Asymmetric Market Update™️ #24

Our thoughts on what is relevant in Crypto and Markets…

Crypto

After a record-breaking performance for Asymmetric in November, it is incredibly difficult to narrow down the list of topics to cover in this month’s Asymmetric Market Update™️. Sure, everyone knows what happened with the election, the new Treasury Secretary, Gensler’s resignation, the appointment of David Sacks as the “Crypto and AI Czar, the announcement of the new SEC Chairman, Paul Atkins, and Microstrategy’s massive move.

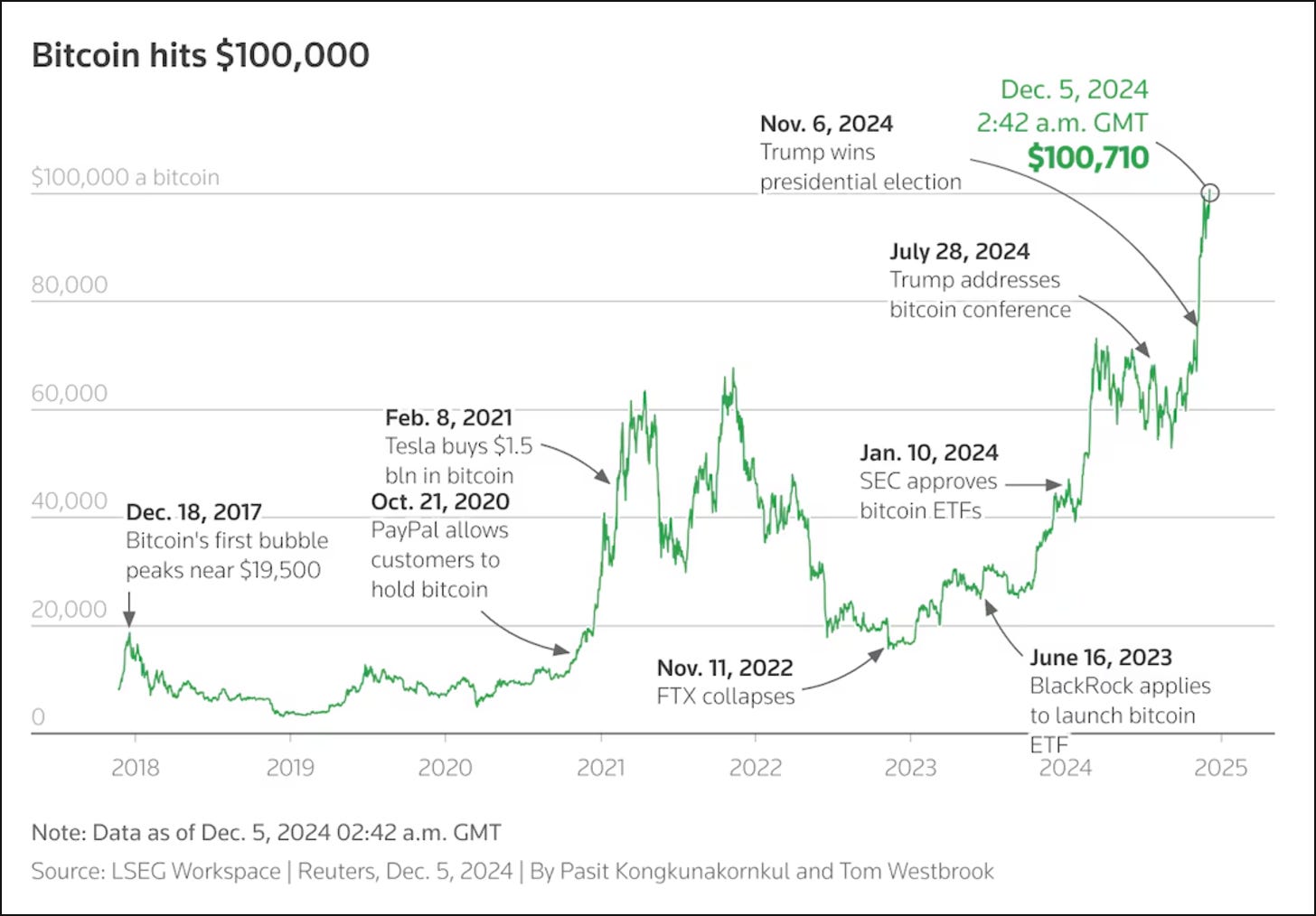

Avid readers of the Asymmetric Market Update™️ will recall that in last month’s writeup, we asserted that if Trump wins the election, Bitcoin is going straight to $100,000 before yead end.

It did exactly that.

Instead of rehashing all of November’s news, I’m instead going to talk about stocks.

No, not in how you think, but in terms of how stocks “work” for investors.

Barring obvious nuance, there are three major things that stocks do:

Issuance (via IPO, direct listing, or a secondary offering)

Buybacks (the company buys back stock in the open market, thus reducing the size of the public float/supply)

Dividends (pay shareholders some percentage of the company’s profit)

Now, let’s juxtapose that with the way things work for cryptocurrencies:

Issuance (via ICO, initial coin offering, or TGE, token generation event)

Buybacks (buy back tokens on the open market and burn them, usually conducted by a DAO, but anyone can choose to burn their tokens)

Dividends (pay token holders some percentage of the protocol’s revenue)

Items #1 and #2 have been around for quite some time, but item #3 has mostly been nonexistent.

And rightfully so. Founders of web3 protocols and services have lacked regulatory clarity from the SEC for years and have wisely decided to not share protocol revenue as to minimize the risk of receiving an enforcement action or a Wells Notice from the SEC as their token could appear to be a security.

However, since Trump won the election and the popular vote, and Republicans now control the House and the Senate (i.e., a Red Sweep), we are seeing a number of proposals drafted for various protocols to turn on the “fee switch”, or simply distribute a portion of the protocol revenue to token holders/stakers.

Take Wintermute’s proposal for the Ethena protocol.

