Asymmetric Market Update™️ #27

Our thoughts on what is relevant in Crypto and Markets…

Crypto & Macro

November 2022 was a month I, and anyone involved in crypto, will never forget. On the heels of the Terra Luna implosion, Three Arrows Capital failure, BlockFi, Celsius and Voyager blow-ups, November’s left-tail event made the prior catastrophes look tame - the FTX collapse.

Coming into the eleventh month of the year, risk assets had been bludgeoned due to global central banks’ coordinated monetary tightening policies aiming to bring down inflation. Stocks were falling. Bonds were falling. Crypto was falling.

Sentiment amongst market participants was dire and depressing. Then FTX happened. It was surreal to say the least that the final act of the year would become one of the biggest frauds in U.S. history.

Would you believe me if I told you that sentiment in crypto in the past few weeks was even lower than during the FTX collapse?

Yes. It’s true.

On February 26th, 2025, the Crypto Fear & Greed Index registered a 10.

Typically these sentiment readings happen when there’s some disturbingly bad news…like a massive exchange imploding.

What were the headlines for crypto in the past few weeks?

Let’s start with the SEC:

Binance lawsuit dropped

Coinbase lawsuit dropped

OpenSea lawsuit dropped

Robinhood lawsuit dropped

Uniswap lawsuit dropped

Gemini lawsuit dropped

Justin Sun lawsuit dropped

Consensys lawsuit dropped

Kraken lawsuit dropped

Yuga Labs lawsuit dropped

DRW lawsuit dropped

SEC clarifies that memecoins are not securities

SEC creates a Crypto Task Force

SEC and CFTC confirm joint effort to tackle crypto regulation

That’s just the SEC.

Beyond that, we observed headline after headline that those of us in crypto could only dream of from the investigation into Operation Chokepoint 2.0 to SAB-121 being repealed to President Trump demanding a Stablecoin bill be on his desk to sign by “August.”

Kraken has confirmed they are filing for an IPO.

Gemini has confirmed they are filing for an IPO.

Bitgo is “considering” an IPO in 2025.

The biggest banks in the world, from Bank of America to Morgan Stanley to JP Morgan, explicitly state they will offer crypto services.

Dutzende of crypto ETFs have been filed, from Solana to Ripple to Litecoin to Trump’s own coin, $TRUMP.

Last but not least, President Trump signed an executive order creating a Strategic Bitcoin Reserve. This comes after over a dozen states have bills to create their own Strategic Bitcoin Reserves.

And this is just the U.S.

The rest of the world is also moving forward with crypto. According to recent 13-F filings, Mubadala, the U.A.E.’s second largest sovereign wealth fund, became the seventh largest holder of $IBIT, Blackrock’s Bitcoin ETF.

So how has the price reacted?

Poorly, to say the least.

Bitcoin’s peak-to-trough for the year is -28%.

Altcoins and memecoins are even worse.

Ethereum’s peak-to-trough for the year is -47%.

Solana’s peak-to-trough for the year is -57%.

Dogecoin’s peak-to-trough for the year is -73%.

TOTAL2 (the total crypto market cap sans Bitcoin) is back to the 2021 highs, having remained flat for almost four years.

The longer tail of tokens (née shitcoins) are down 80-99% depending on the token.

On top of it all, crypto fund-related products saw the largest outflow on record.

Huh?

“That doesn’t make sense,“ you must be thinking.

You are correct—it doesn’t make sense! However, the market has other headwinds with less to do with crypto and more with traditional finance (tradFi).

Over the past month, momentum and high beta stocks have been absolutely destroyed.

Take a look at the six-month momentum factor as of March 7th, 2025:

Over two years of gains wiped out in 13 days.

The speed of this move is simply incredible.

The beta factor also crashed, from 180 to 130 in 13 days.

Last but not least, the realized volatility factor has plummeted as well.

