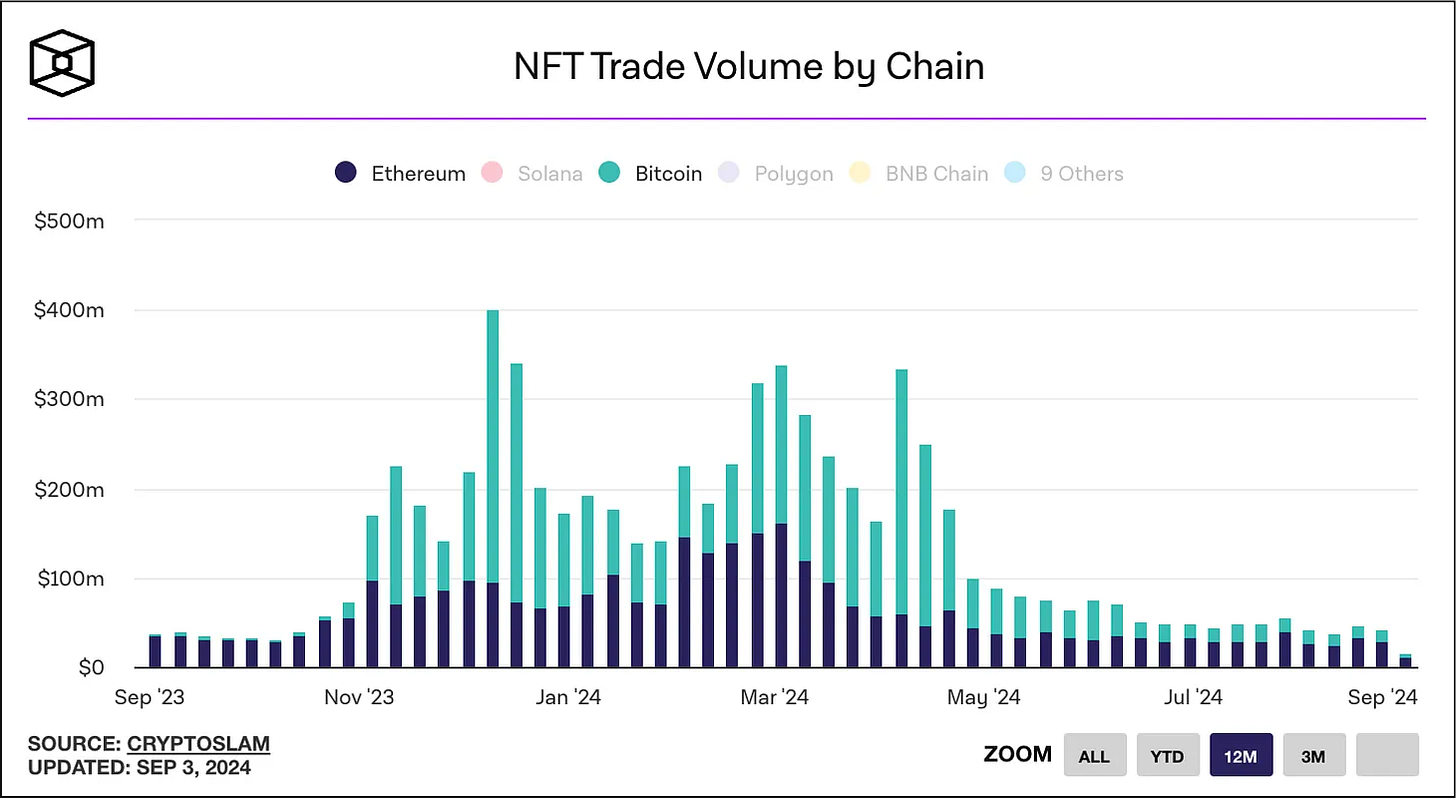

Bitcoin NFTs Continue to Slow Down with Market

Since our last update, NFT volume has declined by 18% from $377M in July to $312M in August, while Bitcoin NFT volumes fell 22% from $69M to $54M. Bitcoin NFT’s relative volume remains relatively stable compared to the broader market, but it is a far cry from prior peaks of both size and market share. Currently, user experience on existing marketplaces is hindered by ‘mempool sniping’ (What is Mempool Sniping?). We anticipate the user experience will improve as teams build Bitcoin-native marketplaces, such as Satflow, a recent Asymmetric investment (see dApps below for more details).