Or the proposal for Asymmetric portfolio company, Jito.

Both of these proposals suggest paying token holders (stakers) a portion of the protocol revenues, completing the holy trinity of how stocks work for investors, but for token holders.

To be clear, these proposals haven’t been implemented yet but the fact they are even being proposed and well received is a stark change in action and acceptance.

For the longest time, skeptics of governance tokens have questioned the fundamental value of said tokens if there was no way to share in the revenue generated by the protocol. I assert that this is all going to change under the new regulatory regime, spearheaded by President-elect Trump.

The era of speculation being the sole use case of cryptocurrencies is well behind us. I envisage a scenario where loads of governance tokens will start to catch major bids as more of these protocols begin to pay “dividends.”

Which leads me back to Trump.

All eyes are on his administration ushering in a new era for crypto in the United States, which clearly will impact policy globally. If Trump makes good on his campaign promises (and it appears he will), crypto will have the steel boot removed from its throat and can finally compete as an alternative financial system.

Burn the boats, we’re never going back.

Macro

“I keep getting older. Data stays the same trajectory.”

Let’s pick up where we left off in our November commentary:

“Certain historical events have deemed “macro” analysis locally unimportant: wars, natural disasters, elections, etc. Luckily, we have (or have recently had) all of the above. That said, the predominant driver of the next phase of markets will be the US Election. The predominant traditional macro data that will drive Fed policy for the next two (at least) FOMC meetings will be US Employment. We will focus on those two things.

Given the economic data evolution, our view is essentially unchanged over the previous month. The election results were the main driver of markets and dwarfed any other micro or macro data with respect to market movements. We are now past the election. There is a window here where the data re-asserts itself as the primary driver of US markets before Trump takes over and implements (or does not) his various policies. We are in wait-and-see mode for the political, fiscal, regulatory, tax, etc., outcomes of the red sweep.

Given all of that, let’s dig into the data that matters in the window to pre-inauguration and policy change:

In November, we stated:

“US Employment - When the Macro Becomes the Micro”

The FOMC has been very clear that real rates are restrictive. They have repeated that they have begun normalizing real rates and will continue to do so. They have also stated that they could accelerate this process should they see weakness in the labor market. Though the labor market is in good shape, broadly speaking, it is certainly decelerating at best. Pundits calling for the FOMC to pause rate cuts (ceterus paribus with the election) are completely missing the point. The fed will (and should) continue normalizing rates to be less restrictive. The labor data indicates this is the correct path for the FOMC.”

We maintain our view that the Fed will cut rates 25bps on the 18th of December FOMC meeting.

This week Powell said: FED IS TRYING TO BE IN A MIDDLE PLACE WHERE POLICY IS LESS RESTRICTIVE SO INFLATION CAN FALL, BUT NOT DAMAGE LABOR MARKET.

Those words are pretty clear to us. As we stated, the labor market will prove to be the driver of the FOMC in the coming months. Powell is unambiguously stating exactly that.

Employment

October payrolls revised from 233K to 184K, the biggest negative revision since May 2023.

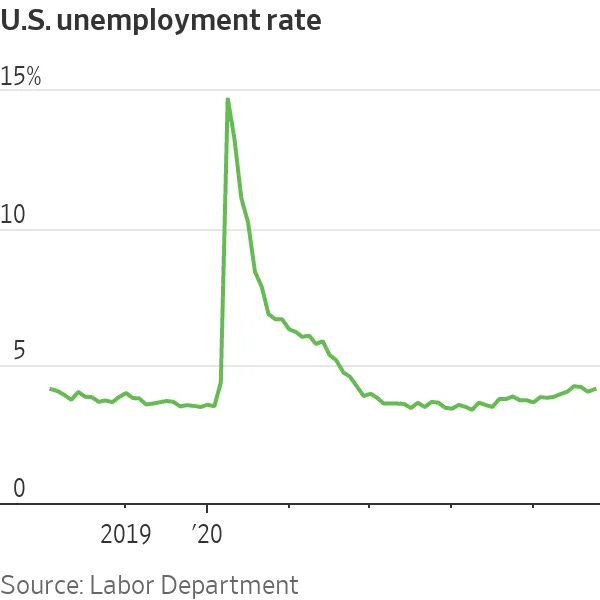

The Unemployment Rate (UR) released in December was .004, away from rounding to 4.3%. That reverses the dip in the UR completely and puts the FOMC on alert for a possible uptick in unemployment. As we have discussed previously, historically, there is a particular non-linearity about the UR. Everything is fine, then it really isn’t.

The Sahm Rule is back into play now that the UR rate (after “un-triggering” the Sahm rule on the UR dipping back below 4.2 pre-election). The market prognosticators oscillate between:

The economy/inflation is too hot.

Employment is cooling down, so we risk recession.