According to Deutsche Bank, at the close on March 7th, Investor Positioning is 38%, a level not seen since last summer, around the time of the Japanese Bank/Yen Carry trade VaR shock.

If one considers crypto one of the purest forms of beta and momentum, it starts to make sense why prices have been crushed in the face of such incredibly positive headlines.

Risk assets have sold off dramatically since Trump became President, largely due to his alleged Tariff policies, which trigger fears about inflation, which triggers fears of a weaker consumer, which triggers fears of a growth slowdown. Moreover, the Department of Government Efficiency (DOGE) is stoking fears of layoffs and a cut in government spending (although this is patently false).

Speaking of fear, how is the VIX doing?

Are you scared yet?

I recently learned a number of hedge fund “pods” got liquidated over the past couple of weeks at some of the world’s largest, most successful hedge funds, amounting to tens of billions of dollars in losses. The markets’ movements have been forcing professional investors to de-risk.

Fear is in the air, but there are reasons to remain bullish.

First, yields have started to come down significantly. Since Trump took office, the 10Y yield has come down nearly 60 basis points. Mortgage rates have followed suit as well.

The futures markets are back to pricing in three additional cuts this year from the Federal Reserve (my target for 2025 has been and continues to be four cuts).

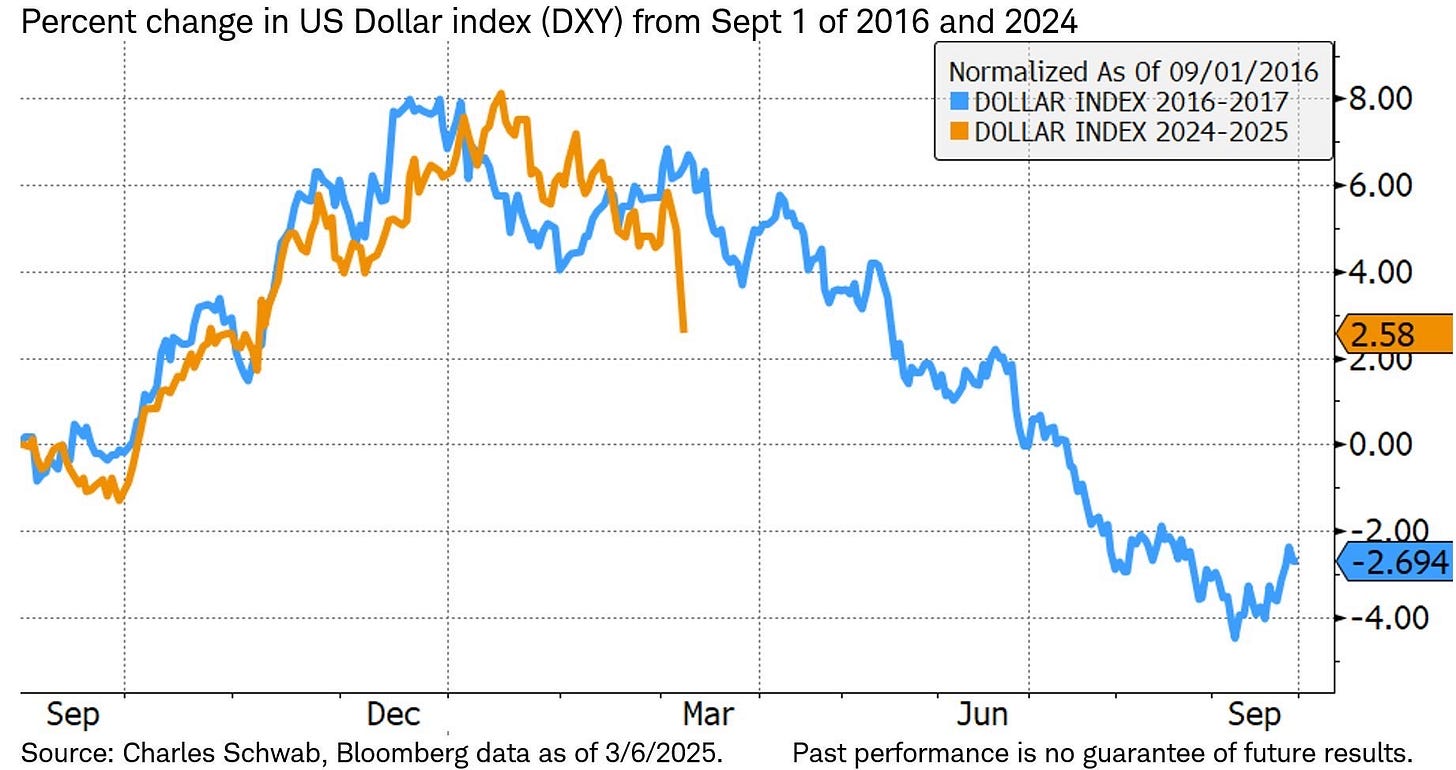

The U.S. Dollar has topped and is following roughly the same trajectory as when Trump took office.

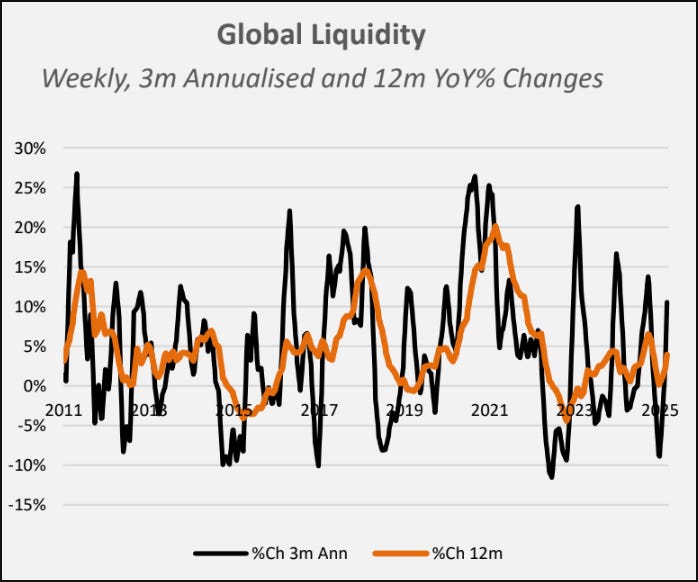

Global liquidity is rising.

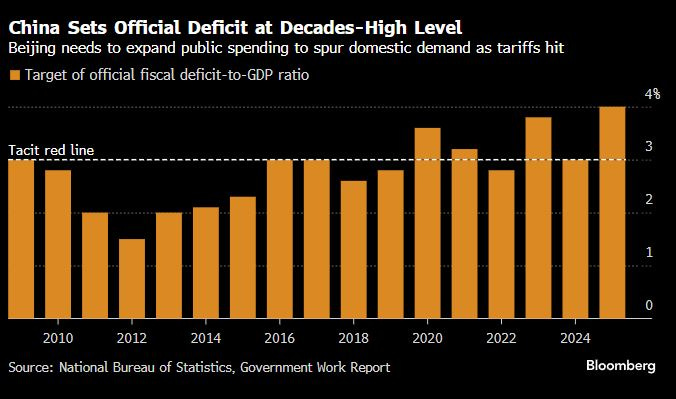

China has set its highest deficit in 30 years (fiscal stimulus).

And is injecting billions into their banks (liquidity).

Moreover, there appears to be a path to peace in the Ukraine/Russia conflict and the Middle East; if anything, this is bullish for humanity, let alone markets.

Oil has topped and continues to move lower as OPEC recently capitulated and decided to unwind their planned production cuts in April, which implies nearly +2.2M additional barrels a day of supply. The lifting of Russian sanctions could also increase global supply. Oil tagged $65.50, its lowest price in over six months. In addition, Trump has a clear desire to increase energy production in the U.S. and as a result, gasoline prices at the pump should drop, putting more money in consumers' pockets.