Source: The Block

Runes vs. BRC-20

Bitcoin now has multiple fungible token standards, but the leading two at this moment are Runes and BRC-20:

Runes: Created by the founder of the Ordinals protocol, Casey Rodamor, and uses a UTXO model much like Bitcoin. Runes on-chain data storage is in the OP_RETURN part of the transaction. The Runes protocol went live in April 2024. The total market capitalization of Runes tokens is $330M.

BRC-20: Created on the Ordinals protocol as a separate metaprotocol using inscriptions indexed by an anonymous developer known as Domo in March 2023. The total market capitalization of BRC-20 tokens is $1.5Bn, and they have been successfully adopted by many CEXs such as Binance.

As shown below, Runes continues to dominate the L1 as the leading token standard. Despite its lower total market capitalization, it also leads on metrics such as the total number of transactions.

Source: Dune Analytics

dApps

Bitcoin dApp builders continue to make progress in building features around Bitcoin NFTs and Bitcoin Fungibles (Runes and BRC-20 tokens) despite limited programmability on L1. Liquidium (Asymmetric PortCo) has announced collateralized lending for Runes and BRC-20 tokens this month.

We have also invested in another dApp, Satflow, which aims to build the best trading experience on Bitcoin for both Bitcoin NFTs and Bitcoin Fungibles. Notably, Satflow is Coinbase Ventures’ first investment in the Bitcoin L1 ecosystem.

Bitcoin L2s

Bitcoin L2s are still in development but have amassed over $1Bn in TVL. L2s such as BitLayer (Asymmetric PortCo; $500M), Mezo (Asymmetric PortCo; $150M), and Bob (Asymmetric PortCo; $80M) lead the way with amassing capital within their ecosystems. These ecosystems have smart contracts that enable decentralized exchanges (DEXes), lending, and other applications that provide yield opportunities.

Law & Regulations

The Uncertain Future of NFTs: Regulatory Scrutiny and Market Shifts

As the SEC inches closer to potentially classifying NFTs—or at least their secondary sales—as securities, the future of this burgeoning market appears increasingly uncertain. The outcome of this regulatory scrutiny could have lasting implications on how digital assets, such as NFTs, are perceived and traded. But what does this all really signify for the evolving crypto space?

The SEC has been quiet about its exact intentions, but a Wells notice sent to OpenSea, the largest NFT marketplace, signals that the regulator is targeting the platform over allegations that the NFTs it facilitates may be unregistered securities. If the SEC proceeds with legal action, this could set a watershed moment in NFT regulation, sending ripples throughout the industry.

NFTs on the SEC’s Radar: A Legal Showdown Looms

Devin Finzer, CEO of OpenSea, voiced shock at the SEC’s actions, calling it a "sweeping move against creators and artists." He warned that by targeting NFTs, the regulator risks stifling innovation for countless online artists and creatives who rely on these platforms. "Hundreds of thousands of online artists and creatives are at risk, and many do not have the resources to defend themselves," Finzer explained on X, formerly known as Twitter.

The SEC has already taken action against smaller NFT projects like Impact Theory and Stoner Cats, both of which settled without challenging the regulator’s assertion that NFTs are securities. However, if OpenSea pushes back, it could mark the first significant legal battle over classifying NFTs as securities, setting a precedent that will ripple across the industry.

As Cameron Pick, a blockchain law specialist at Marshall, Gerstein & Borun, points out, going after the largest NFT exchange sends a clear signal: the SEC isn’t just targeting individual NFTs or creators but implying that all NFTs could be considered securities. “If you are representing a client who sells NFTs, they have to consider this as a potential risk,” Pick emphasized.

The Precedent Problem: Past Settlements vs. New Challenges

Should this case go to court, the SEC will likely rely heavily on past settlements as a basis for its arguments. However, the Department of Justice’s (DOJ) earlier insider trading case involving NFTs didn't bring securities fraud charges, despite the nature of the trades. This raises the question: why didn’t the DOJ pursue that route if NFTs are indeed securities?