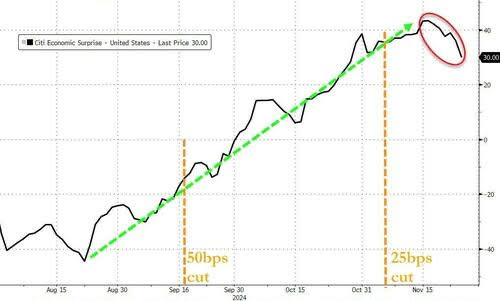

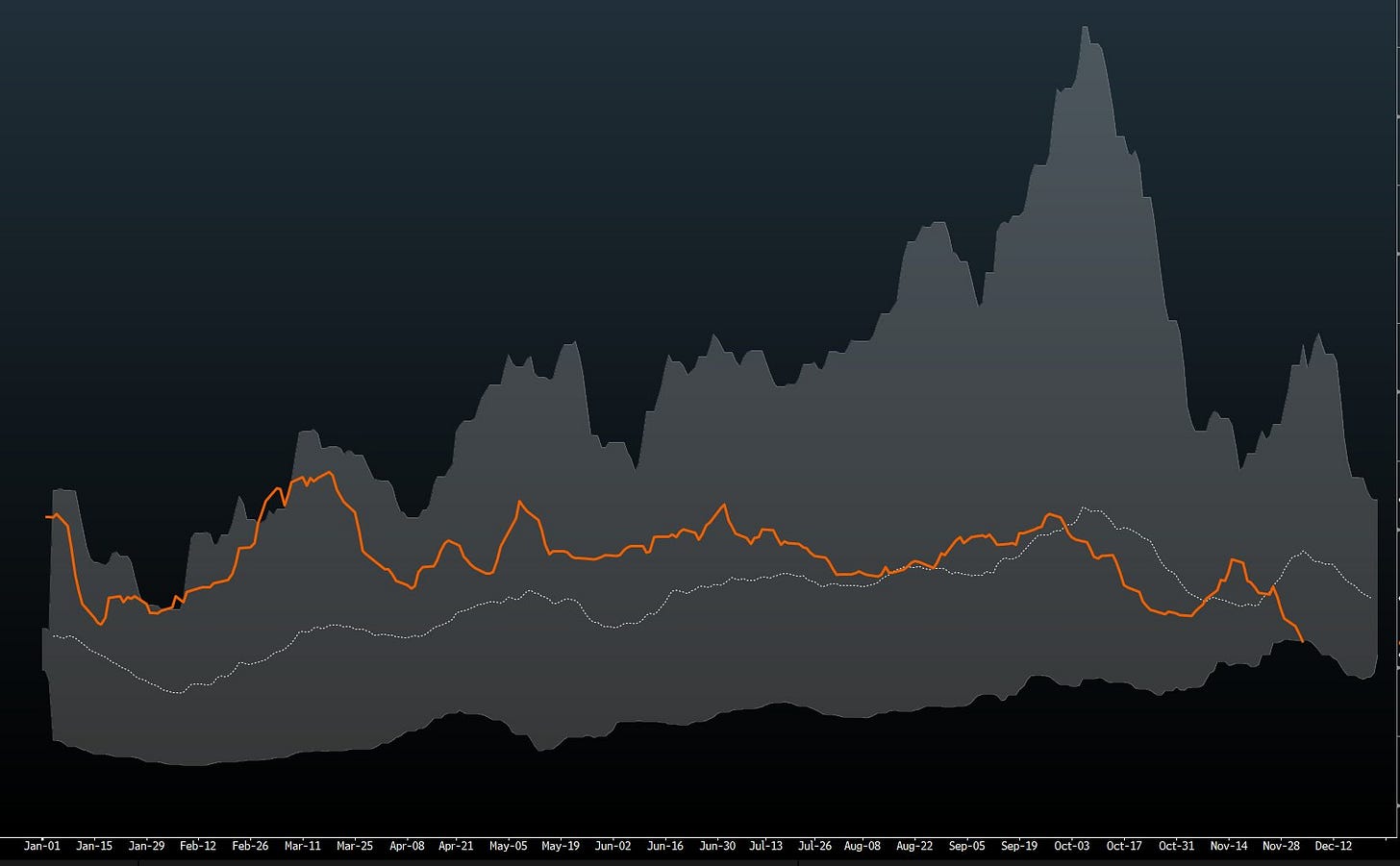

It seems pretty clear that we are in the middleof transitioning from 1) to 2) above. Nothing illustrates this more simply than the city surprise index of US economic data:

The aforementioned all suggest plenty of reasons for the Fed to continue normalizing real rates and removing restrictions. Given the non-linearity of unemployment, risk management favors cutting sooner rather than later, with the data appearing to have peaked and rolled a bit.

Inflation

Inflation - the other half of the Federal Reserve’s mandate. We view this as less relevant CURRENTLY to monetary policy. Inflation has been pulling back to target (albeit on a choppy downtrend), and real rates are still historically high. So, though inflation is currently playing second fiddle to employment, we always have one eye on it for any material change that would affect monetary policy.

Interesting (to us) Inflation Data

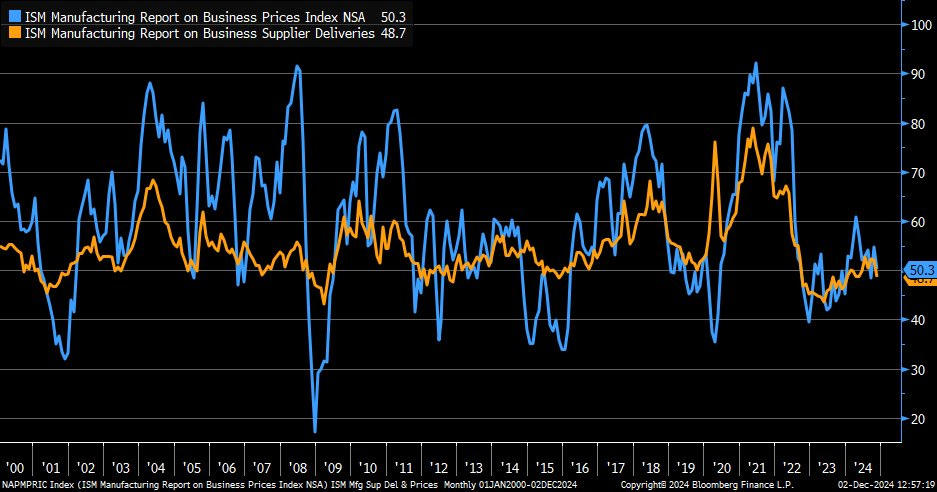

Both prices paid (blue) and supplier deliveries (orange) components in the ISM Manufacturing PMI ticked lower in November, but this does not indicate any major inflation risk.

Not unrelated to the above chart, soft commodities (chart below) indicate a directionally shifted softening of inflation ahead.

In our November commentary, we stated that a Trump Red Sweep would mean oil structurally over time. So far, that has been the case, and we believe it will continue to be, putting further downward pressure on energy and headline inflation.