Is this the bottom? No one knows, but one thing I know for certain is that volatility is back and not subsiding anytime soon.

Volatility is the price you pay for returns.

VC

Crypto M&A is undergoing a quiet revolution—a shift that’s reshaping the market as both investors and founders begin to see deals not merely as one-off transactions, but as strategic pivots for long-term growth. There’s a growing consensus that we’re on the cusp of a more robust, mature merger and acquisition environment in the crypto space, driven by renewed venture capital enthusiasm and the promise of a friendlier regulatory landscape.

In recent months, multiple voices in the industry have pointed to this trend. For example, a recent study from The Block highlights how top venture capital firms are anticipating an uptick in crypto M&A activity as the market matures. Investors are increasingly viewing mergers and acquisitions as essential tools for consolidating market share, scaling operations, and ultimately, fortifying competitive positions in an ecosystem that has historically been fragmented.

Insights from Montague Law offer a nuanced perspective on venture capital's evolving role. No longer confined to fueling early-stage innovation, VCs are taking on a more active role in later-stage consolidation. They’re providing not just capital but also strategic guidance, which is proving invaluable in an industry where regulatory uncertainties and rapid technological changes can derail even the most promising ventures.

Data from Architect Partners’ 2024 Year-End Crypto M&A and Financing Report underscores this renewed investor confidence. Although many deals remain tactical and modest in size, the report shows a clear recovery in transaction counts and a bounce-back in private financing activity.

This suggests that while the market may still be in its early consolidation phase, the underlying momentum is building towards larger, transformative deals that could redefine the crypto landscape.

Recent policy insights from Troutman Pepper Locke add another layer to this evolving narrative. Their recent report outlines a potential easing of regulatory burdens—a development that many in the industry see as a significant tailwind. With a lighter regulatory touch, compliance costs could drop, and antitrust scrutiny might ease, thereby creating a more conducive environment for larger mergers and acquisitions. This policy shift could remove some of the long-standing barriers that have previously held back strategic deals in the crypto arena.

Together, these threads paint a picture of an industry in transition. Venture capital is no longer just about seeding the next big innovation—it’s about actively shaping the market’s future through strategic consolidation. The data is clear: deal activity is picking up, investor confidence is growing, and there’s a palpable sense of optimism that the regulatory landscape will soon catch up with the fast-evolving needs of the crypto world.

For founders and investors, these developments are more than just signals of market recovery—they’re a call to reassess strategies. Whether you’re considering an acquisition as a path to scale or weighing the benefits of a public exit, the time to explore these opportunities is now. As crypto continues to evolve, the next few years could very well define the next chapter of the industry—one where strategic mergers and smart capital deployment drive innovation, market consolidation, and ultimately, a more resilient crypto ecosystem.

Bitcoin DeFi

The Evolving Bitcoin DeFi Ecosystem

At ETHDenver, the Bitcoin DeFi narrative was notably strong, even as Ethereum's presence felt more muted. The event underscored Bitcoin’s ability to support multiple parallel innovations, with more teams than ever experimenting across different aspects of its ecosystem. Builders are leveraging Bitcoin’s sound money properties to position it as a premier staking asset, while others are exploring trust-minimized ways to bring BTC into external execution environments.

Beyond staking and interoperability, Bitcoin is increasingly being utilized as a foundational security layer. Teams are developing checkpointing mechanisms that extend Bitcoin’s PoW security to new ecosystems, while others are building directly on Bitcoin as a data availability layer, fostering a native on-chain economy. This breadth of experimentation highlights Bitcoin’s expanding role in DeFi, security models, and infrastructure development.

Bitcoin L2s

Asymmetric is an investor in various Bitcoin L2s such as BOB, BitLayer and Mezo, and we wanted to highlight some of the progress that one of our portfolio companies has been making within this category, outside of consistently being among the top Bitcoin L2s in total transaction activity and TVL.