The SEC has faced challenges in its pursuit of digital asset regulation. In the Kraken case, for example, the judge expressed doubt about the SEC’s inconsistent arguments regarding securities laws and digital tokens. This uncertainty could carry over to NFTs, which many see as digital art rather than financial instruments. Unlike fungible tokens, NFTs represent ownership of unique assets, a key distinction that could affect how they are classified legally.

OpenSea has been a key player in this space, operating without SEC interference since its launch in 2017. Finzer has been vocal in asserting that digital art and collectibles shouldn’t be treated the same as financial products, such as collateralized debt obligations. Artists, indie game developers, and passionate collectors use platforms like OpenSea to sell their creations and items, with the marketplace seeing trading volumes of $5.8 million in a single day.

The Art of Regulation: Are NFTs Really Securities?

One of the most concerning implications of the SEC’s case against OpenSea is the potential conflation of digital and traditional art markets. As Jason Gottlieb, an attorney representing key figures in NFT-related cases, notes, the SEC has never regulated the sale of physical artwork as securities, so why should digital art be any different? The idea that NFTs, which often represent digital art or collectibles, could be deemed securities introduces a troubling precedent.

Wayne Aaron, co-chair of the broker-dealer regulation practice at Katten Muchin Rosenman, further emphasized the need for clarity. “There should be clear guidance and analysis available for participants to know what regulatory scheme applies,” Aaron said, highlighting the industry’s frustration with regulation through enforcement rather than proactive guidance.

Regulating NFTs as securities could open a legal Pandora’s box, with ramifications stretching beyond the crypto world and into broader art markets. Could traditional art markets follow suit if digital art falls under securities law? The SEC has refrained from doing so for nearly a century, but this case could force a reexamination of those long-standing boundaries.

Market Shift: Timing Matters More Than Ever

Even if the SEC were to win its case, the NFT market may have already shifted beyond its reach. OpenSea, once the dominant marketplace, now only accounts for 10% of the NFT trading volume, with competitors like Blur and Solana-based platforms like MagicEden capturing much of the market. Additionally, Bitcoin-native Ordinals have emerged as a significant player, contributing to nearly 34% of the past year’s NFT trading volume.

Simply put, the SEC’s efforts may be arriving too late. While OpenSea remains a significant player, much of the NFT activity now takes place outside the agency’s direct jurisdiction. With the market evolving and diversifying, enforcing securities laws on one platform may do little to rein in the broader NFT ecosystem.

NFTs at a Crossroads

NFTs have always been easy targets for critics, often seen as a speculative bubble. Yet, despite the volatility and occasional absurd use cases, NFTs represent a transformative shift in how we perceive and trade digital ownership. Whether viewed as art, collectibles, or securities, their impact on the digital economy cannot be denied.

Finzer’s statement that “regulatory saber-rattling” could harm artists and creators is a stark reminder of the broader implications of this legal battle. OpenSea has pledged $5 million to help cover legal fees for creators and developers who face SEC actions, emphasizing the potential chilling effect on innovation in the space.

If the SEC successfully argues that NFTs are securities, it could impose significant regulatory hurdles that stifle creativity and innovation within the space. On the other hand, a pushback from OpenSea and the courts could create more clarity, allowing the NFT market to flourish with fewer constraints.

In the coming years, we’ll see whether the NFT market follows its own trajectory, separated from the larger crypto ecosystem, or whether regulatory actions stifle its growth. The only certainty is that NFTs are here to stay—whether in their current form or a new, heavily regulated landscape remains to be seen.

Team Updates

Joe co-hosted a couple more Bits and Bips podcast episodes.

Joe spoke at the Wyoming Blockchain Symposium.

Joe was featured in the 'Speak Up' Wealthion Interview with Anthony Scaramucci.

In her article, Frances Yue from MarketWatch mentioned Joe, “Ether is suffering an ‘identity crisis’ as the crypto trails Bitcoin and Solana.”

Joe will be speaking at Token2049 and Solana Breakpoint in September.