Fear Porn

The “CMBS Crisis” really came front and center for analysts in March of 2023. At the time, that, coupled with the fear of a shortage of bank reserves, caused bank equities to tank and the market to seize up. The Fed came in with the par lending facility to plug this accounting capital hole. As time goes on, it becomes relevant again when these loans are due for re-financing. That time is now and peaks in the next couple of years. The banks either need to roll the debt (extend and pretend), or they reposses and sell the properties for recovery value, taking losses for whatever they sell it for that is less than their current CMBS marks + any other reserves they have taken. It is well telegraphed, so we do not believe it becomes anything like a systemic issue, but it is something to keep an eye on again.

The Baltic Dry Index is at a new 8-year low for this time of the year, a dramatic drop in the last few weeks.

Given the state of European and Chinese growth, the above graph should not come as a surprise. That graph is here to indicate that globally, we do have some potential growth concerns. The US economy has been the main driver of global growth for some time now. It is time for the EU and China to do some real stimulus, or they are going to have an economic disaster on their hands.

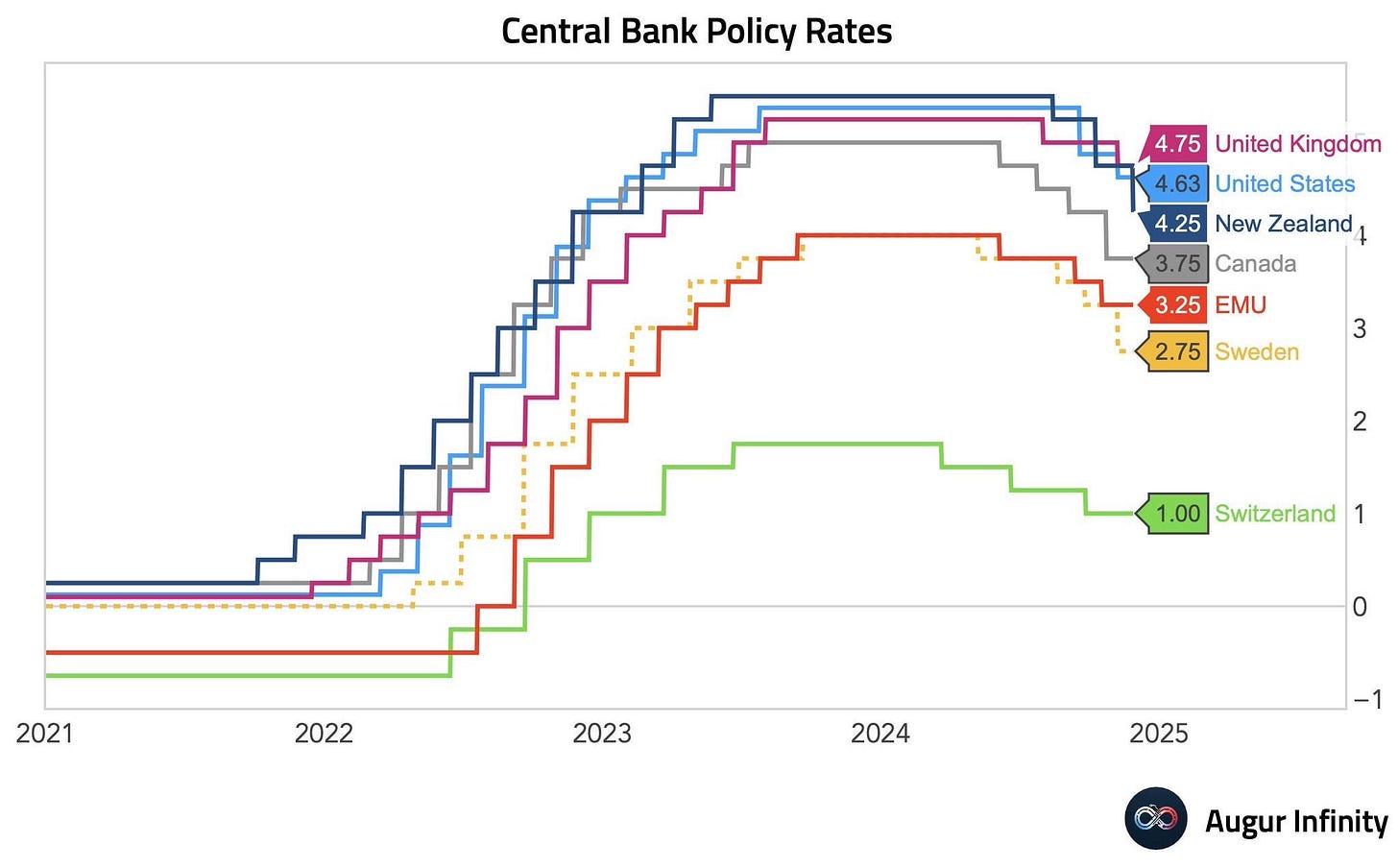

Given the above, it is not surprising that a large portion of the G20 is already meaningfully into rate-cutting cycles. This will continue.

Liquidity - US and Global

The market is hyper-focused on US interest rate policy. Thus far, there is very little talk about excess reserves and tapering further or ending QT. As you can see below, RRP has steadily drained down to approximately $130bln from $2.5trln+. That is an incredible change when one thinks about it. The trillion-dollar question is, “What is the long-run equilibrium rate for RRP?”. We suspect, just like employment, the function around excess reserves in the system is non-linear. Everything is fine, then it’s really not. Similar to rates, risk management would suggest the Fed tapers QT again sooner rather than later to lengthen the runway of QT but also shorten the tail of running off the runway and crash landing. We are keenly listening for any commentary on QT/excess reserves from Federal Reserve officials.

We have harped on about the importance of global liquidity for asset prices for months. Lately, global liquidity has actually been reduced (see below), while at the same time, quite a few global central banks have cut rates.