Source: BitcoinEcoTK

BOB is a Bitcoin L2 designed to be the liquidity hub for Bitcoin DeFi yield. The four pillars of success for BOB are targeted as:

BOB's Modular EVM Framework: Built on OP Stack, BOB seamlessly integrates with Ethereum’s DeFi ecosystem, accelerating adoption by leveraging existing tooling instead of proprietary solutions. This enhances composability and enables developers to build within a familiar environment, with Bitcoin as the dominant functional asset in dApps.

Trustless Bitcoin Bridge (BitVM2): Developed by Robin Linus, BitVM2 enables BTC to move onto L2s without custodians, using Bitcoin’s own script capabilities. Unlike wrapped BTC models, it ensures Bitcoin remains verifiable and enforceable under its consensus rules, enabling decentralized onboarding while preserving security.

Bitcoin-Secured Network: BOB will inherit Babylon-staked Bitcoin for enhanced chain-level security. While Bitcoin-based security is essential for any Bitcoin L2, it doesn’t have to rely solely on PoW.

Performance Boost via Flashblocks: Built on OP Stack, BOB benefits from Flashblocks, reducing settlement times and improving execution latency. This enhances Bitcoin DeFi’s trading and yield-generation experience.

We are excited to see the roadmap of BOB continue to expand and our thesis be validated.

Source: BitcoinEcoTK

Metaprotocols (Ordinals, Runes, BRC-20s)

When Runes were introduced in April 2024, Bitcoin users expected them to revolutionize Bitcoin-native tokenization, driving significant on-chain activity and adoption. Unlike BRC-20 tokens, which rely on the Ordinals protocol and require JSON inscriptions on individual satoshis, Runes introduced a more streamlined UTXO-based model. This innovation was designed to minimize inscription overhead, reduce on-chain bloat, and improve capital efficiency by enabling batch minting and native token transfers.

However, Runes have struggled to meet expectations due to capital inefficiencies in minting. Unlike Ethereum and Solana - where token creation is fast and low-cost - Runes and BRC-20 require high miner fees, multi-block wait times, and significant upfront costs. This structure benefits miners but limits adoption, as capital is burned in fees rather than allocated to liquidity or development. While Runes streamlined certain aspects of the on-chain UX, it too continued with a high-cost distribution model leading a declines of on-chain activity surrounding the etching/minting of the tokens.

Source: Dune

Despite these challenges, Bitcoin-native token standards continue to evolve. Projects like OdinFun are introducing a Runes launchpad with an AMM on ICP, offering a more scalable and cost-effective approach. As the ecosystem matures, Bitcoin’s fungible asset landscape is set to improve, bringing it closer to the seamless experience of other blockchains while maintaining Bitcoin’s security and decentralization.

Bitcoin Staking

Babylon is a Bitcoin staking protocol with a roadmap structured into three key phases, each progressively unlocking Bitcoin’s security for broader blockchain applications. A crucial part of this vision is SatLayer (Asymmetric PortCo), which serves as Babylon’s key restaking partner, enabling Bitcoin’s economic security to be utilized across decentralized networks and applications.

Phase 1: Bitcoin Timestamping (Concluded)

Babylon's Bitcoin Timestamping Protocol enhances the security of Proof-of-Stake (PoS) blockchains by anchoring their data to Bitcoin's immutable ledger. This process involves creating concise, verifiable representations of PoS blockchain data, which are then embedded into Bitcoin transactions using techniques like the OP_RETURN script. Importantly, this method does not require modifications to Bitcoin's base layer, nor does it necessitate direct BTC transactions from the PoS networks. By leveraging Bitcoin's robust security, PoS chains can bolster their resilience against attacks without altering Bitcoin's core protocol.

Phase 1 has concluded with 54,093 BTC staked with a total of 3 “Caps”.