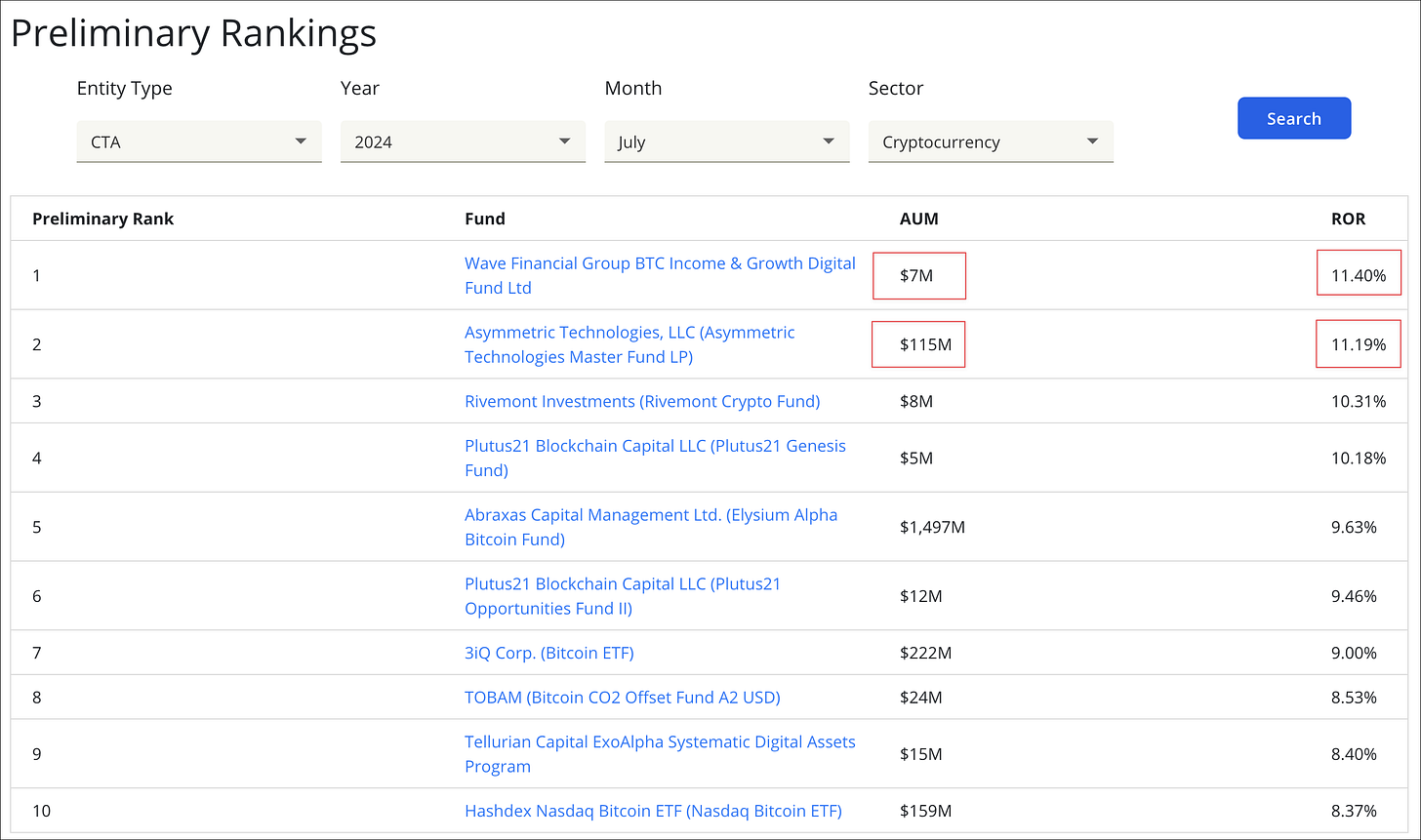

We were also informed by BarclayHedge that Asymmetric’s Liquid Alpha Fund was ranked #2 in performance for the month of July, 2024, and #1 for funds with > $10M AUM.

All Market Updates

Please let us know if you have any questions or comments.

As always, thank you for your support.

– Asymmetric

Well done. Excellent work. Again.

Great update, as always