As those two directionally opposed outcomes have occurred, US stocks, Bitcoin, etc., are at all-time highs. What do we take from this? Nothing. We clearly stated that the Trump effect would trump (pun intended) all of the immediate data when it came to asset prices. Clearly, this has been the case. So now we wait and watch.

Conclusion

We are in wait-and-see mode for the political, fiscal, regulatory, tax, etc., outcomes of the red sweep. We know that US interest rates are restrictive, and the FOMC is very aware of this. What we do know is that employment seems past its peak (though still in quite strong shape). We know that inflation has continued to pull back to target, albeit on a bumpy path thus far. Given this, it is clear the FOMC is going to cut 25bps at the FOMC meeting on December 18th. January is currently priced for another 6bps of cuts (effectively, the FOMC is expected to not cut in January with a higher probability they cut 25bps again by the end of q1). We do not have a strong view on whether the Fed cuts in January or later in the quarter, but we do believe they continue to normalize rates with a sensible target of 3.5% (ceterus paribus, given we do not know how Trump policy evolves).

Also, from our November monthly:

“Trump Wins - Red Sweep of Congress

Bitcoin going much, much higher is the most obvious trade for this. Not only will we have a full set of crypto-friendly regulations within 90 days of Trump taking office, but the strategic BTC reserve at the US Treasury seems like a high-probability event.”

Our prediction of Bitcoin behavior on a red sweep played out as expected. Bitcoin has now traded over $100k for three days in a row. Bitcoin is acclimating to these levels before its next leg up. Assets get volatile (up and down) when they go into price discovery mode, which is where Bitcoin is now. So we are aware of incoming volatility, but we believe that is within the larger uptrend that will continue into Q1.

We are constructive markets (crypto specifically) from now into Q1. You have the holy trinity:

There is a favorable growth backdrop in the US, such that recession fears are not on people’s minds at this time, keeping the risk-taking appetite strong.

The Fed consistently and publicly states that it wants to reduce the restrictive levels of interest rates (real rates).

The regulatory and policy seachange is coming to the US concerning crypto.

Sometimes (rarely), predicting the price movements just isn’t that hard. Analysis paralysis could prove very expensive in a seminal time like now. Follow the flows.

VC

Rearview Mirror

Q4 is shaping up to be nearly everything Asymmetric anticipated. After a year of what felt at times like aimless ambiguity, Crypto VC is closing on very bullish prospects for next year. 2024 was defined as a year of recovery and recalibration for the space. Some predictions came to fruition, but others lagged, and the sector faced notable challenges – all setting the stage for what is likely to be a transformative 2025.

Predictions Realized

Several projections for 2024 materialized, notably the resurgence of VC investments in the crypto sector. After a downturn in 2023, Q1 2024 blasted off, providing a significant uptick, with investments reaching $2.4 billion—a 40.3% increase from the previous quarter. This surge was driven by factors such as legal victories for Ripple and Grayscale, as well as the approval of Bitcoin ETFs in the U.S.

Another anticipated development was the growing intersection of AI and crypto. Startups at this nexus attracted substantial funding, exemplified by Together AI's $106 million raise. This trend underscored the industry's shift towards integrating AI capabilities within blockchain applications.

Unmet Expectations

Despite the overall positive trajectory, certain expectations fell short. The anticipated widespread adoption of DeFi platforms did not fully materialize, with user engagement and transaction volumes remaining below projections. Additionally, while institutional interest in crypto assets grew, the influx of traditional financial institutions into the space was more gradual than many had hoped.

Challenges

The Crypto VC landscape undoubtedly encountered obstacles throughout 2024. Regulatory uncertainties, particularly in the U.S., created a cautious investment environment. The SEC’s stringent stance led to delays in project approvals and heightened scrutiny of crypto ventures. Moreover, the collapse of major crypto entities in 2022 left a lingering skepticism among retail investors, impacting market dynamics.

Getting Too Hot

The convergence of AI and crypto, while promising, exhibited signs of overheating. The rapid influx of capital into crypto-AI startups raised concerns about the sustainability and practical applications of such ventures. Industry experts cautioned that many projects might capitalize on the hype without delivering tangible value, potentially leading to market corrections. Despite the bearishness, the general sentiment in the industry suggests that while some projects failed to meet expectations, others continued to attract substantial funding, indicating a complex and still-evolving investment landscape.

Infrastructure Deals Dominated

In 2024, infrastructure deals became a focal point in the Crypto VC arena. Venture capitalists directed significant funds towards projects to enhance blockchain infrastructure, recognizing the necessity for robust and scalable systems to support the growing ecosystem. This trend is expected to persist into 2025, with VCs continuing to prioritize investments in infrastructure to facilitate the development of more efficient and secure blockchain networks.

Bitcoin Halving Event and Market Dynamics

The Bitcoin halving event in April 2024, which reduced the mining reward from 6.25 BTC to 3.125 BTC, has historically influenced market dynamics by decreasing the rate of new Bitcoin supply, potentially leading to price appreciation. This supply shock often attracts increased investor interest, impacting venture capital flows into the crypto sector. The 2024 halving is expected to continue this trend, contributing to more bullish market sentiment and encouraging further investments in blockchain and cryptocurrency ventures.

Emerging Fields: Decentralized Science (DeSci) and Beyond

Beyond traditional sectors, 2024 saw the rise of Decentralized Science (DeSci), which leverages blockchain to democratize scientific research funding and data sharing. This movement aims to reduce reliance on traditional funding bodies and promote open-access research. Additionally, the concept of Software-Defined Cryptography emerged, emphasizing cryptographic agility to swiftly adapt to new algorithms and standards without overhauling existing infrastructure.

Bullish Sentiment For The Incoming Trump Administration

The election of Donald Trump has injected renewed optimism into the U.S. crypto VC sector. Trump's campaign promises to make America the "crypto capital of the planet," and his commitment to fostering a favorable regulatory environment have been well-received by investors. This has been reflected in the Bitcoin price surge, which, unless you’re living under a rock, has reached record highs following his election victory.