Source: DefiLlama

Phase 2: Bitcoin Staking & Restaking (Testnet & Rollout)

The second phase introduces Bitcoin Staking, allowing BTC holders to stake their Bitcoin to secure Proof-of-Stake (PoS) networks without giving up custody. This unlocks Bitcoin’s latent economic power, enabling BTC to secure L1s, L2s, and appchains without requiring native staking tokens.

A critical part of Phase 2 is Bitcoin Restaking, which enables Bitcoin LSTs to be reused for additional validation services beyond securing a single chain. SatLayer plays a key role in this by enabling the restaking of Bitcoin LSTs for Bitcoin-validated services, expanding the range of applications that can be secured by BTC. This allows LST holders to compound yield opportunities while securing decentralized infrastructure such as oracles, bridges, rollups, and other Bitcoin-aligned services.

Phase 3: Bitcoin Finality & Security (Future Development)

The final phase will bring Bitcoin Finality, effectively allowing blockchains to leverage Bitcoin’s security to finalize transactions with Bitcoin-validated checkpoints. This would enable Bitcoin to serve as a finality layer for PoS and modular blockchains, significantly reducing the risk of reorgs or validator attacks. By anchoring blockchain states directly to Bitcoin in a decentralized manner, Babylon aims to turn Bitcoin into a global security layer for Web3.

Babylon’s native token $BABY has signaled a near-term TGE and other partners and protocols built on Babylon will likely have their TGE’s shortly follow. Notable are the current and expected yield through staked Bitcoin which are incentivized through token rewards shown below.

Source: BitcoinEcoTK

dApps

While marketplace volume for NFTs on Bitcoin (Ordinals) has slowed down recently due to market conditions, Ordinals have established clear product-market fit for NFTs by enabling fully on-chain data storage on Bitcoin, unlike Ethereum-based NFTs, which often rely on off-chain metadata and IPFS links. This ensures permanence, immutability, and true ownership for digital art and collectibles on the most secure blockchain.

Source: Dune

However, as an asset class, art is inherently low-frequency — trading volumes remain cyclical, largely driven by collector demand, market sentiment, and speculative waves. Despite this, active traders have found ways to introduce liquidity and price discovery mechanisms, with innovations such as in-mempool trading playing a key role.

Satflow (Asymmetric PortCo) is working towards in-mempool trading that allows traders to execute trades before transactions are confirmed on-chain, leveraging Bitcoin’s transaction pool (mempool) as a real-time order book. This method enables:

Arbitrage Opportunities: Traders can identify underpriced Ordinals before final settlement and execute transactions accordingly.

Front-Running & MEV Strategies: Some traders actively optimize transaction sequencing to capitalize on price inefficiencies in pending trades.

Enhanced Market Liquidity: By allowing price adjustments before final confirmation, in-mempool trading creates a more dynamic and responsive market.

Satflow is positioned to leverage these market dynamics by integrating efficient order execution mechanisms for Bitcoin-native assets.

We are excited to share further progress that Satflow and the team are working on currently that would enable a better UX for the underlying assets, while eliminating the friction that exists to currently use Bitcoin-based dApps.

Team Updates

Joe was interviewed by Decrypt’s Sebastian Sinclair for “Bitcoin Slides as Macro Uncertainty and AI Weakness Fuel Risk-Off Sentiment”

Watch Joe on the Bits + Bips episode “Could the LIBRA Scandal End the Memecoin Craze?”

Read Joe’s interview with Business Insider “A hedge funder shares his precise strategy for finding high-upside meme coins, and lays out his bets for 2025”

Check out Joe on the Trends with Friends episode “Enough Infrastructure - It's Time To Build Consumer Applications!”

Don’t miss Joe on the most recent episode of "Speak Up with Anthony Scaramucci”

All Market Updates

Please let us know if you have any questions or comments.

As always, thank you for your support.

– Asymmetric