Industry leaders anticipate that the new administration will implement legislative and regulatory changes that favor the crypto sector, including replacing outgoing SEC Chairman Gary Gensler. This anticipated shift in regulatory approach is expected to create a more conducive environment for crypto ventures, encouraging further investments and innovation in the space.

Outlook for 2025

Looking ahead, 2025 is poised to be a transformative year for Crypto VC. The maturation of blockchain technologies and clearer regulatory frameworks are expected to foster a more stable investment climate. The anticipated Bitcoin halving event in April 2024 will likely influence market dynamics, potentially driving up prices and attracting further investment.

Additionally, the continued integration of AI into blockchain applications is expected to yield innovative solutions, provided that investments are directed toward projects with demonstrable utility. The focus will likely, and should, shift towards sustainable growth, with VCs prioritizing ventures that offer real-world applications and long-term viability.

As we move into 2025, we anticipate the space emphasizing strategic investments, regulatory clarity, and the responsible integration of emerging technologies to drive the next wave of innovation in the crypto space.

Bitcoin DeFi

The Evolving Bitcoin DeFi Ecosystem

Bitcoin DeFi continues its upward trajectory as foundational infrastructure and innovative use cases mature.

Metaprotocols like Ordinals (NFTs) and Runes (tokens) are driving increased activity on Bitcoin’s base layer. Arch Network (Asymmetric PortCo), which recently launched on testnet, is enhancing expressivity for these L1 assets, unlocking new possibilities for Bitcoin-native applications.

L2s are showing accelerated growth in total value locked (TVL), fueled by a surge of dApps enabling users to earn yield on their Bitcoin. For example, BOB (Asymmetric PortCo) has seen TVL grow over 200% in the past 30 days. BOB also published its Vision Paper, outlining how its L2 could serve as the backbone for Bitcoin DeFi in EVM-compatible environments.

Staking is evolving as Bitcoin’s liquidity and security extend beyond PoS chains. Babylon’s restaking integration with SatLayer (Asymmetric PortCo) exemplifies this trend, supporting apps and infrastructure across the ecosystem. Additional details can be found here: PR Newswire

For the first time, lending dApp Liquidium (Asymmetric PortCo) has seen collateralized lending on Runes exceed activity on Ordinals, signaling a shift in dynamics. Builders are increasingly delivering trust-minimized, decentralized applications, supported by metaprotocols like Arch Network.

November highlighted Bitcoin’s continuing transition from a static asset to a dynamic force in DeFi.

Metaprotocols (Ordinals, Runes, BRC-20s)

Bitcoin metaprotocols are redefining the boundaries of what's possible with the world's most secure blockchain. By building on Bitcoin's immutable foundation, these innovative protocols unlock new use cases like tokenization, decentralized finance, and smart contracts, all without altering Bitcoin’s base layer (ie. Almost like augmented reality glasses, you see the metaprotocol as a translucent overlay on Bitcoin blocks. It processes additional instructions ex: smart contracts, tokens, or data, without modifying Bitcoin’s core).

Ordinals enabled for NFTs on Bitcoin, and Runes enabled token issuance. Both have been able to capture assets/tokens with a combined market cap over $2Bn.

Building on this foundation, Arch Network (Asymmetric PortCo) emerges as a key metaprotocol designed to enhance Bitcoin’s programmability while maintaining seamless interoperability with assets like Ordinals and Runes. Arch Network acts as a layered framework, enabling the development of decentralized applications (dApps) and DeFi platforms on Bitcoin without overburdening its base layer.

Key aspects of Arch Network include:

Interoperability: Supports Ordinals, Runes, and other Bitcoin-native assets, enabling developers to build applications that leverage these innovations.

Efficiency: Provides high-throughput, off-chain processing while settling securely on Bitcoin’s base layer.

Composability: Bridges Bitcoin-native assets with broader dApp ecosystems, unlocking new opportunities for liquidity and functionality.

By integrating with Ordinals and Runes, Arch Network amplifies Bitcoin’s potential as a platform for decentralized finance.

Bitcoin L2s

Bitcoin Layer 2 (L2) projects have experienced explosive growth, increasing over sevenfold from 10 projects in 2021 to 75 in 2024, according to Galaxy’s Bitcoin L2 Research (Nov 20, 2024). These L2 solutions aim to expand Bitcoin’s utility by enabling advanced applications and unlocking liquidity for DeFi, payments, and fungible token ecosystems.

Venture capital investment in Bitcoin L2s has surged, with $447 million allocated since 2018, and over 36% of that funding directed in 2024 alone. This influx of capital is fueling innovation, positioning Bitcoin L2s to attract significant liquidity from both native BTC holders and existing wrapped BTC markets.

Galaxy estimates that by 2030, $47 billion worth of BTC could be bridged into Bitcoin L2s, representing 2.3% of Bitcoin’s circulating supply—up from just 0.8% as of November 2024.

This growth aligns with our view that Bitcoin L2s are poised to unlock substantial opportunities in decentralized finance, and can be evidenced below in the recent TVL growth of these chains (BOB and Bitlayer are Asymmetric Portcos).

We are particularly excited about Mezo (Asymmetric PortCo) which has recently launched their testnet and is gearing up for their mainnet launch in the first quarter of 2025. Mezo is taking a Bitcoin-first approach with initial dApps to build a vibrant DeFi ecosystem and while not included within the graphic below, they have been able to amass a TVL over $300M, which would rank it among the top of all Bitcoin L2s.

Source: BitcoinEcoTK

Bitcoin Staking

Babylon Labs has emerged as a leader in this space, with nearly 24,000 BTC staked, representing $2.2 billion in Total Value Locked (TVL). However, Babylon is just one player in the broader landscape of Bitcoin staking only focused on securing PoS blockchains. Their recent partnership with SatLayer (Asymmetric PortCo), expands the scope through restaking to secure other pieces of critical infrastructure such as app chains, oracles and bridges. This is done with the introduction of additional extension smart contracts that implement Bitcoin slashing.

While Babylon has chosen to launch with fixed caps for cap-1, and cap-2, their most recent cap-3 which is launching on Dec. 10, will not have a cap on the amount of Bitcoin able to be staked, we expect this value to grow substantially as we report on this in our next monthly newsletter.

Source: DefiLlama

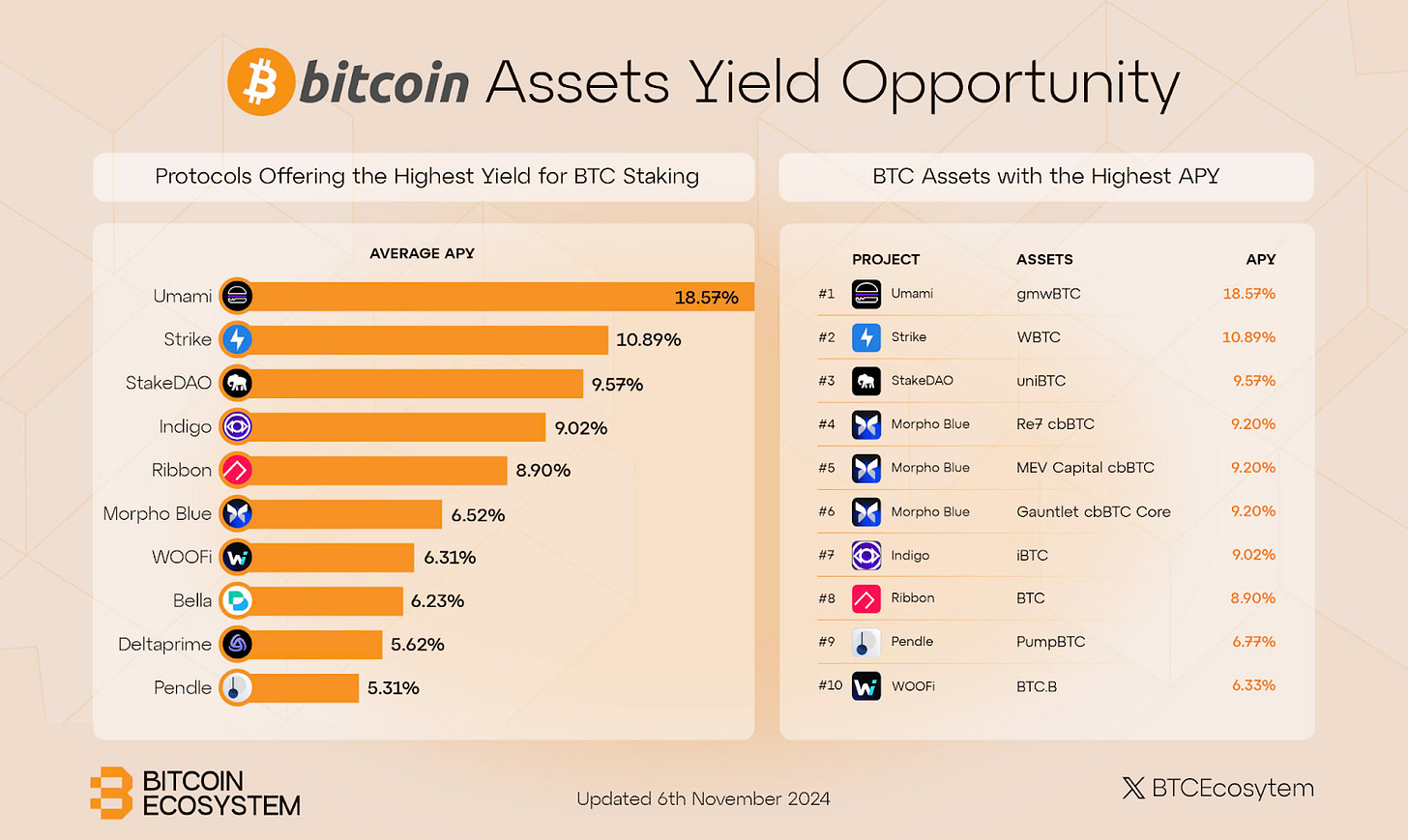

Alternative protocols are enabling Bitcoin holders to earn rewards across various chains through strategies such as borrowing and lending, covered calls, and liquidity provision via staking vaults. These protocols offer competitive yields, expanding the ways Bitcoin holders can participate in decentralized finance. However, accessing these yields involves additional risks, as they rely on wrapped Bitcoin as the underlying asset on different chains. This introduces risks such as blockchain vulnerabilities, wrapped asset security, and smart contract reliability. The next visual provides a snapshot of the yields offered by these platforms, highlighting the current opportunities and associated risks.

Source: BitcoinEcoTK

dApps

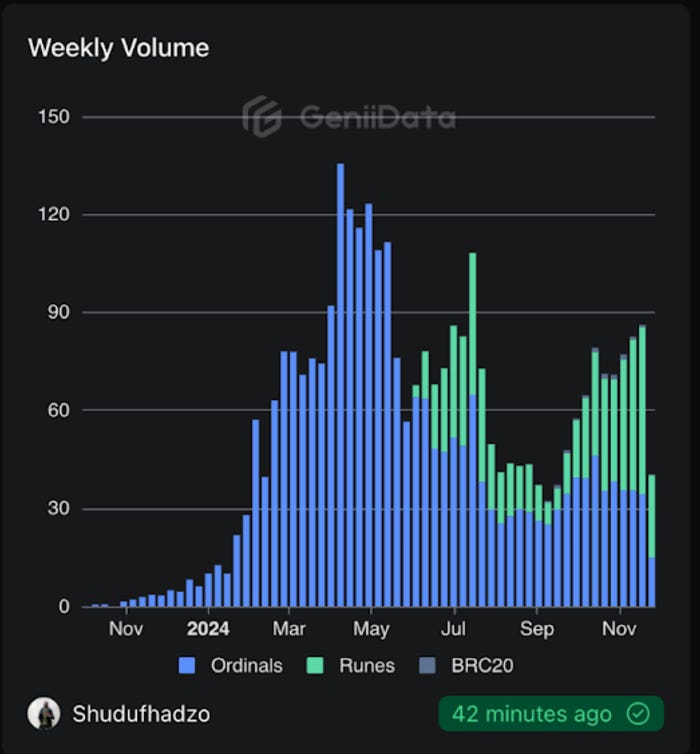

Bitcoin’s Layer 1 ecosystem is experiencing a significant shift with the rise of Ordinals (Bitcoin NFTs) and Runes (Bitcoin fungible tokens), driving the creation of innovative decentralized applications (dApps) directly on the Bitcoin blockchain.

A key example of this new wave of Bitcoin-native dApps is Liquidium (Asymmetric PortCo). Unlike traditional DeFi platforms, Liquidium allows users to borrow and lend BTC using Runes and Ordinals as collateral through Discrete Log Contracts (DLCs). This innovative approach enables more flexible, trustless lending and borrowing, with BTC as the primary asset being leveraged against the collateral in the form of Ordinals and Runes. By utilizing DLCs, Liquidium allows users to engage in decentralized, Bitcoin-backed financial agreements with enhanced security and privacy, extending Bitcoin's utility in the DeFi ecosystem.

Growth in this category is promising, with weekly volumes climbing after a slowdown over the summer toward this category, and for the first time ever, fungibles have shown dominance over NFTs in the volume of loans

Source: GeniiData

Law & Regulations

A Pivotal Moment for Crypto Innovation

The recent election cycle has sparked questions from crypto founders about what the outcomes mean for their projects. While speculation abounds, the reality is that this marks a pivotal moment for the industry—a chance to build on bipartisan progress and bring the transformative potential of crypto to the forefront. Over the coming months, you’ll hear plenty of noise about the legislative and regulatory landscape. While much of it will be premature, one thing is clear: the environment for innovation in the U.S. has never been more promising. With a government that appears poised to support technological progress, we see an opportunity to establish a framework that nurtures crypto innovation while ensuring consumer trust.

This could pave the way for realizing the potential of blockchain technology. From enabling digital ownership and empowering creators to providing low-cost, cross-border stablecoin transactions, decentralized social networks, and innovative business models for small enterprises, the possibilities are vast. Blockchain could also power physical infrastructure like energy grids and democratize fields like AI and gaming. The U.S. has the chance to lead this wave of transformation.

Regulatory Clarity and Opportunities for Builders

Regulatory clarity will play a crucial role in enabling this future. While the environment may become more accommodating, the principle that “where there is trust, there is regulation” still holds. Projects must continue to prioritize reducing centralized dependencies and increasing transparency to navigate regulatory scrutiny effectively.

We’re optimistic that 2024 could bring significant advancements, particularly with clearer guidelines for perpetual trading and token launches in the U.S. The Commodity Futures Trading Commission (CFTC) could take a more progressive stance, potentially opening pathways for perpetuals under well-defined conditions that protect consumers. Similarly, the evolving approach to token launches might provide a lawful, structured framework for projects to distribute control and build communities within U.S. borders.

For those hesitant to integrate tokens into their ecosystems due to past uncertainties, this shift could offer the confidence needed to proceed. New structures, such as the Decentralized Unincorporated Nonprofit Association (DUNA), are being developed to help projects align with U.S. regulations, manage liability, and enable sustainable economic activity.

A New Chapter for U.S. Crypto Markets

This shift could also mean moving beyond the era of enforcement without clarity—a system that stifled legitimate projects while failing to curb bad actors. Clearer rules would empower regulators to shut down fraudulent schemes while fostering a fair environment where genuine innovators can thrive. Entrepreneurs should see this as both an opportunity and a call to action: develop projects that showcase how decentralization reduces risks and opens the door for adaptive regulatory approaches.

The future is particularly exciting for perpetual markets. With the right advocacy and frameworks, the CFTC may establish pathways that allow perpetuals to operate in the U.S., balancing innovation with consumer safeguards. Similarly, tokens launching directly in the U.S. could become the norm rather than the exception, provided projects align with principles-based guidance and demonstrate strong decentralization and compliance mechanisms.

The opportunity to build in the U.S. has never been greater. Builders should feel empowered to push boundaries responsibly, knowing that the emerging regulatory clarity is designed to support innovation while protecting consumers. We’re at the cusp of a new chapter for crypto, and the steps taken now will define its trajectory for years to come.

Team Updates

Catch Joe on the When Shift Happens podcast with Kevin Follonier.

CoinMarketCap featured Joe in the article “Joe McCann Interview: Solana is the Actual Decentralized SuperComputer”.

Joe spoke on two panels at the Propy’s Web3 and Property Rights Summit in Miami: “Real Life Applications Onchain Through Tokenized Complex Financial Instruments” and “VCs: Web3 Investment Trends”.

Yahoo! Finance’s article “Bitcoin could hit $100K under Trump: Asymmetric CEO” highlighted Joe.

Reuter’s article “Cryptoverse: ‘Elation’ as bitcoin basks in Trump glow” highlighted Joe.

Joe was a guest on a Trends with Friends episode “Meme Coins, Solana's Rise, the Future of Crypto”.

Watch Joe on Paul Barron Network’s Tech Path “Solana Hits All-Time High! w/ Joe McCann”.

Jordan Smith with CNBC Crypto World interviewed Joe for “Trump picks former SEC Commissioner Paul Atkins to lead agency: CNBC Crypto World”.

All Market Updates

Please let us know if you have any questions or comments.

As always, thank you for your support.

– Asymmetric

I read this to sleep better during down days.

Great update Joe! You are the top guy in this space!